Bank of America Advises Allocating 1-4% of Portfolios to Cryptocurrencies

Bank of America advises clients to allocate 1-4% of portfolios to digital assets.

Bank of America (BoA), one of the largest banks in the United States, is advising its institutional clients to allocate between 1% and 4% of their portfolios to digital assets. This was reported by Yahoo Finance, citing a statement from the organization’s CIO, Chris Hyzy.

“For investors with a strong interest in thematic innovations and who are willing to tolerate increased volatility, it may be advisable to invest 1–4% in cryptocurrencies,” stated the senior executive.

This opportunity will be available to clients of the Merrill, Bank of America Private Bank, and Merrill Edge platforms. The new asset class is intended to be offered in the form of ETFs.

Starting January 5, 2026, the bank’s product lineup will include the Bitwise Bitcoin ETF (BITB), Wise Origin Bitcoin Fund from Fidelity (FBTC), Bitcoin Mini Trust from Grayscale (BTC), and iShares Bitcoin Trust from BlackRock (IBIT).

Previously, investors could not access cryptocurrencies as advisors were prohibited from recommending such instruments.

“This update reflects the growing client demand for access to digital assets,” added BoA’s head of investment solutions, Nancy Fahmi.

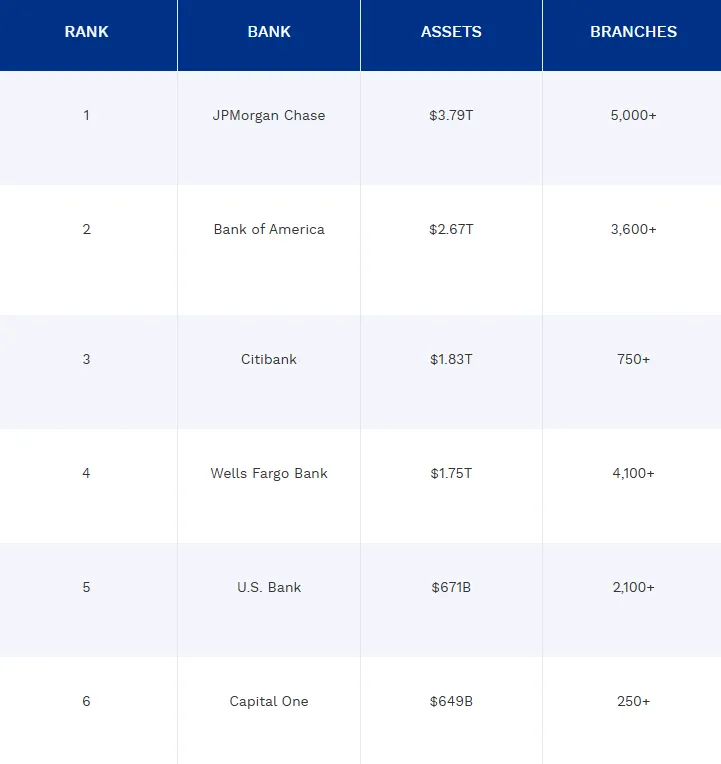

According to Forbes, Bank of America is the second-largest bank in the U.S. with consolidated assets of approximately $2.67 trillion and more than 3,600 branches.

Earlier, on December 2, Vanguard Group, the world’s second-largest asset management company, opened access to trading ETFs and mutual funds based on cryptocurrencies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!