US Inflation Rises Below Forecasts; Bitcoin Shows Tepid Reaction

US CPI rose 0.3% in September; annual rate at 3.0%. Bitcoin showed limited response.

In September, the US Consumer Price Index increased by 0.3%, compared to 0.4% the previous month. On an annual basis, without seasonal adjustment, the CPI rose to 3.0% (up from 2.9% in August).

The main contributors to the inflation rise were gasoline prices, which jumped by 4.1%, and energy prices, which increased by 1.5% over the month.

The data released by the US Bureau of Labor Statistics (BLS) fell short of analysts’ expectations. Experts had forecast a CPI value of 3.1%.

🚨 Just In: September US CPI annual inflation rises 3.0%, below expectations of 3.1%.

Core CPI inflation increased 3.0% Y/Y, compared to forecasts for a gain of 3.1%. pic.twitter.com/bS9KEUN9I1

— Jesse Cohen (@JesseCohenInv) October 24, 2025

The Core CPI figure for September also fell below consensus forecasts, registering at 3.0% versus the expected 3.1%.

The BLS noted that the inflation data was prepared before the government funding halt. Following the release, major US stock indices continued to rise. The S&P 500 reached a new all-time high above $6800, while the NASDAQ 100 gained over 1% since the start of the trading session.

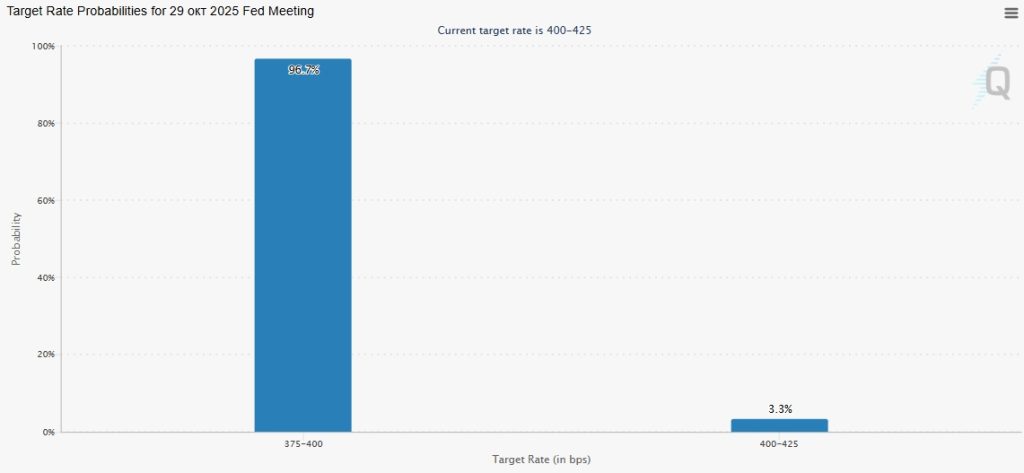

Swap and options markets express near-total confidence in the Federal Reserve lowering the target range for the key rate to 3.75-4% at the October 29 meeting. The probability of this scenario is estimated at 96.7%.

Traditionally, increased liquidity availability is considered beneficial for the prices of risk assets like Bitcoin and other digital currencies.

Following the release of US inflation data, digital gold prices briefly exceeded $112,000 but retreated from these levels during the subsequent correction.

Over the past 24 hours, the asset has risen by 1.2%, and the cryptocurrency market capitalization has increased by 1.9% (CoinGecko).

Earlier, Bitcoin and the S&P 500 may have entered the late stage of a bull market, according to CryptoQuant analyst Axel Adler Jr.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!