The best crypto exchanges of 2025, according to CoinGecko, Forbes and CoinDesk

An objective 2025 ranking of crypto exchanges for the CIS and Eastern Europe.

We analysed the exchange-rating methodologies of CoinGecko, Forbes and CoinDesk to compile an objective league table of platforms popular across the CIS and Eastern Europe.

Methodology

CoinGecko uses a 0–10 scale (Trust Score) that considers:

- liquidity and order-book depth — how easily trades can be executed at fair prices;

- transparency — based on the openness around the exchange’s leadership;

- operational scale — judged by trading volumes and order-book depth relative to peers: how large the venue is and how frequently trades occur;

- cybersecurity — assessed by the third-party service Hacken via cer.live, covering infrastructure and account protection as well as resilience to attacks;

- completeness of API implementation — ticker data, trade history, order book, charts (OHLC), WebSocket, trading via API and documentation;

- past incidents — records of hacks, outages or threats to user funds;

- proof-of-reserves — whether the exchange discloses assets and liabilities: audits, public balances and user-verifiable proofs.

Forbes evaluates venues across 40 inputs. Data are verified via in-house research and direct requests to exchanges to clarify or supplement missing details.

The main factors are the range of tradable cryptocurrencies (20%), trading fees (15%), security and asset custody (15%), and a consumer sentiment index (17%) reflecting real client experience — from interface usability to support quality.

The analysis also considers withdrawal fees (7.5%), advanced features such as futures and stop orders (10%), staking (5%), educational content (6%), USD on- and off-ramps (2%) and margin-trading options (2.5%).

CoinDesk assigns a letter grade from F to AA based on 100 criteria, including:

- operational transparency;

- infrastructure security;

- quality of service;

- regulatory compliance;

- user accessibility.

Exchanges scoring 65 points or more — or rated BB and above — are deemed best in class.

We adapted the framework to the realities of the CIS, where many large platforms such as Coinbase are unavailable, and applied it to exchanges popular in the region.

1. OKX

OKX tops the ranking thanks to sizeable reserves and the absence of major incidents. Back in October 2020, OKEx paused withdrawals after losing contact with one holder of private keys, but restored them by late November. No further incidents have been recorded since.

OKX publishes monthly proof-of-reserves reports attesting to 100% backing of user funds.

In April 2025 the exchange officially entered the US market after settling US Department of Justice claims over providing financial services without registration and evading the implementation of KYC/AML programmes.

OKX also became one of the first global exchanges to obtain a MiCA licence and passport its services across the European Economic Area.

The platform offers advanced trading tools, a VIP programme with reduced fees, as well as its own Web3 wallet and the OKX Pay service.

Key metrics:

- number of trading pairs: 675;

- base fees: spot — 0.08% maker and 0.1% taker; futures — 0.02% maker and 0.05% taker;

- Trust Score: 10/10;

- CoinDesk Score: A (75/100).

2. Bybit

In 2025 Bybit remains a frontrunner in Russia: in April, 26% of its traffic came from the country.

In February 2025 the exchange was hit by an attack attributed to the Lazarus hacker group, with losses of about $1.4bn. The platform swiftly restored client withdrawals and strengthened its security.

In May 2025 Bybit obtained a MiCA licence in Austria and launched a regulated platform for European users.

Key metrics:

- number of trading pairs: 680;

- base fees: spot — 0.1% maker and taker; futures — 0.02% maker and 0.055% taker;

- Trust Score: 10/10;

- CoinDesk Score: A (75/100).

3. MEXC

MEXC stands out for the broadest selection of altcoins among the exchanges reviewed. At the time of writing the platform offers 2,690 spot pairs.

The exchange is often first to list tokens right after launch. Aggregate trading in new assets has exceeded $34bn since the start of 2025.

MEXC’s fees are among the lowest: makers pay 0% on spot and futures, while takers pay 0.05% on spot and 0.02% on futures.

An additional 20% discount applies when paying fees with the MEXC token (MX). If a user holds at least 500 MX (~$1,300 at the time of writing) for 24 hours, the discount rises to 50%.

Key metrics:

- number of trading pairs: 2,690;

- base fees: spot — 0% maker and 0.05% taker; futures — 0% maker and 0.02% taker;

- Trust Score: 10/10;

- CoinDesk Score: C (50/100).

4. KuCoin

Like MEXC, KuCoin focuses on broad token coverage. It runs several platforms — such as GemSPACE and Spotlight — to launch and farm new tokens.

In 2024 the exchange introduced Apple Pay support for its KuCard and refreshed its suite of trading bots.

New AI-driven strategies and Earn services arrived for traders, while projects gained the GemSlot and GemPool listing programmes. By year-end the exchange rolled out futures copy-trading, options trading and a Learn and Earn service.

In 2025 KuCoin has focused on trust and regulation. It implemented SOC 2 Type II and ISO 27001:2022 security standards and launched Project Trust with a $2bn fund to protect users.

In August the Thai Ministry of Finance selected KuCoin as the first international partner for its tokenised government-bond programme, G-Token.

Key metrics:

- number of trading pairs: 1,317;

- base fees: spot — 0.1% maker and taker; futures — 0.02% maker and 0.06% taker;

- Trust Score: 9/10;

- CoinDesk Score: B (60/100).

5. Gate

In 2024 Gate expanded globally. The exchange received regulatory approval in the Bahamas for digital-asset operations. In the same month its user base surpassed 20m.

In parallel the company launched an OTC platform in Malta, took part in major industry events in Asia and the Middle East, partnered with Inter Milan and sponsored the Blockchain Life and Coinfest conferences.

In 2025 Gate Dubai obtained a full licence from VARA. The firm marked its 12th anniversary in Dubai and unveiled a new domain (Gate.com) and brand identity. The exchange became an official sponsor of Oracle Red Bull Racing in Formula 1. In July its user count topped 30m.

Key metrics:

- number of trading pairs: 2,664;

- base fees: spot — 0.09% maker and taker; futures — 0.02% maker and 0.05% taker;

- Trust Score: 10/10;

- CoinDesk Score: BB (74/100).

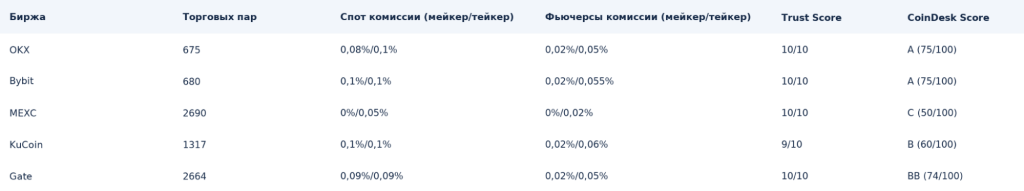

Comparison table

Which exchange to choose

The right platform depends on your goals and priorities:

- OKX — a strong all-rounder, with advanced tools, deep VIP discounts and Web3 integration. It suits active DeFi users seeking a balance between centralised and decentralised finance;

- MEXC offers market-leading fees — zero for makers and minimal for takers. Extra discounts of up to 50% when paying in MX appeal to high-frequency traders. A catalogue of nearly 2,700 pairs enables early access to new tokens;

- Bybit remains a top destination for Russian traffic. Despite the February 2025 incident, the exchange quickly resumed operations and reinforced security. Its MiCA licence adds protection for European users;

- KuCoin specialises in trading bots and AI-led strategies. GemSlot and GemPool provide early access to new tokens, while a $2bn protection fund underpins user safety;

- Gate — with 2,664 pairs and a VARA licence in Dubai — is well suited for the Middle East. Formula 1 sponsorship and 30m users point to financial resilience.

Diversify your holdings — do not keep all assets on a single exchange, even the “most reliable” in your view. Regularly move profits to cold wallets for long-term storage.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!