Bitcoin Distribution Phase Nears Completion, Analyst Claims

Long-term Bitcoin holders near end of active selling phase, says K33 Research head.

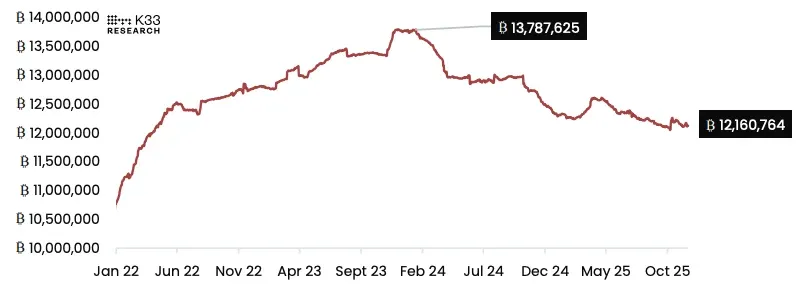

Long-term holders of Bitcoin have nearly concluded their phase of active selling. This conclusion was reached by Vetle Lunde, head of research at K33 Research, after examining the multi-year distribution phase of the coins.

The analyst noted a reduction in the volume of assets that have not moved for over two years. Since the beginning of 2024, owners have transferred about 1.6 million BTC ($138 billion). This indicates sustained sales by early investors.

Lunde emphasized that the scale of outflow points to a genuine redistribution of assets, rather than technical factors. The transformation of the Grayscale trust into an ETF, wallet consolidation, and security system updates only partially explain the situation.

Change in Ownership Structure

In terms of reactivation volumes of old coins, 2024 and 2025 are second only to the 2017 rally. However, the reasons for sales have changed. Previously, investors shifted capital to altcoins and ICO, but now they are moving into fiat. This is facilitated by the deep liquidity of spot Bitcoin ETFs and demand from corporate treasuries.

As examples, the expert cited several large transactions:

- an over-the-counter sale of 80,000 BTC by Galaxy in July;

- a whale’s exchange of 24,000 BTC for Ethereum in August.

This year, coins aged one year or more worth about $300 billion have been mobilized. Institutional liquidity has allowed long-term holders to lock in profits at six-figure levels. This has reduced ownership concentration and established new price levels.

Forecast and Rebalancing

K33 anticipates a weakening of selling pressure. Over two years, 20% of the supply has returned to the market, and this process is nearly complete. Lunde predicted that by the end of 2026, the volume of coins held for more than two years will exceed the current 12.16 million BTC.

The analyst also suggested a capital influx at the end of the year. In the fourth quarter, Bitcoin grew more slowly than other assets. This may prompt investment funds to purchase more cryptocurrency in December–January to balance asset shares in their portfolios.

Earlier, CryptoQuant analyst Carmelo Aleman reported that new investors in the first cryptocurrency are incurring losses. For over a month, the asset’s price has remained below their average entry price.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!