Analysts warn the XRP market is structurally fragile

Glassnode says 41% of XRP supply sits at a loss, flagging a top-heavy, fragile market.

Over 41% of the total XRP supply — about 26.5bn coins — is under water, according to Glassnode.

The share of XRP supply in profit has fallen to 58.5%, the lowest since Nov 2024, when price was $0.53.

Today, despite trading ~4× higher ($2.15), 41.5% of supply (~26.5B XRP) sits in loss — a clear sign of a top-heavy and structurally fragile market dominated by late buyers.

📉… https://t.co/CBXPzDalxV pic.twitter.com/UpLNKV7LqD— glassnode (@glassnode) November 17, 2025

The share of the altcoin’s supply in profit has fallen to its lowest since November 2024, when it traded at $0.53. The firm said this points to a “structurally fragile” market dominated by buyers who entered near the peaks.

At press time, XRP is $2.1, down 3.5% on the day and more than 10% on the week.

Potential reversal

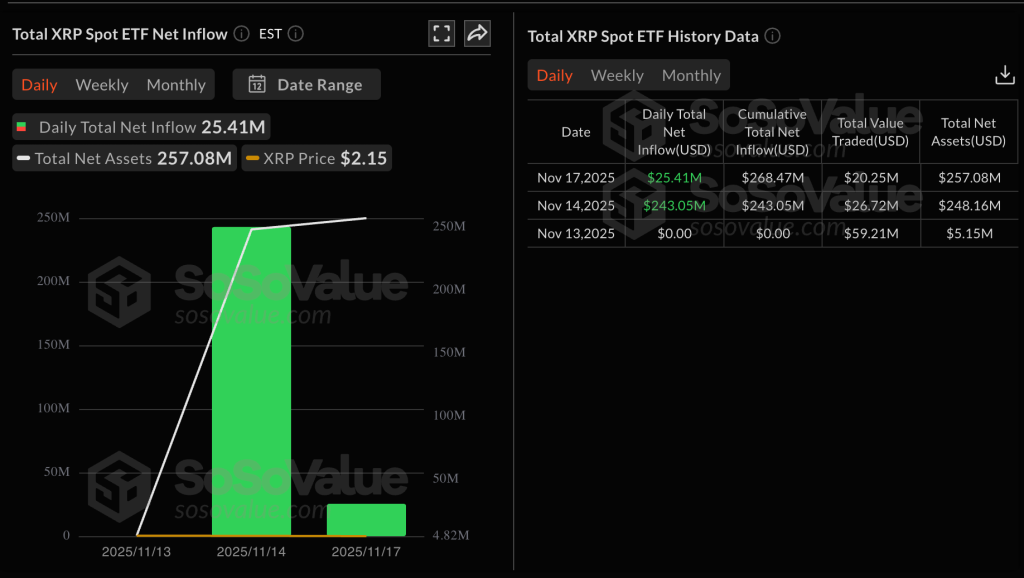

On 13 November, Nasdaq began trading a spot ETF based on XRP, ticker XRPC, from Canary Capital. First-day turnover reached $58m — the best result among all exchange-traded funds launched this year, noted Bloomberg analyst Eric Balchunas.

The print beat expectations — the expert had forecast around $17m.

Since launch, the vehicle has drawn $268m. Canary currently manages $257m in assets.

By the end of the week, approval of four spot XRP ETFs is expected. Another three are due to launch over the following 21 days.

🚨 NEXT WEEK WILL BE HUGE — 4 #XRP ETFs WILL LAUNCH:

1️⃣ NOV 18: FRANKLIN TEMPLETON

2️⃣ NOV 19-20: BITWISE

3️⃣ NOV 20-22: 21SHARES

4️⃣ NOV 20-22: COINSHARES

PREPARE FOR IT & ACT ACCORDINGLY 🫡 pic.twitter.com/rLyvODbwvs

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) November 16, 2025

Traders hope the new wave of ETF launches will revive the altcoin’s bullish trend.

Earlier, JPMorgan analysts said that in the first six months, inflows into spot XRP ETFs could surpass those of comparable Ethereum funds. They estimate $4–8bn.

Technically, the token has hit critical resistance at $2.2. Reclaiming that level would increase the odds of the uptrend continuing.

According to the analyst known as Marzel, XRP is consolidating above the key $2 mark in a pennant pattern. That could signal a price floor.

$XRP is consolidating above $2 in a pennant, signaling a potential bottom. 🔅

A breakout above $2.62 would turn bullish, while a close below $2 would invalidate the pattern, with volume spikes likely indicating the breakout before late Q4.🚀

🟨 Trade $XRP on WEEX:… pic.twitter.com/ObIFe88bzr

— Marzell (@MarzellCrypto) November 17, 2025

“A breakout above $2.62 will turn the trend bullish, and a close below $2 will invalidate the pattern, with volume spikes likely to indicate the breakout before the end of the fourth quarter,” the expert added.

Santiment’s analysts noted that XRP has entered a “favourable buy zone.” They used the MVRV metric to determine it: the lower it is, the higher the probability of a swift recovery.

The reading for Ripple’s cryptocurrency stands at -10.2%.

🤕 The vast majority of cryptocurrencies are now flashing extreme pain for average trading returns. Wallets active in the past 30 days have an average performance of:

📌 Cardano $ADA: -19.7% (Extreme Buy Zone)

📌Chainlink $LINK: -16.8% (Extreme Buy Zone)

📌Ethereum $ETH: -15.4%… pic.twitter.com/l0mUrDWOzm— Santiment (@santimentfeed) November 17, 2025

Earlier, Matthew Sigel, head of digital-asset research at VanEck, questioned the usefulness of Ripple’s token.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!