Analysts Say Connection of Bitcoin Hashrate Fall to China Crackdown Is Exaggerated

Bitcoin's hashrate drop linked to US pools, not just China, says TheMinerMag.

The sharp 8% decline in the Bitcoin network’s hashrate was not solely due to China and was temporary in nature, reports TheMinerMag.

On December 13, rumors spread across social media about the disconnection of 200,000 to 400,000 devices used for mining the leading cryptocurrency. One of the first to highlight this was Jack Kong, former co-chair of miner Canaan and founder of Nano Labs.

Some speculated that the number could reach 500,000 units with a capacity of 2 GW.

Roughly ~2GW of Bitcoin mining has been shut down in Xinjiang China 🇨🇳.

There are now ~500,000 displaced mining machines looking for new homes

— Kevin Zhang (@SinoCrypto) December 15, 2025

Several days later, Kong reported that the blockchain’s digital gold hashrate had decreased by 8%—approximately 100 EH/s.

The metric indeed fell, but not solely due to the shutdown of mining farms in Xinjiang.

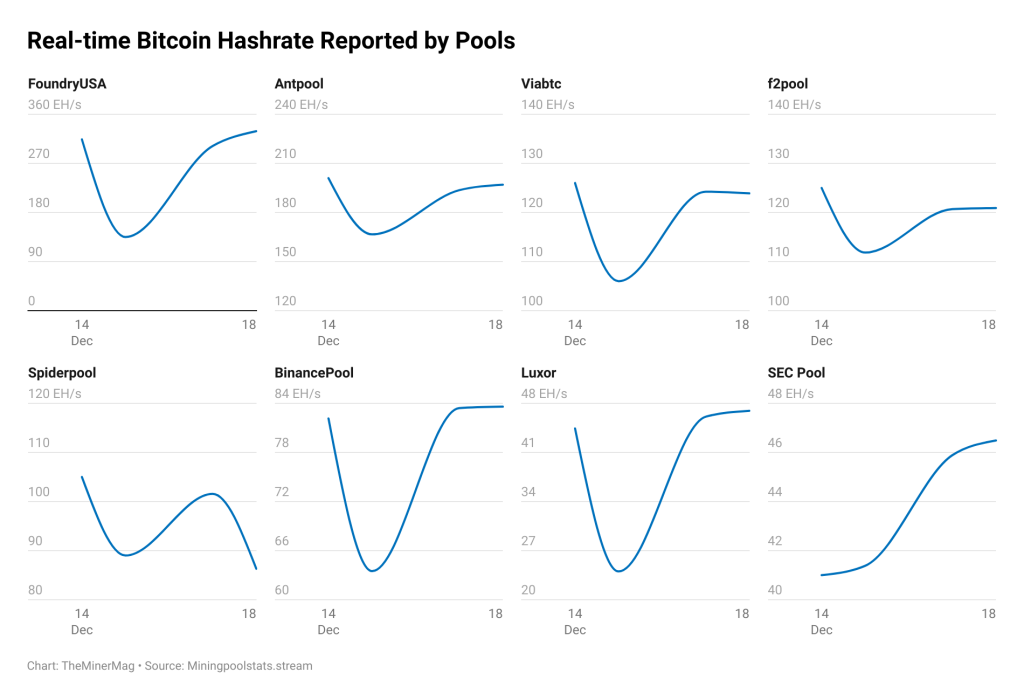

According to experts, the primary contributors were US-based pools. The most significant declines were recorded by Foundry USA and Luxor due to cold weather and energy consumption restrictions. Together, they accounted for about 200 EH/s of the total decrease.

The hashrate of major Chinese-origin pools—Antpool, F2Pool, ViaBTC, SpiderPool, and Binance Pool—dropped by 100 EH/s. Many of these are located outside China, so some may have been affected by issues beyond the country’s borders.

By December 17, their metrics had nearly recovered, indicating a temporary glitch rather than equipment shutdown.

SpiderPool was an exception, with its hashrate remaining lower by ~20 EH/s as of December 18. TheMinerMag suggests this indirectly confirms real but limited-scale shutdowns.

“It is quite likely that some miners in Xinjiang voluntarily shut down over the weekend to avoid attention during inspections, then quietly returned to the network when the pressure eased,” they added.

Amidst Bitcoin’s situation, Litecoin stood out—on December 15, its hashrate fell by 20%, from 3.38 PH/s to 2.65 PH/s, and has yet to recover.

“This suggests that the mining revival in the region was not limited to Bitcoin, and other PoW-based networks may be more vulnerable,” experts concluded.

In late November, China’s share in mining the leading cryptocurrency exceeded 14%, placing the country third globally in this metric.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!