SharpLink to Allocate $200 Million in ETH to Linea-Based DeFi Protocols

SharpLink Gaming to allocate $200 million in ETH to Linea's L2 ecosystem.

SharpLink Gaming intends to allocate $200 million in ETH within the L2 ecosystem of Linea by ConsenSys. The funds will be drawn from the firm’s Ethereum reserves.

NEW: SharpLink plans to deploy $200M of $ETH on @LineaBuild through a collaboration with @ether_fi, @eigenlayer, and @Anchorage.

Through this partnership, SharpLink will now access enhanced $ETH-denominated yield from:

— Native staking yield

— Direct incentives from Linea and… pic.twitter.com/1bRXO1vZ6l— SharpLink (SBET) (@SharpLinkGaming) October 28, 2025

“We are confident that ETH will become the settlement layer for the global financial system and are building the infrastructure for this future,” the statement reads.

The long-term strategy aims to achieve a “competitive, diversified, and risk-adjusted yield” in the second-largest cryptocurrency by market capitalization. SharpLink plans to generate this through staking and restaking via the EigenCloud AVS protocol, as well as through incentive payments from Linea and the ether.fi protocol.

Asset management will be overseen by custodian Anchorage Digital Bank.

“Ethereum forms the programmable foundation for next-generation financial markets. Linea’s mission is to transform ETH from a mere tool into a productive asset, growing in value with each new operation,” noted ConsenSys founder Joseph Lubin.

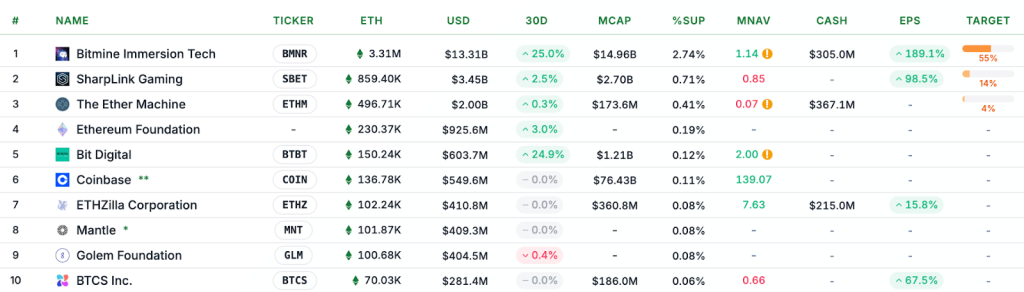

Currently, SharpLink ranks as the second-largest holder of Ethereum among public companies, possessing 859,400 ETH valued at $3.4 billion.

The firm’s plans include accumulating 5% of the total supply of the leading altcoin.

Who Else Has Entered DeFi?

SharpLink is not the only company opting to use DeFi for managing its reserves. In early September, ETHZilla allocated $100 million in cryptocurrency through the ether.fi platform.

In February, the non-profit Ethereum Foundation invested 45,000 ETH in decentralized protocols, including Spark and Compound.

Centralized exchanges have also joined the new trend. Earlier, Coinbase partnered with the lending service Morpho, while Crypto․com announced the integration of this DeFi platform into its Cronos blockchain.

In September, decentralized finance protocols earned $600 million from fees, with Uniswap leading the way.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!