How EU Crypto Sanctions Are Hitting Ordinary Russians

How sanctions shut Russians out of Europe’s crypto exchanges

At the end of October, Russia’s crypto community was reminded that the European Union intends to crack down on sanctions evasion via digital currencies. As so often, the restrictions hit ordinary users first.

After the EU’s 19th sanctions package, platforms such as Revolut and Bybit EU began cutting off customers from Russia. We examine how strict and unambiguous the document’s wording is, and how the current world order is bearing on the digital-asset industry.

The substance and interpretation of the bans

Announcing the latest package, European Commission president Ursula von der Leyen said it was “aimed at the financial loopholes that Russia uses to evade restrictions.” For the first time, the curbs were extended to crypto platforms.

The official document was published on October 23. Beyond import and personal sanctions, its provisions prohibit EU-licensed venues from providing services to residents of the Russian Federation.

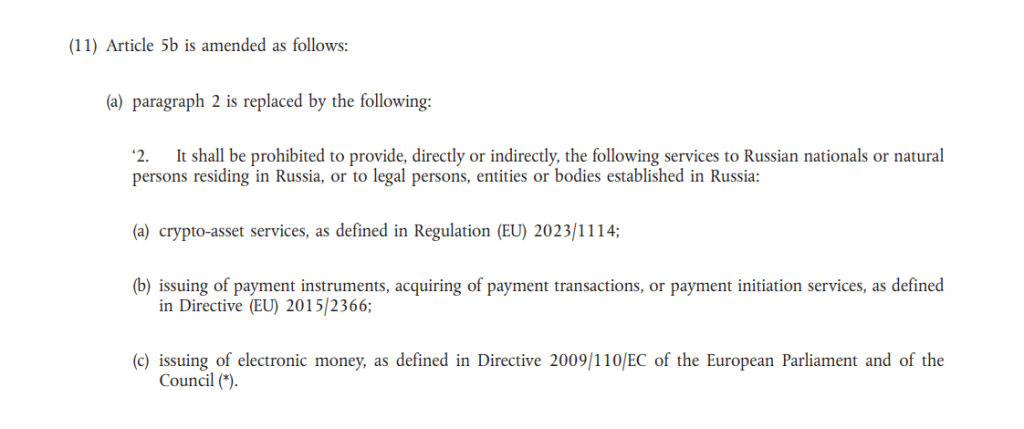

“It is prohibited to provide, directly or indirectly, [crypto-asset-related services] to citizens of the Russian Federation or natural persons residing in Russia, as well as legal persons, entities or bodies established in the country,” paragraph 5b(2) states.

Prohibited services include:

- use of any crypto-asset services (as defined by the EU);

- provision of payment instruments;

- issuance of electronic money.

In effect, any European crypto-asset service provider (CASP) operating under MiCA must cease serving Russian users.

“The wording is fairly unambiguous. When we talk about the European entities of crypto exchanges, they are obliged to comply with the 19th package; this is all clear-cut,” Andrey Tugarin, founder of law firm GMT Legal, told ForkLog.

He noted that the ban was not sudden. It is a logical continuation of measures introduced back in April 2022, which restricted custody services for Russians.

In recent years, passing KYC verification on a European platform with Russian documents was already extremely difficult; the 19th package has put a full stop to that, Tugarin stressed.

Real-world cases

In late October and early September, several media outlets began highlighting instances of Russian users being blocked on European exchanges. Headlines featured the European division of Bybit — Bybit EU — and the British online bank Revolut.

We have already covered this in a news report, but it is worth recapping the key points.

Most complaints came from Russians and Belarusians residing in the EU. One affected user with a Russian passport had a residence permit in Europe but still failed re-verification.

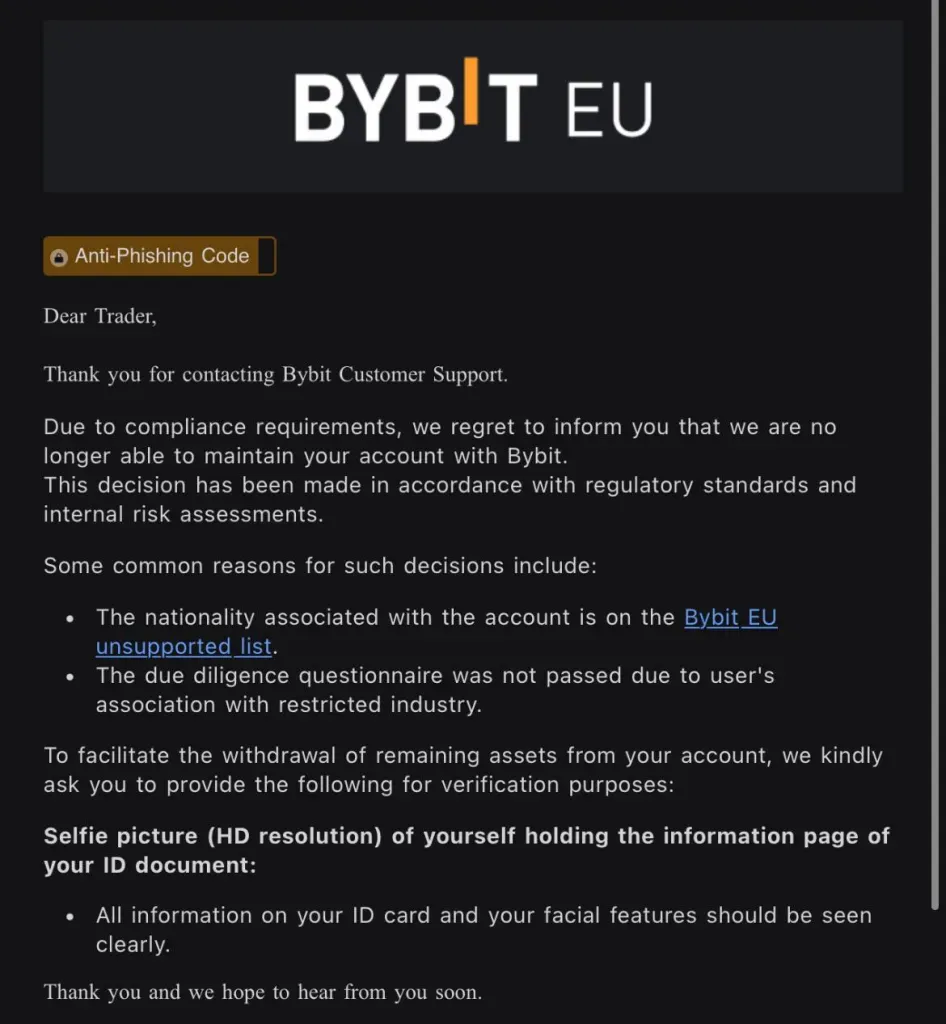

“Recently ByBit NL migrated to ByBit EU. And they asked me to pass KYC again. […] With the very same documents I used to verify before, they refused,” the user described the problem.

Customer support cited “regulatory standards and possible risks.”

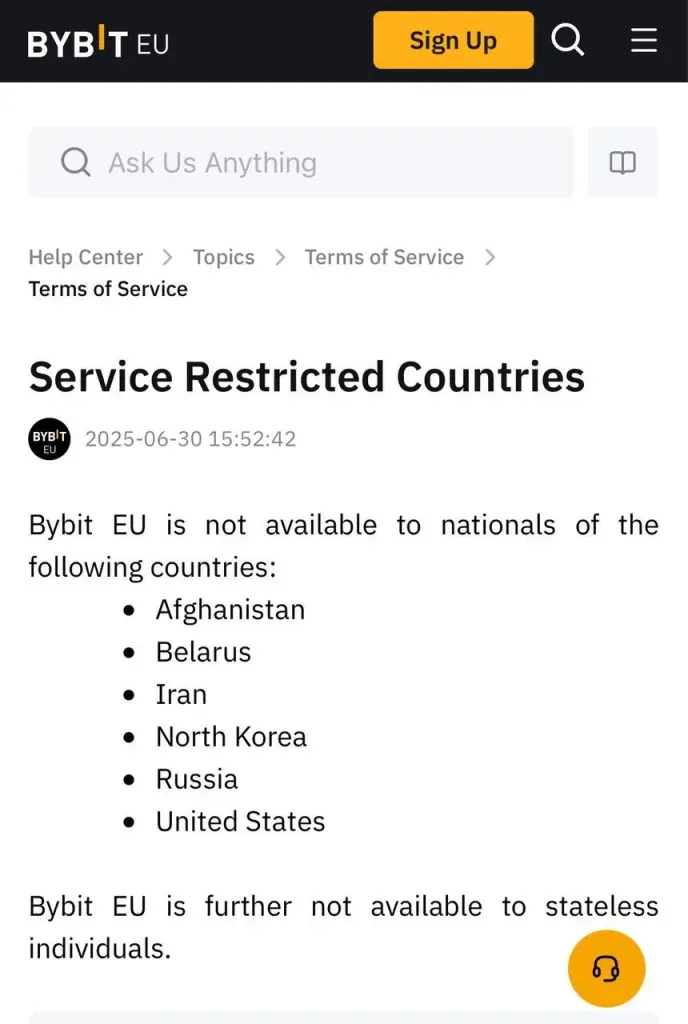

Under its updated policy, Bybit’s European arm now bans registration by users with citizenship of Afghanistan, Belarus, Iran, North Korea, Russia and the United States.

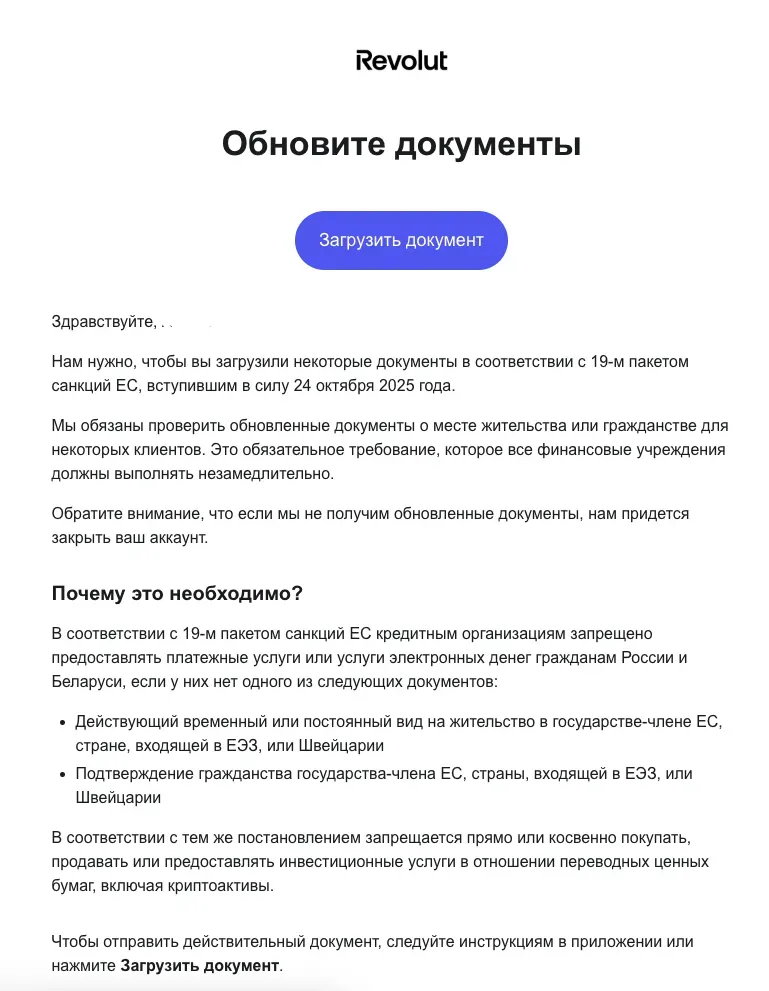

Revolut has been closing the accounts of Russians with EU residence permits on similar grounds, citing the new restrictions. Although the bank had previously opened accounts for such residents, from November 1 even existing clients began receiving closure notices.

ForkLog sought comment from both platforms but received a response only from Revolut’s press office.

“As a regulated financial institution around the world, Revolut must comply with the sanctions laws and regulations of the UN, the European Union, the United Kingdom, the United States and all other applicable laws and regulations in all jurisdictions in which the company operates. More detailed information on this can be found in Revolut’s global sanctions policy,” the letter says.

The bank also made clear that the 19th package was the main reason.

Pre-emptive compliance

Traditionally, crypto platforms have been less quick to react to new laws. But the actions of Revolut and Bybit EU appear to have set a new standard for “pre-emptive” compliance among fintech firms in the EU.

“Compliance in general should be pre-emptive; that is its essence. Compliance at European crypto exchanges had already been reacting to the receipt of assets from ‘Russian wallets’. The inflow of such assets was admitted by the exchange, but could then be frozen for an indefinite period and, in some cases, appropriated,” the GMT Legal founder added.

On the speed of decision-making, Tugarin noted: “Well, at least not the same day.”

However, only divisions registered in EU jurisdictions observe the bloc’s rules. For example, Bybit’s global arm still accepts Russians.

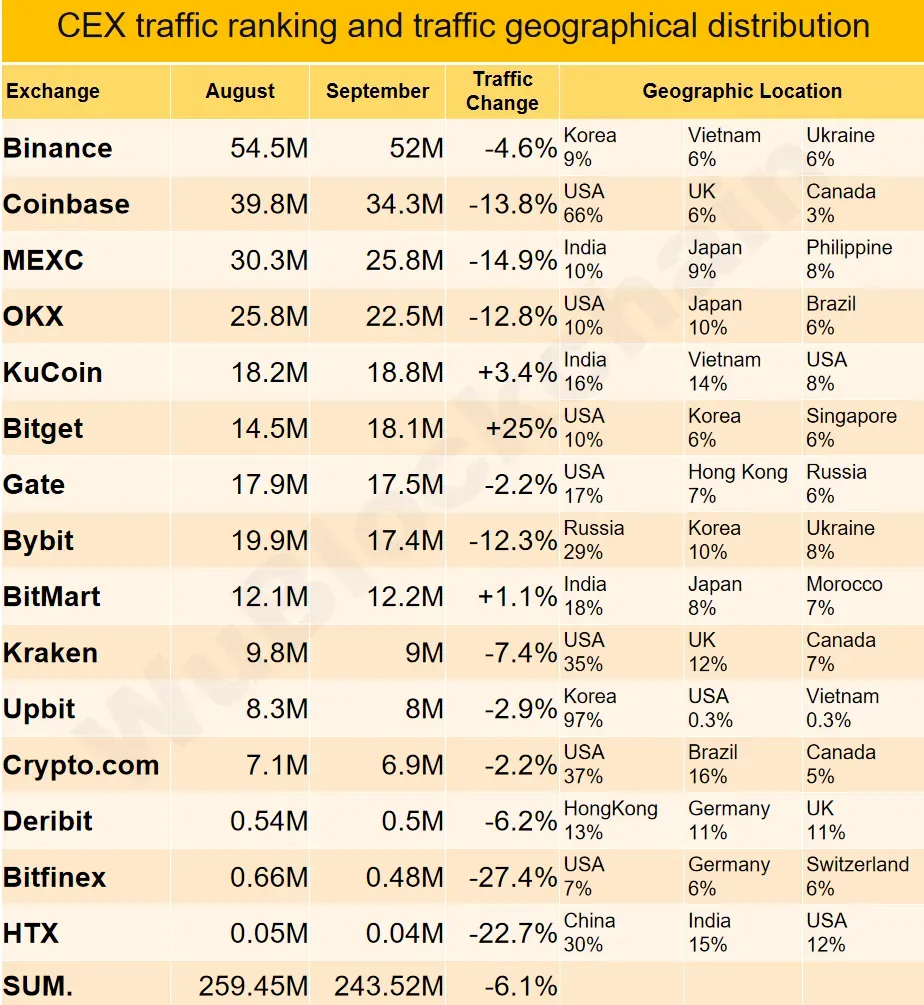

As of September, the share of traffic from Russia on the platform reached 29%.

Food for thought

Beyond the obvious inconveniences, the sanctions prompt reflection on deeper and longer-term consequences.

Many people now use cryptocurrency to send funds to family and friends across borders. For them, a host of new problems arises: at a minimum, they will have to find a platform that allows Russians to register.

In the worst case, users will have to rely on less reliable P2P venues and exchangers.

At the same time, exchanges face a liquidity dilemma. Russia is far from a small user base, and its traders constantly look for loopholes. Bybit could lose around a third of its trading volume if it fully shuts out clients from Russia and Belarus, as Binance did in 2023.

For the market’s mastodons, the loss of a slice of traffic means little. But for smaller exchanges, shedding part of their clientele could seriously hit the business.

***

The restrictions have clearly complicated operations for Russians and Belarusians living in Europe, yet they have little direct impact within the sanctioned countries themselves.

We may never know how effective these bans truly are, but understanding their substance and nuances is vital to adapt to future shocks.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!