Traffic Aggregation and AI Impact

How Asia’s crypto media have become rivals to TradFi outlets

ForkLog reviewed the Outset Data Pulse report on crypto media in East and Southeast Asia. The study records fundamental shifts in content consumption: direct visits to specialist outlets hit 54%, while large publishers captured 82% of all regional traffic in the segment.

Methodology: Outset PR analysed Similarweb data for 171 outlets across ten Asian countries in Q2 2025. Sites with fewer than 10,000 monthly visits were excluded. The quantitative data were supplemented by a survey of local media representatives.

Crypto-native media versus the mainstream

Asia has long shown keen interest in digital assets. Yet each jurisdiction has its own quirks:

- Vietnam, the Philippines and Indonesia remain the most active. The drivers are the Play-to-Earn sector and remittances;

- Singapore and Hong Kong are building the institutional base, setting standards through licensing and regulation of stablecoins;

- South Korea and Japan lead in trading intensity, powered by strong local exchanges and a tech-literate retail audience;

- Thailand, Taiwan and Malaysia sit in the middle, expanding their presence by integrating fintech with cryptocurrencies.

Despite upbeat narratives about adoption, the real transformation is happening under the media industry’s bonnet. In Q2 2025, specialised crypto outlets and traditional financial media diverged markedly.

Specialist outlets proved resilient. Combined traffic to crypto-native publications reached 102.1 million visits, with a modest rise in May (+2.23%) and a slight pullback in June (-1.34%). Some 42.74% of sites recorded growth.

By contrast, traditional financial outlets saw audiences ebb. Total visits fell from 267.31 million in April to 229.38 million in June (-7.29%). Only 17.65% of such outlets posted growth.

A survey of editors in Vietnam, Korea and Indonesia confirms the trend: readers are moving away from large financial portals in favour of localised, community-run content and using artificial intelligence to find information.

Dominance at the top

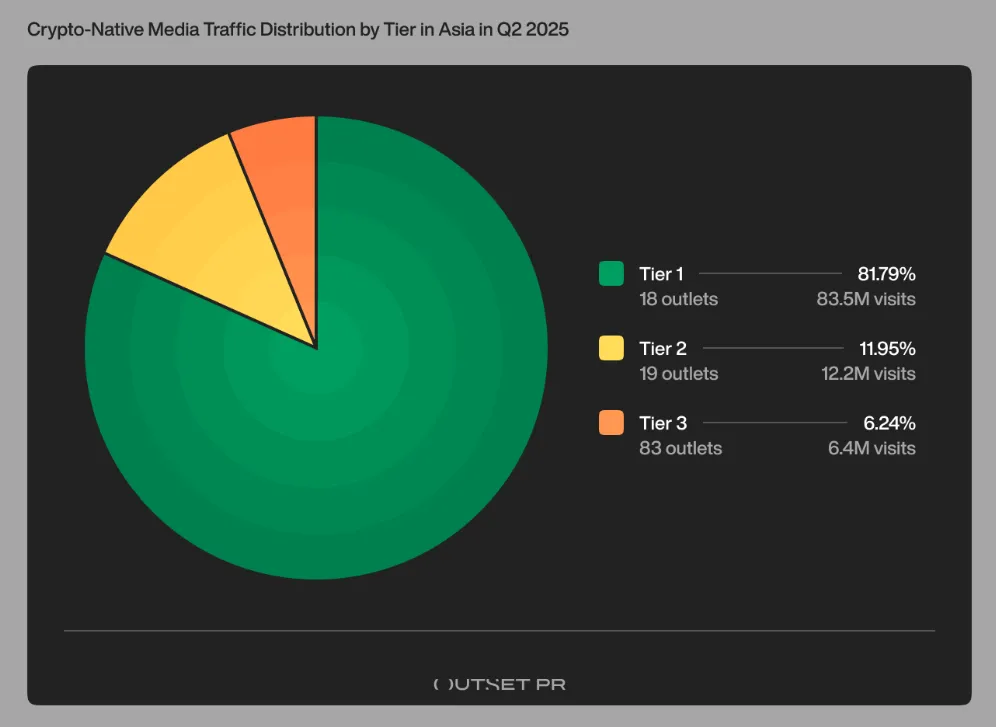

Asia’s crypto-media market is highly centralised. Traffic distribution resembles an inverted pyramid:

- First tier. 18 outlets with more than 400,000 monthly visits each. This group, which includes Coinpan, Coin Readers, BlockMedia, CoinPost, Cointelegraph Japan and others, captured 81.79% of all regional traffic (83.52 million visits).

- Second tier. 19 outlets with 130,000–400,000 visits. Their share was 11.95%. This tier includes CoinCarp, ChainCatcher and Blog Tien Ao.

- Base of the pyramid. 83 smaller outlets (fewer than 130,000 visits) split the remaining 6.24% of traffic.

Top 10 publishers

Outlets were assessed using RCS, which weights absolute growth (55%), relative growth (25%) and audience engagement (20%). The ranking surfaced two successful models: a Korea–Japan approach (trust-led) and a China–Southeast Asia one (AI-optimised).

- CoinReaders (South Korea). A benchmark for audience loyalty, with direct visits at 58.5%. Its leadership rests on brand recognition rather than algorithms.

- CoinPost (Japan). A “real-time engine”. 96% of social traffic comes from X. The outlet prioritises speed over depth (a high bounce rate of 79.42%).

- TokenPost (South Korea). Evenly spreads its presence across platforms: from X and YouTube to LinkedIn and Telegram.

- 528BTC (China). A breakthrough via AI. 27.05% of referral traffic comes from neural networks. It is the first Chinese project whose content strategy is fully integrated with artificial intelligence.

- Jinse.cn (China/Hong Kong). A bridge between mainland China and Hong Kong. A 68.3% direct share underpins its status as a trusted source.

- CoinEdition (Indonesia). A hybrid of SEO and AI. A rare traffic mix for crypto media: YouTube (36%) and LinkedIn (31%).

- TechFlow Post (Malaysia/Taiwan). A bet on deep analysis. Average visit duration is a hefty 5 minutes 51 seconds.

- The BlockBeats (Multiregional). Covers China, Taiwan, Hong Kong and Singapore. Growth is driven by a strong cross-border brand (65.52% direct).

- DigitalAsset.Works (South Korea). A niche player focused on blockchain infrastructure and tokenisation.

- Coinness (South Korea). A community-media model. High loyalty (72.96% direct) and long time on site (4 minutes).

Traffic sources and the role of platforms

User behaviour differs markedly between crypto-native and mainstream outlets:

- Crypto media: direct visits dominate (54.15%), signalling high loyalty and established reading habits; organic search ranks second (35.28%);

- Financial mainstream: critically dependent on organic search (56.48%) thanks to strong domain authority and broad topic coverage.

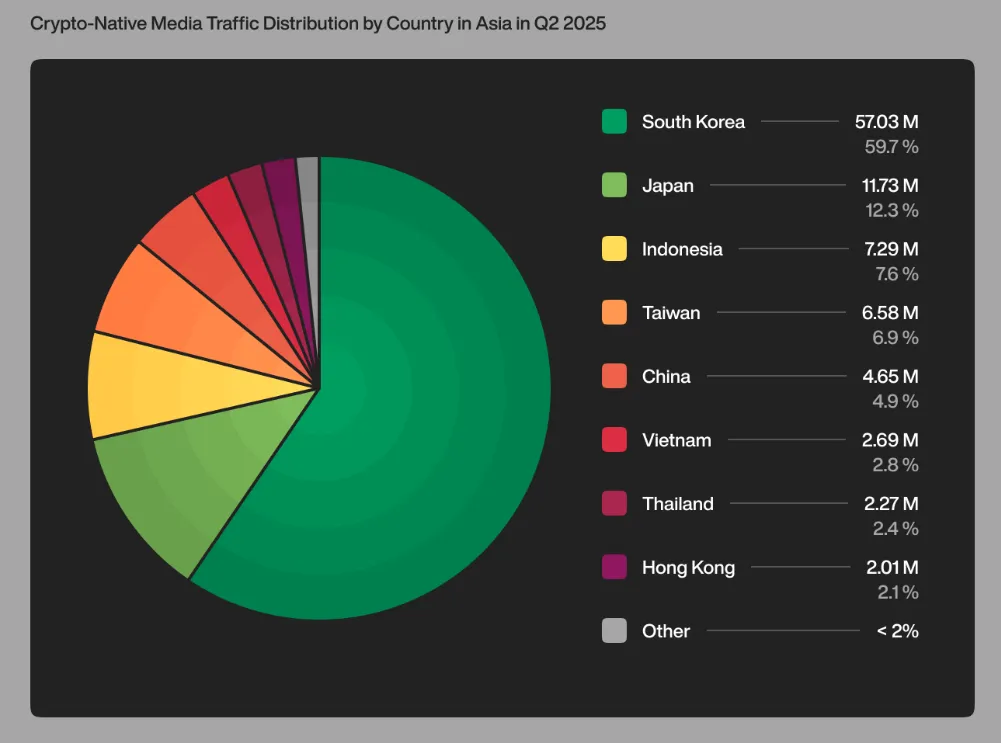

Geographically, South Korea (57.03 million visits) and Japan (11.73 million) generate most of the traffic—together accounting for 70.8% of all visits to crypto media.

In mainstream media that cover cryptocurrencies, Indonesia and Vietnam lead (over 61% of traffic), reflecting the integration of digital assets into the mass agenda in those countries.

Social media

Although social media supplies only 4.85% of traffic, it is critical for engagement:

- X is the undisputed leader (49.71% of social traffic), the main arena for debate in Japan and Korea;

- YouTube takes 23.19%, remaining the chief platform for educational and analytical video;

- Facebook holds its ground in Vietnam and Thailand, while Telegram matters to users in Vietnam and Indonesia.

The AI factor

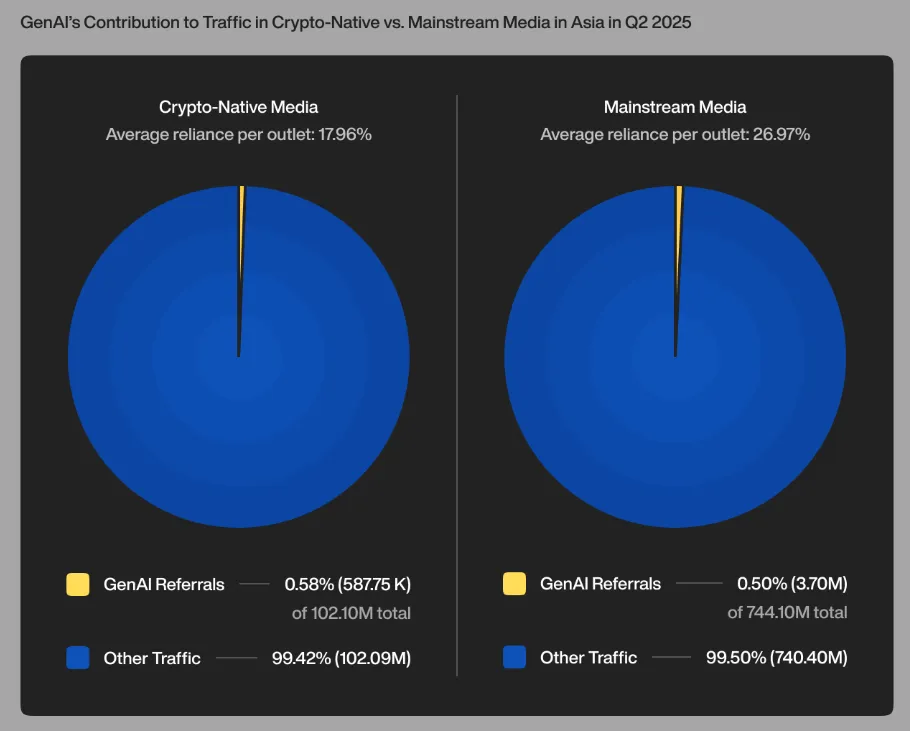

AI tools (for example, ChatGPT) are starting to influence audience distribution directly. In Q2 2025, referrals from AI accounted for 0.58% of total traffic, but for some top outlets this share within referral traffic reached 68%.

Publishers report declining Google traffic as users increasingly receive answers directly from language models. A new SEO trend is emerging: optimisation not just for search results, but for visibility in models (Model Visibility).

Overall, Asia’s crypto-media ecosystem has become a complex, multi‑layered network:

- Trust as currency. In Japan and Korea, media integrate with strict financial standards, while in Southeast Asia the emphasis is on self‑regulation and scam protection.

- Topical focus. The key drivers of interest are narratives around the integration of AI and blockchain, and the tokenisation of real‑world assets (RWA).

- Localisation. Smaller platforms show that linguistic proximity and community work can trump global reach.

As one survey respondent noted:

“Crypto media here are not just reportage, they are participation.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!