Strategy pauses bitcoin buying as share sales fail to raise capital

BitMine bought 179,251 ETH for $820m

From 29 September to 5 October, Strategy did not buy the first cryptocurrency after failing to raise capital through stock sales. The company disclosed this in an 8-K filing with the SEC.

The firm led by Michael Saylor holds 640,031 BTC worth about $79.4bn, acquired at an average price of $73,983 per coin. Since August 2020, Strategy has amassed more than 3% of bitcoin’s total supply.

The chief executive had hinted at a pause in buying. On 4 October he posted a tweet, writing:

“There will be no orange dots this week—only a reminder of the $9bn profit for which we continue to HODL.”

The pause coincided with bitcoin achieving a new all-time high above $125,000. That has not typically deterred Strategy—the firm is known for buying digital gold at peaks. One community member jokingly remarked:

“Have you realised that buying at highs is not the smartest move? Now waiting for a dip?”

By the end of the third quarter, the company recorded unrealised profit of $3.89bn. Tax liabilities amounted to $1.12bn of that.

BitMine keeps buying ETH

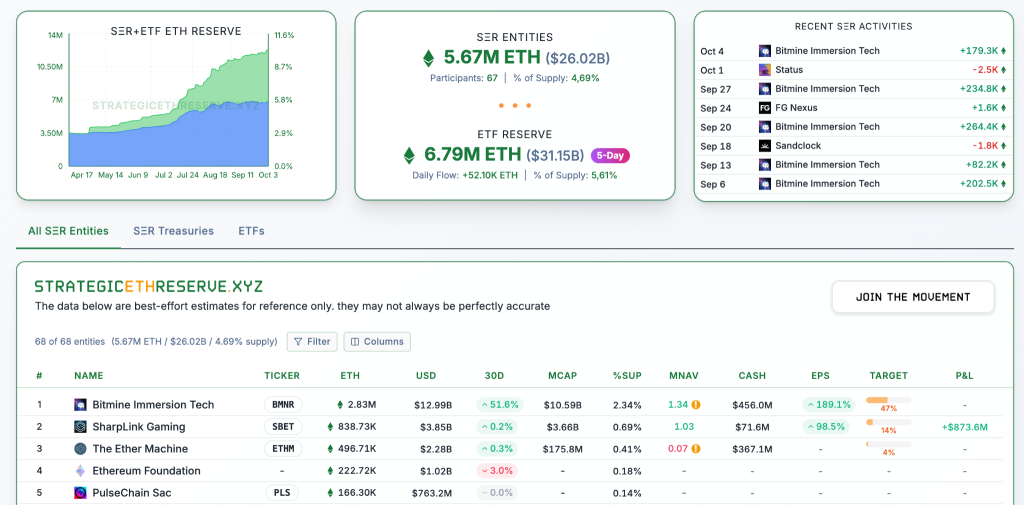

Last week, BitMine Immersion Technologies, led by Tom Lee of Fundstrat, acquired 179,251 ETH worth $820m at the prevailing rate. The firm’s assets under management exceeded 2.83m ETH—more than 2% of Ethereum’s total supply.

BitMine representatives also said total crypto and cash holdings reached $13.4bn. It also holds 192 BTC (~$24m).

The company began accumulating the second-largest cryptocurrency in late June. Its goal is to amass and stake 5% of Ethereum’s supply.

What is wrong with Tom Lee’s strategy?

Mechanism Capital co-founder Andrew Kang criticised Lee’s investment concept, calling his theses “financially illiterate”.

— Andrew Kang (@Rewkang) September 24, 2025

The first posits that activity with stablecoins and RWA should increase transaction volumes and, in turn, boost fees and revenues for the Ethereum network.

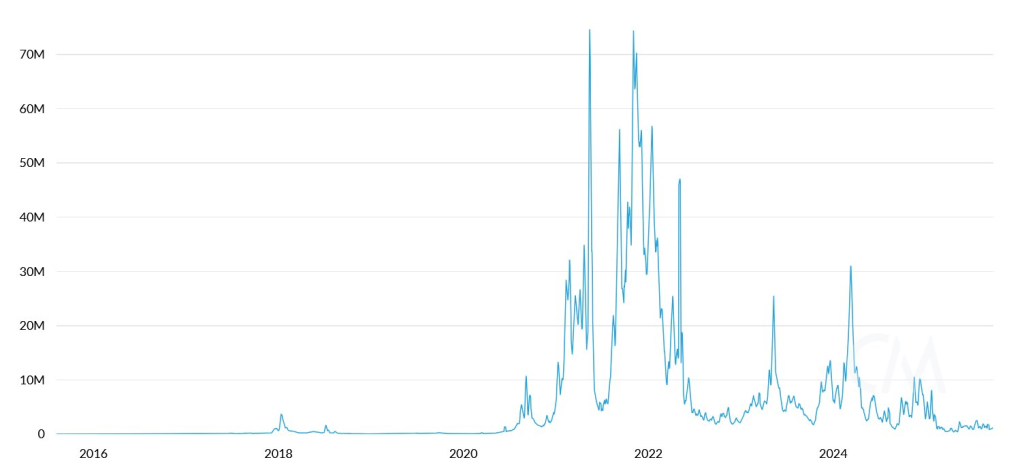

“Over five years, the value of tokenised assets and stablecoin transaction volumes have increased 100–1,000x. Yet Tom fundamentally does not understand how value accrues and wants to make you believe that fees will rise proportionally, when in fact they remain almost at the same level as in 2020,” Kang noted.

In his view, this is due to constant protocol upgrades and the migration of activity to Solana, Arbitrum and other venues.

He also rejected comparing Ethereum to “digital oil”.

“Oil is a commodity. Real oil prices, adjusted for inflation, have traded in the same range for more than a century, with periodic spikes that then revert to the mean. I agree with Tom that ETH can be viewed as a commodity, but that is not a bullish argument,” he wrote.

Kang paid particular attention to the notion of institutional demand. To date, no major bank has announced plans to add the leading altcoin to its balance sheet, the Mechanism Capital founder stressed.

Technical analysis likewise points to years of sideways movement in Ethereum, with a recent bounce from the top of a $1,000–4,800 range. In the expert’s view, the cryptocurrency’s current capitalisation is “supported more by macro liquidity”.

JAN3 chief executive Samson Mow agreed with Kang’s conclusions. He argues that ETH’s price depends on retail investors in South Korea known as “seohak-gaemie”. They have directed about $6bn into Ethereum-focused crypto-treasury companies.

The only thing keeping ETH at these levels is the Korean retail investor, specifically the seohak gaemie (서학개미). There’s around $6 billion dollars (dollars, not KRW) of Korean retail capital propping up the Ethereum treasury companies.

ETH influencers have been flying to… https://t.co/ezc2cGtQhx

— Samson Mow (@Excellion) October 5, 2025

“Ethereum influencers are literally flying to South Korea to promote the coin to local investors. They don’t look at the ETH/BTC chart and think they’re buying an analogue of Strategy. This will not end well,” Mow said.

At the time of writing, the second-largest cryptocurrency is trading above $4,600.

Earlier, Bit Digital head Sam Tabar outlined survival strategies for DAT companies in a bear market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!