Bitcoin Long-Term Holders’ Reserves Hit Cyclical Low

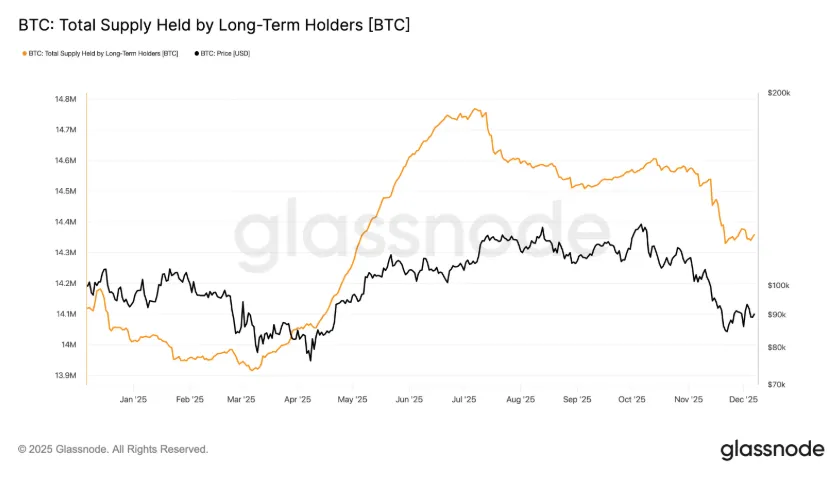

Bitcoin supply among long-term holders reached a cyclical low, with prices bottoming at $82,000.

On November 21, the supply of the leading cryptocurrency among long-term holders (LTH) reached a cyclical low. On the same day, the asset’s price found a bottom around $82,000.

At the time of writing, Bitcoin is trading at $91,660 (+2.9% over the past day).

Data indicates the end of spot sell-offs that have hindered market growth throughout 2025. The correction from peak to trough was 36%. Stabilization of the LTH metric and a trend reversal suggest a significant reduction in selling pressure.

From July to November, long-term investors’ reserves decreased from 14.77 million BTC to 14.33 million BTC. This category includes addresses holding coins for more than 155 days.

Previous lows were recorded in April 2024 after a historical price peak and in March 2025 amid tariff concerns.

In the 2017 and 2021 cycles, LTH supply sharply declined during retail frenzy. The current situation features a more gradual asset distribution without abrupt spikes. This change in market participants’ behavior questions the relevance of the classic four-year cycle theory.

Bitcoin’s Momentum Weakens

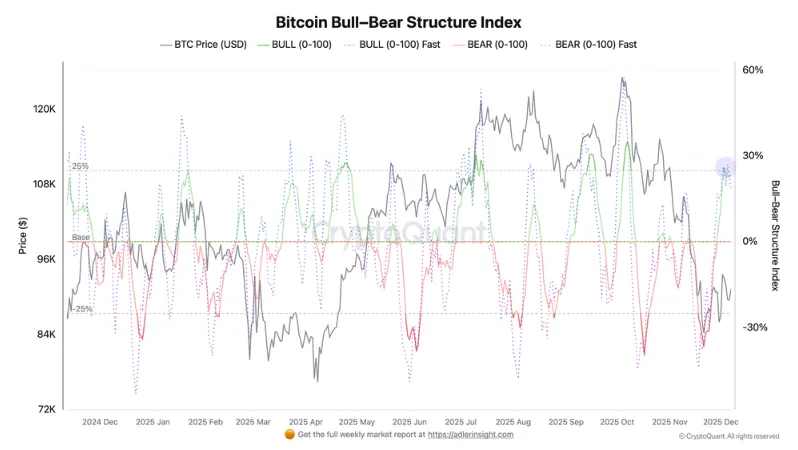

Analyst Axel Adler Jr. noted a divergence in the technical indicators of digital gold. According to him, despite maintaining a global bullish structure, the short-term momentum of the leading cryptocurrency is weakening.

Bull-index rose to 23%, while its “fast” version dropped to 18%. The resulting divergence (FAST < SLOW) signals potential challenges for buyers. The current divergence is -5.28 points — the first such signal since the beginning of the month.

According to the expert, this scenario indicates that short-term growth drivers (funding rate, taker imbalance, inflows into ETF) have weakened faster than the medium-term market structure. Historically, such divergences have preceded corrections or prolonged consolidation periods.

The situation is exacerbated by the anticipation of the Fed meeting in December. The market is pricing in an 85% chance of a 25 basis point rate cut. Any deviation from this scenario threatens to push the “fast” index below zero. Conversely, a dovish policy could return the indicators to the +25–30% zone.

Adler described the current market as “tactically fragile.” He recommended avoiding increasing risks while maintaining core long positions. The weakening of the fast component of the index serves as an early warning of the local momentum’s burnout and the risks of a market regime shift.

An analyst known as Mister Crypto highlighted the sentiment among traders.

We are seeing Max Fear in the crypto market right now.

This could be a local bottom. pic.twitter.com/ag9k5XV2UW

— Mister Crypto (@misterrcrypto) December 8, 2025

He noted a state of “maximum fear” in the crypto market, which, in his view, could indicate the formation of a local bottom.

In December, an expert under the pseudonym Daan Crypto identified a key support level before a potential Bitcoin correction to $76,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!