Federal Reserve Delivers Third Straight Interest Rate Cut

The crypto market reacted with high volatility.

On December 10, the United States Federal Reserve (Fed) reduced the key interest rate by 25 basis points for the third consecutive time, bringing it down to 3.5-3.75%.

“Available data indicate a moderate increase in economic activity. This year, employment growth has slowed, and the unemployment rate rose slightly through September. More recent indicators confirm these trends. Inflation has increased compared to the beginning of the year and remains somewhat elevated,” the press release states.

The Fed reiterated its inflation target of 2%. September’s growth rate of the CPI was 3% compared to 2.9% the previous month.

The Federal Reserve Committee will continue to monitor macroeconomic data to make further decisions on the rate.

Additionally, representatives of the regulator noted that they might start purchasing short-term Treasury securities to support their reserves, which have decreased, if necessary.

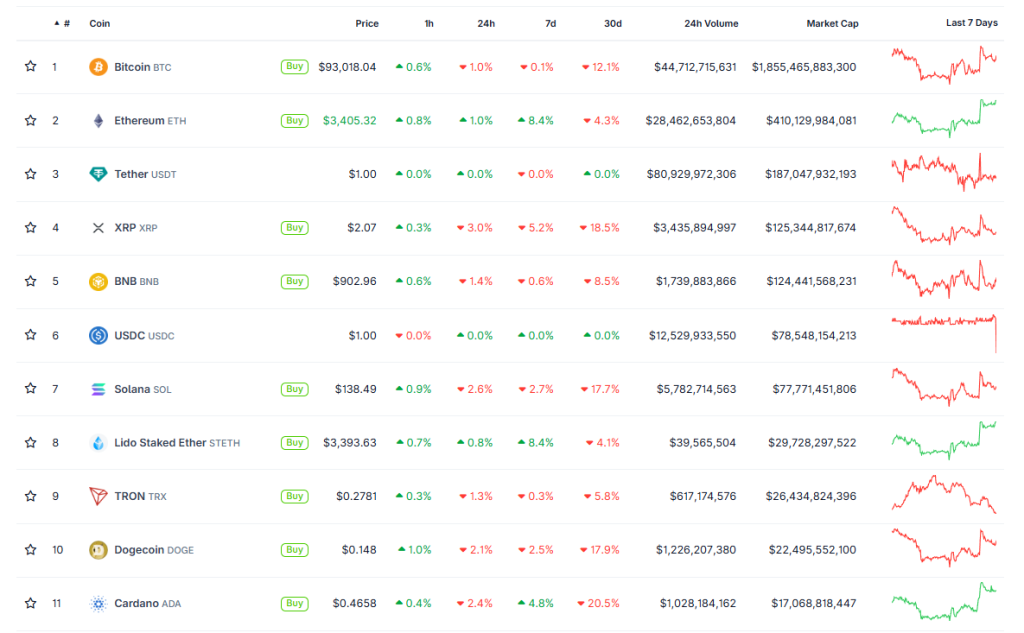

Bitcoin reacted to the rate cut with increased volatility. Within 10 minutes of the announcement, the coin tested the boundaries of the $91,600-$93,300 range.

At the time of writing, the leading cryptocurrency is trading around $93,000.

Ethereum showed similar dynamics. Currently, the asset’s price has stabilized around $3,400.

Overall, most cryptocurrencies in the top 10 by market capitalization found themselves in the “green zone” on a short timeframe.

The Crypto Fear and Greed Index rose to 26.

Powell’s Commentary

During a press conference, Fed Chairman Jerome Powell noted that the macroeconomic situation has changed little: inflation and unemployment remain high.

According to him, the U.S. economy has been significantly affected by the government shutdown. The rate is now in a “neutral range,” so markets perceive the situation as a “pause,” added the head of the regulator.

Powell also confirmed large purchases of Treasury bonds into the Fed’s account in the coming months. The pace of accumulation will then gradually decrease.

Winds of Change

Reports of Powell’s imminent replacement have become more frequent in the media. Prior to the meeting, the FT reported that U.S. President Donald Trump will soon begin the final stage of interviews for the position of Fed Chairman.

The main candidate is considered to be White House economic advisor Kevin Hassett. He will compete with three other contenders.

“We will consider several different candidates, but I have a pretty good idea of who I want to see in this position,” Trump noted.

It is believed that if Hassett is chosen, the Fed will begin to cut rates more actively and focus on quantitative easing.

As reported by ARK Invest, they suggested that the return of liquidity to the markets and positive signals from the Fed could aid in Bitcoin’s recovery in December.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!