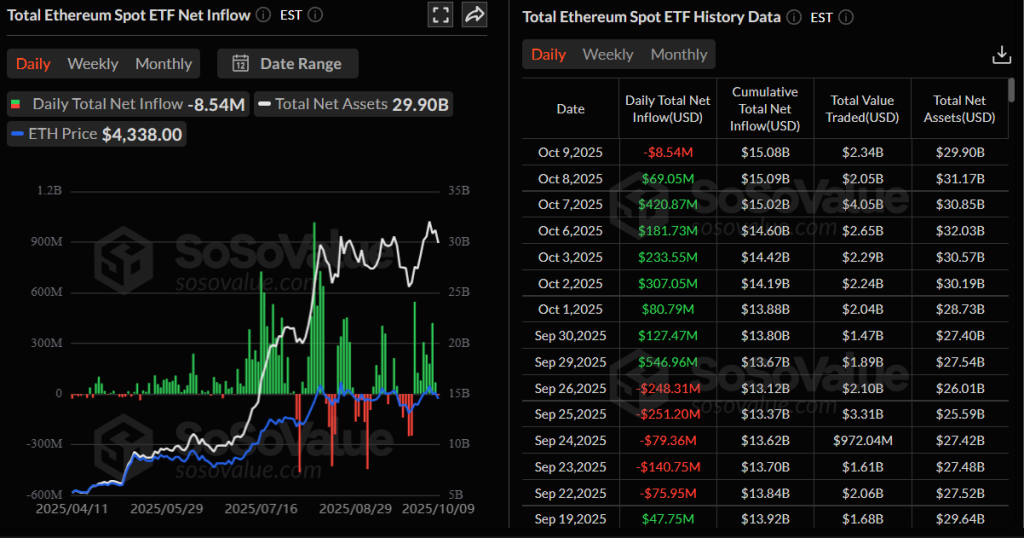

Ethereum ETFs record first outflow after an eight-day $2bn inflow streak

BlackRock’s ETHA stood out, attracting $39.3m

On October 10, investors pulled about $8.7m from Ethereum-ETF, breaking an eight-day run of inflows totaling $1.97bn, according to SoSoValue.

The bulk of the outflow came from Fidelity’s FETH — $30.3m. Products from Bitwise, VanEck, 21Shares and Invesco saw similar moves.

The exception was BlackRock’s ETHA, which attracted $39.3m in the latest session.

The previous run of inflows was the largest since August, when Ethereum ETFs took in $3.7bn over eight days. It was also the fourth-biggest since launch. The record was set in July — $5.4bn over 20 days.

Trading volumes in funds backed by the second-largest cryptocurrency totaled $2.31bn. ETHA led with $1.65bn, followed by ETH at $213.5m and FETH at $185m.

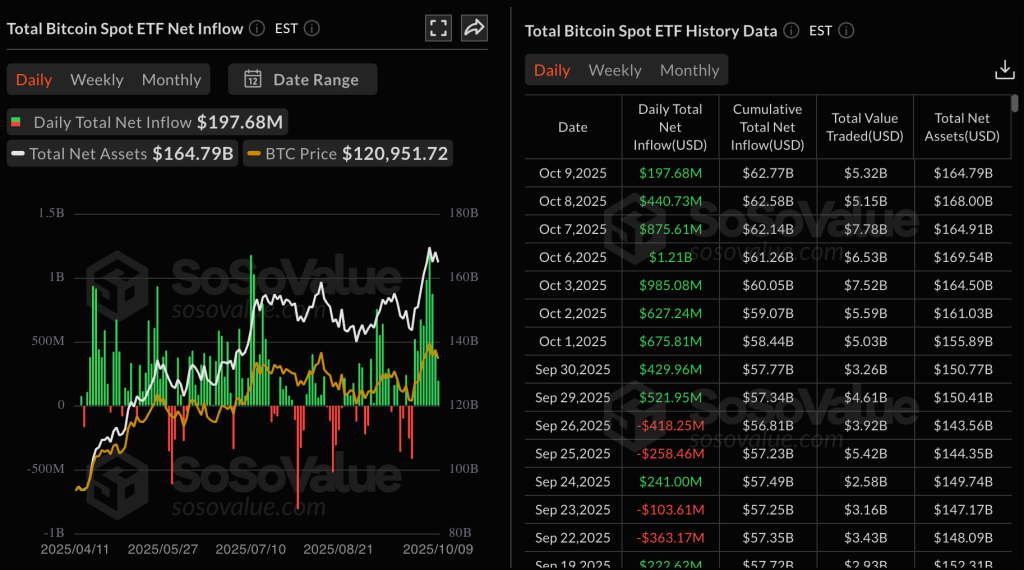

Spot bitcoin ETFs extended a nine-day streak of inflows, drawing $197.8m over the day. Since the start of October, they have attracted $5bn, versus $1.2bn for Ethereum products.

Consolidation

At the time of writing, the leading altcoin traded around $4,400. According to BRN’s head of research Timothy Misir, the $4,250–4,500 range remains key for the cryptocurrency.

“Traders are preparing for significant network upgrades that promise to improve scalability,” he said in comments to The Block.

The expert added that the market is not overheated — leaving room for further gains.

Investor Ted Pillows noted that Ethereum bounced off the $4,250 support. If the cryptocurrency holds that level, a recovery is likely; otherwise the price could correct toward $4,000.

$ETH had a bounceback from the $4,250 support level.

If this level holds, Ethereum will show some recovery.

If ETH fails to hold this level, expect a correction towards the $4,000 level. pic.twitter.com/JHEuPFxn8b

— Ted (@TedPillows) October 10, 2025

The analyst known as Ash Crypto pointed to the same support, adding that the nearest resistance sits at $5,000.

“ETH has returned to the price on October 1, but since then BlackRock’s ETHA fund has acquired $1.4bn worth of the cryptocurrency. This is a clear sign of aggressive Ethereum accumulation by whales. […] If the asset breaks through resistance, I expect a sharp rise to $6,000 and above,” he stressed.

Web3 researcher under the nickname ZYN believes the altcoin “is completing the final phase of accumulation under the Wyckoff method”. In his view, to trigger a new rally the second‑largest cryptocurrency needs to close the current week above $4,750.

$ETH Wyckoff accumulation is in its final phase.

Ethereum just needs a weekly close above $4,750 and a new rally will start.

My target is $8K by Q4 end and $10K by cycle top. pic.twitter.com/P1rIbC2gdt

— ZYN (@Zynweb3) October 9, 2025

“My targets are $8,000 in the fourth quarter and $10,000 by year-end,” the expert shared.

BitMine adds $104m of Ethereum

On October 10, BitMine Immersion Technologies topped up its Ethereum reserve with 23,823 ETH worth $103.7m, analysts at Lookonchain noted, citing Arkham data.

Bitmine keeps accumulating $ETH — 5 hours ago, they received another 23,823 $ETH($103.68M) from BitGo.https://t.co/DLOO6fgc7Khttps://t.co/w5uTBr9jZg pic.twitter.com/nScuFMDf5X

— Lookonchain (@lookonchain) October 10, 2025

The firm has not officially confirmed the latest cryptocurrency purchase.

BitMine now oversees more than 2.8m ETH worth about $12.4bn. The company is the largest holder of the asset and the second-largest DAT after Strategy.

Ethereum co-founder and ConsenSys CEO Joseph Lubin called the leading altcoin the best asset for corporations.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!