Grayscale launches spot Solana ETF with staking

Grayscale launches Solana spot ETF with staking; GSOL trading starts Oct 30 on NYSE Arca.

Grayscale Investments has launched a spot exchange-traded fund (ETF) on Solana with staking. Trading under the ticker GSOL begins on 30 October on NYSE Arca.

Introducing Grayscale Solana Trust ETF (Ticker: $GSOL), offering investors exposure to @Solana $SOL, one of the fastest-growing digital assets. $GSOL features:

⚡ Convenient Solana exposure paired with staking benefits.

🔑 Exposure to a high-speed, low-cost blockchain.… pic.twitter.com/TgVNlhqBPO— Grayscale (@Grayscale) October 29, 2025

The firm initially launched GSOL in 2021 as a closed-end trust.

Grayscale representatives said the company has become one of the largest managers of the “people’s cryptocurrency” ETP in the US by assets.

“The launch of GSOL confirms our conviction that a modern portfolio should include digital assets for growth and diversification,” said Grayscale senior vice president Inku Kan.

Market competition

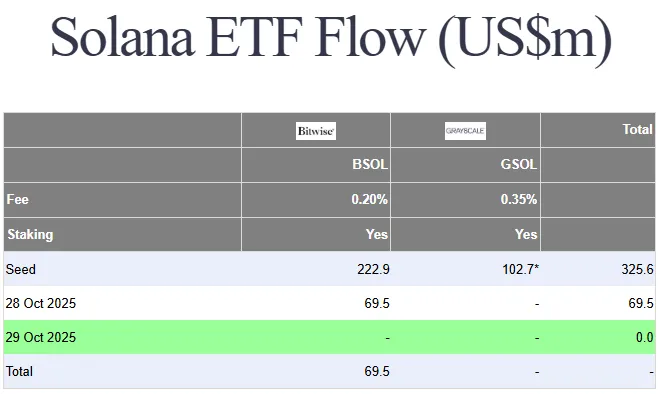

On 28 October, Bitwise launched a spot Solana ETF (BSOL). The same day, Canary listed products on Litecoin (LTCC) and HBAR (HBR) on Nasdaq.

The launches came against the backdrop of a US government shutdown. As a result, the Securities and Exchange Commission (SEC), which regulates ETFs, is operating in a limited capacity.

Despite the shutdown, the SEC issued guidance for companies. It allows filing S-1 registration statements without a “delaying amendment”, which gave the regulator time to review documents.

Without it, an ETF is automatically approved 20 days after the final filing, even without active review by the Commission. Firms need only meet the exchange’s listing standards.

Early results

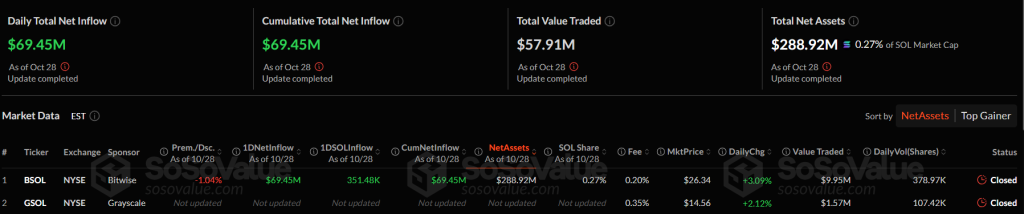

At launch, net inflows into BSOL totaled $69.5m. It is the first US exchange-traded fund with 100% direct backing in the SOL cryptocurrency.

Total assets under management reached $288.92m.

BSOL’s first-day trading volume reached $57.9m. According to Bloomberg ETF analyst Eric Balchunas, this is the best result among all products launched this year.

Final tally of Day One trading.. $BSOL: $56m$HBR: $8m$LTCC: $1m

I can’t believe how close I came. ETF sixth sense for the win. Wish there was a @Polymarket for this I’d be rich. https://t.co/TODOk13WUt— Eric Balchunas (@EricBalchunas) October 28, 2025

According to SoSoValue, LTCC and HBR saw zero net inflows despite trading volumes of $8.6m and $1.4m, respectively. Bloomberg analyst James Seyffart explained that this is common.

Okay too many questions about #Bitcoin ETFs and zero flows — a few quick thoughts:

1. On any given day, the vast majority of ETFs will have a flow number of ZERO — this is very normal. There are ~3,500 ETFs in the US. Yesterday 2,903 of them had a flow of exactly zero

— James Seyffart (@JSeyff) April 16, 2024

New ETF shares are created or redeemed only when there is a significant imbalance between supply and demand, the expert said.

Vetle Lunde, head of research at K33 Research, noted BlackRock’s dominance in the bitcoin-ETF market. According to him, excluding inflows into IBIT, all other funds would have posted a net outflow of $1.3bn since the start of 2025.

Lunde believes that the absence of BlackRock from the altcoin-ETF market could limit overall inflows. However, this opens opportunities for other issuers to compete for dominance in the Solana-ETF segment.

CoinShares and Toncoin

The investment company CoinShares has launched the exchange-traded product CoinShares Physical Staked Toncoin (CTON). It will give investors exposure to the asset of The Open Network (TON) blockchain with the ability to earn staking rewards.

More here: https://t.co/YoVww77GeN

— CoinShares (@CoinSharesCo) October 28, 2025

Trading in US dollars will begin on Switzerland’s SIX Swiss Exchange.

CoinShares noted growing interest from European institutional investors in blockchain assets. In their view, TON’s integration with the Telegram messenger gives the network a unique advantage. The project combines high performance—over 104,000 transactions per second—with access to Telegram’s 900m active users.

The head of CoinShares Jean-Marie Mognetti called TON “an interesting development of blockchain infrastructure”.

Key features of CTON:

- zero management fee;

- 2% staking yield;

- physical backing of the underlying asset at a 1:1 ratio.

Toncoin is already part of the CoinShares Altcoins (DIME) exchange-traded fund in the US. The new product broadens access to the asset for European investors.

In October, media reported that the Hong Kong Securities and Futures Commission approved the region’s first spot ETF based on Solana.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!