CryptoQuant Identifies ‘Bitcoin Dolphins’ as New Market Growth Drivers

CryptoQuant sees 'bitcoin dolphins' as key market drivers, holding 26% of supply.

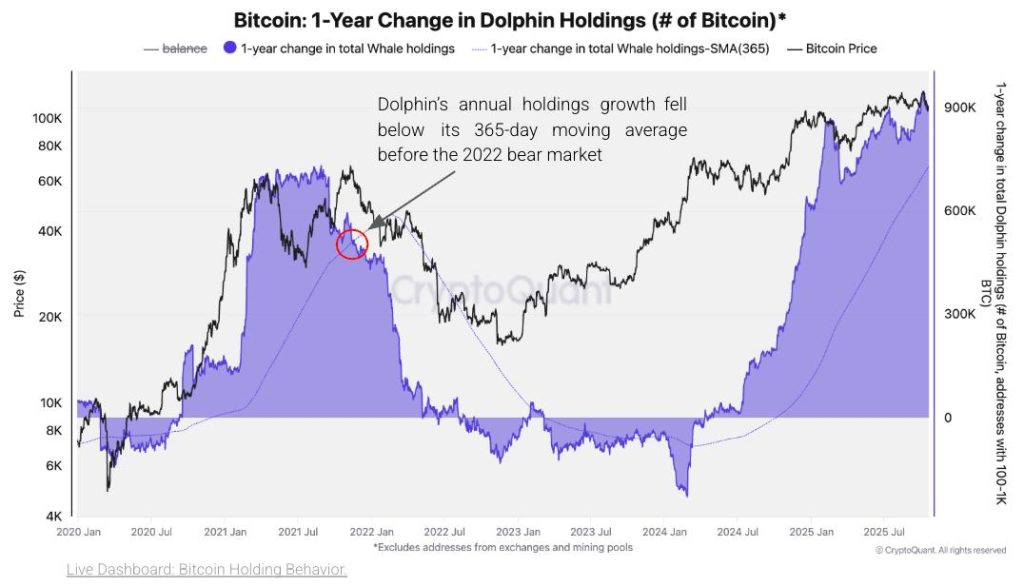

The high concentration of the leading cryptocurrency in the hands of ‘dolphins’ (100-1000 BTC) makes their activity a key factor in determining market direction during the late stage of a bull phase, according to CryptoQuant analysts.

Experts observe that such addresses control the largest share of digital gold supply — about 26% (5.16 million BTC).

“Historically, accumulation growth in this segment coincided with bullish impulses, while a slowdown often preceded distribution phases and corrections. In 2025, ‘dolphins’ increased their holdings by 681,000 BTC, while other groups reduced theirs — this confirms the dominance of institutional players,” the analysts wrote.

They also noted a weakening of bitcoin’s short-term price momentum while long-term demand remains:

“The growth cycle shows signs of maturity, not completion.”

CryptoQuant primarily considers ETFs, corporations, and other large holders as ‘dolphins’. Analysts are convinced that in the coming weeks, the activity of this group will be decisive: if the pace of accumulation accelerates, bitcoin could reach new highs; if not, the correction will deepen.

The Bull Phase Is Not Over

Experts noted that the pace of digital gold accumulation remains positive — with an annual increase of 907,000 BTC compared to a 365-day average of 730,000 BTC. This indicates that the bull phase is not yet over.

In such conditions, a weakening of short-term momentum usually points to an upcoming phase of consolidation or moderate correction within the current trend.

“To return to $126,000, purchases need to resume,” the analysts emphasized. “To reach new historical highs, the pace of accumulation on a monthly horizon must accelerate again.”

In the short term, the market remains in a correction phase. Resistance is at $115,000, with support around $100,000.

“A breach of the $100,000 level could trigger a deeper decline down to $75,000,” CryptoQuant warned.

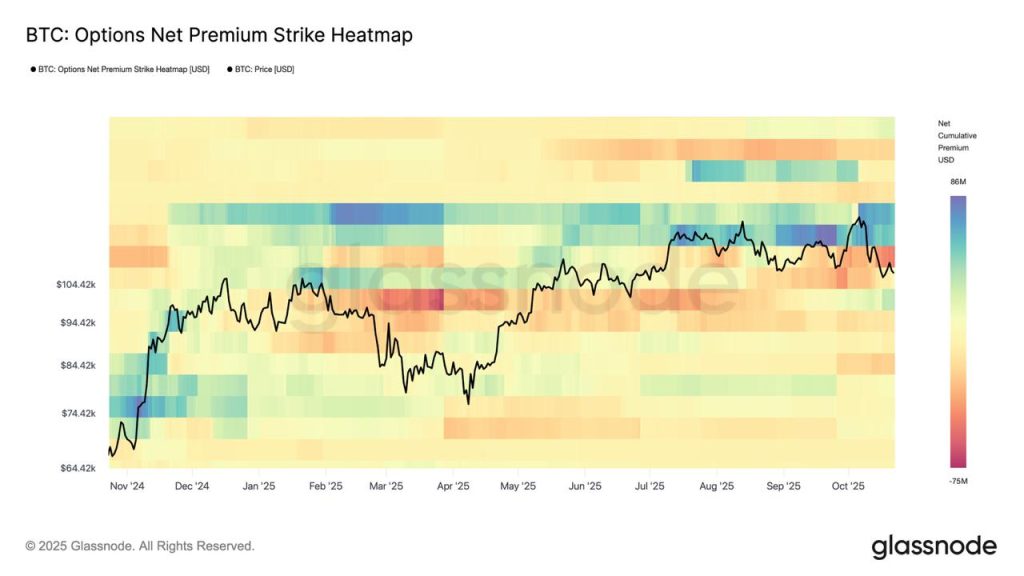

Meanwhile, Glassnode analysts, based on options data, noted a “concentration of sales” in the $109,000-115,000 range.

The current situation in this derivatives market “indicates the use of recent growth for hedging”.

“Traders are taking defensive positions amid market consolidation,” the researchers explained.

Earlier, analyst Axel Adler Jr. warned of bitcoin’s transition into the late phase of the cycle.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!