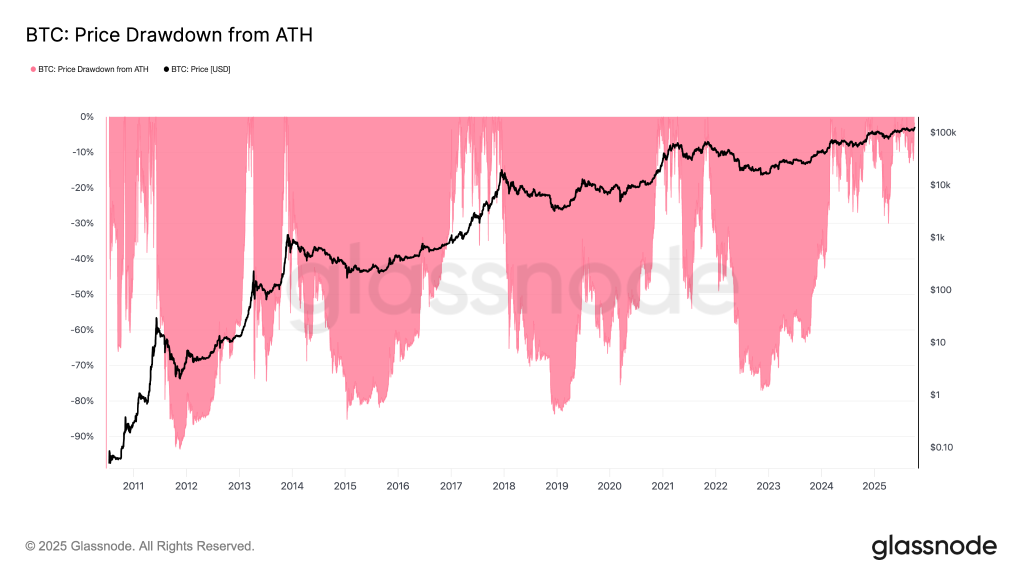

Analysts see nothing unusual in bitcoin’s 19% pullback from its peak

Bitcoin’s 19.1% pullback from its peak is mild by this cycle’s standards.

Bitcoin’s current 19.1% decline from the all-time high above $126,000 is among the mildest in this cycle, according to Glassnode.

A trader under the moniker Lourenco VS noted that bitcoin’s drop aligns with historical patterns. According to him, in this cycle corrections have typically been 20%–25%, on rare occasions reaching 30%.

$BTC corrections

During this cycle, the typical correction signature has been between 20-25%, with a couple of 30% ish ones.

This current correction is at 21%, totally within the normal parameters.

Looking at the current move as this horrible crazy outlier is just not… pic.twitter.com/IOv3JKSnVa

— Lourenço VS (@lourenco_vs) November 5, 2025

“To see this move as something terrible and anomalous is to ignore the facts. What is happening fits within normal volatility, and the long-term market structure remains intact,” the expert said.

Others on the market share the view. A trader using the pseudonym cotton was surprised by the reaction to the latest correction in digital gold.

Why do you all pretend that something extraordinary has happened ?

” $BTC at $105k WOOOOW — WHAT A SHOCK!? “

We’ve seen such dips many times before

And we’ve always recovered

Hold your bags and be patient — everything will be back to normal pic.twitter.com/ZFBJVAkPrS

— cotton (unstable/acc) (@cottonxbt) November 4, 2025

“Why all this panic, as if something extraordinary had happened? We have seen such drops many times. And the market has always recovered,” he noted.

A Binance Live analyst known as On-Chain College emphasised that nothing has changed fundamentally or technically, so it is premature to call a bear phase. He was backed by a DeFi researcher under the pseudonym Cypher.

$BTC‘s drop isn’t FUNDAMENTAL, it’s pure vibes.

Yeah, seeing $BTC slip under $100K looks scary on the chart but it’s different.

Fear & Greed Index dumped to 21, the headlines turned bearish, CT started calling crazy targets… and yet:

✅ Exchanges are seeing big withdrawals

✅… pic.twitter.com/TS9jYydUXZ— Cypher (@NxtCypher) November 5, 2025

The latter highlighted several factors indicating a still-bullish market structure:

- exchanges are seeing significant outflows;

- only 12% of UTXO are at a loss;

- the bitcoin network’s hashrate remains close to ATH;

- inflows of stablecoins are rising.

Record pace of accumulation

Over the past month, accumulator addresses — wallets that only buy and never sell — acquired a record 375,000 BTC. Around 50,000 BTC were bought on 4 November, when bitcoin fell below $100,000, said a CryptoQuant analyst under the moniker Darkfost.

🚀 Addresses accumulating BTC are reaching record levels.

With more than 375,000 BTC accumulated over a 30-day change, these accumulator addresses have just set a new all-time high in BTC purchases.

💥 Just yesterday alone, over 50,000 BTC were added by this type of address.… pic.twitter.com/8d2xyREB0M

— Darkfost (@Darkfost_Coc) November 5, 2025

“Overall market demand is slowing, but activity by this investor cohort continues to increase. Over the past two months, their average monthly purchases have more than doubled — from 130,000 BTC to 262,000 BTC,” the expert noted.

In his view, spot bitcoin-ETFs are supporting the increase despite continuing outflows. During the latest trading session, $577 million was withdrawn from the investment products.

Aggregate inflows remain positive. Since launch, exchange-traded funds based on the first cryptocurrency have attracted more than $60bn.

Earlier, Wintermute analysts called the redistribution of liquidity one of the main reasons for the crypto market’s stagnation.

A CryptoQuant expert under the pseudonym CryptoOnchain said that a bitcoin break below $101,000 would hit the bullish trend.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!