Galaxy Digital cuts its 2025 year-end Bitcoin target to $120,000

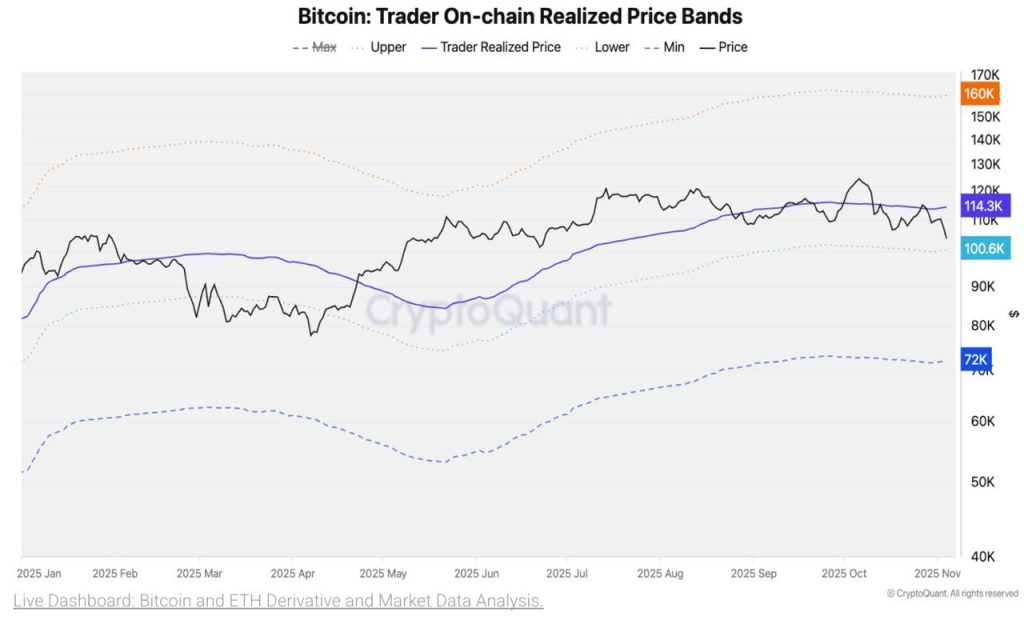

CryptoQuant analysts flagged a potential drop to $72,000.

Investment firm Galaxy Digital has lowered its year-end 2025 price target for the first cryptocurrency to $120,000, head of research Alex Thorn said.

i’m lowering my BTC bullish EOY target to $120k (prev $185k) 👀

just sent this note to clients

whale distribution, non-BTC investments, treasury company malaise, and other factors contributed to BTC headwinds in 25

(long-term future still bullish, of course) pic.twitter.com/2aj1eoJlno

— Alex Thorn (@intangiblecoins) November 5, 2025

Analysts had previously forecast $185,000.

Thorn attributed the revision to Bitcoin’s entry into a “maturity era”. It is characterised, he said, by dominant institutional flows and reduced volatility.

The long-term outlook for Bitcoin remains structurally sound, he emphasised.

He cited as key drivers of the pullback large-scale whale coin sales — roughly 470,000 BTC worth $50bn — and a retreat by retail participants. Thorn said these have created persistent resistance near key levels.

“If Bitcoin manages to hold $100,000, the structural integrity of the nearly three-year bull market will be preserved, though the pace of further gains may slow,” he added.

Bitcoin’s price has also been affected by capital rotating into other popular themes — artificial intelligence and gold. The asset failed to become the “main trade” in 2025, the expert said; with abundant liquidity, “investor attention is limited”.

Over the past seven days Bitcoin has fallen almost 5%. At the time of writing it trades around ~$103,350, 18.2% below the all-time high above $126,000 reached in October.

Earlier, a trader known as Lourenco VS said there is nothing anomalous about Bitcoin’s current decline.

“The thin red line”

Bitcoin has lost a key support level that confirmed the bear market in 2022, noted analysts at CryptoQuant.

They stressed that the first cryptocurrency fell below the 365-day moving average — $102,000. Throughout the current bull phase this level has served as the main support. Its breach in December 2021 and January 2022 was among the final signals of the bear market’s onset.

It is important for Bitcoin to hold above $100,000 — the realized price for traders, which has so far served as a key reference point. A renewed drop below that level would likely send it towards the next boundary at $72,000.

On a network-value basis, support sits around $91,000.

“The calculation is based on Metcalfe’s law, according to which a network’s value is proportional to the square of its number of users. […] Historically, Bitcoin traded near this level from November 2024 to May 2025, which confirms its significance,” the analysts said.

Beyond price levels, investor conviction plays a crucial role, noted CryptoQuant contributor MorenoDV.

Nearly 1/3 of All Bitcoin in Circulation is Now Held at a Loss

“While this might sound alarming, history shows that such levels have often marked local bottoms rather than breakdowns during bullish cycles.” – By @MorenoDV_ pic.twitter.com/r9IfQcaktx

— CryptoQuant.com (@cryptoquant_com) November 5, 2025

Nearly one in three Bitcoin holders is now at a loss, signalling mounting stress among buyers. Such levels in the past have often coincided with local lows, the expert noted.

The longer the price stays under pressure, the greater the emotional burden on participants. Prolonged stress can spur impulsive behaviour: long-term holders begin to take profits, and new investors leave the market as soon as they break even.

MorenoDV said the sector is in a fragile balance “between fear and patience”. If sentiment does not recover, the demand structure could be disrupted.

“But if fear reaches an extreme and selling pressure fades, these same levels could form a solid bottom, laying the foundation for the next accumulation phase,” he concluded.

Earlier, Bitwise chief investment officer Matt Hougan called Bitcoin’s current sideways movement a “quiet IPO moment”. In equities, this implies a lull of 8–16 months before prices begin to rise.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!