Experts Highlight Capital Concentration in Bitcoin and Ethereum

Capital concentrates in Bitcoin and Ethereum, narrowing market structure.

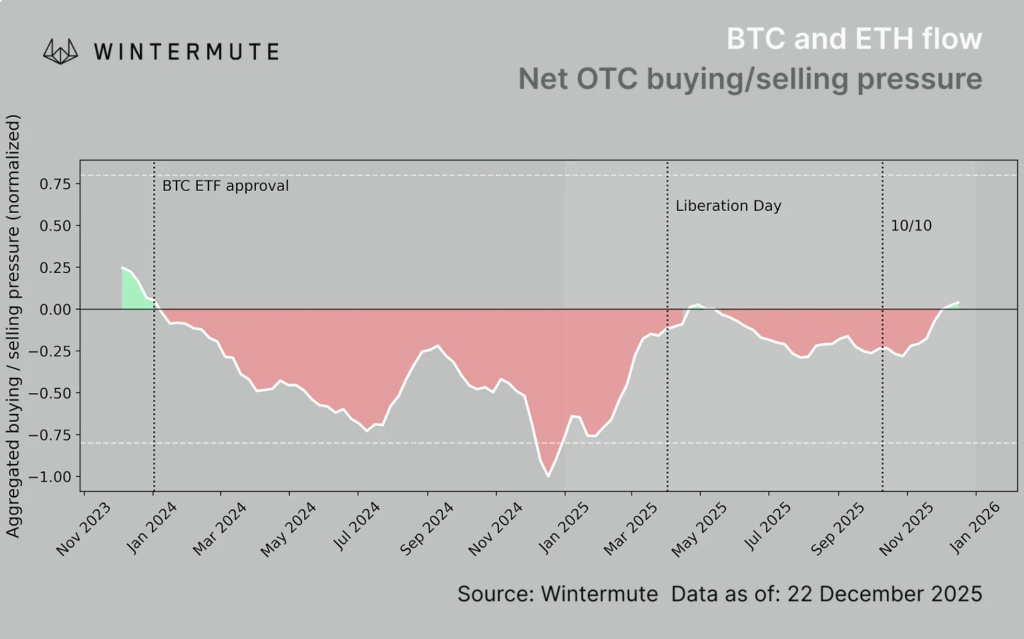

The cryptocurrency market structure is “narrowing” as capital increasingly concentrates in the two largest coins, according to analysts from market maker Wintermute.

— Wintermute (@wintermute_t) December 23, 2025

“Bitcoin’s dominance has risen again, reinforcing a trend that has defined much of the second half of the year. Altcoins continue to lag, burdened by significant oversupply and a tight schedule of unlocks, which maintains pressure on the market’s ‘long tail’,” they noted.

The experts reached several conclusions:

- Capital is concentrating in “blue chips.”

- Ethereum is entering a phase of catch-up growth, with buying pressure increasing.

- Institutional activity remains stable.

- Retail investors are closing positions in altcoins, shifting to Bitcoin and Ethereum.

According to the specialists, the dynamics align with the market consensus that a primary impulse and leadership from digital gold are necessary to initiate a new sustainable rally in altcoins.

The Role of Derivatives

Key price benchmarks are currently set by the derivatives market, where uncertainty prevails.

Funding rates for Bitcoin and Ethereum remain relatively low even amid sell-offs, indicating an absence of extremely overheated long positions.

The options sector lays out a wide range of possible scenarios. Implied volatility remains elevated, with participants’ positions divided between bets on further declines to $85,000 and hopes for a swift return to recent highs.

An important event will be the expiration of contracts on December 26 with a nominal value of $28.5 billion. This amount is double last year’s figure and accounts for nearly 50% of all open interest on the Deribit exchange.

“The expiration of options contracts concludes a year defined by institutional maturity and a shift from speculative cycles to a politically driven supercycle,” noted the exchange’s commercial director, Jean-David Pekigno.

According to the expert, the market’s attention is focused on the $96,000 level—the “maximum pain” point where contract expiration is most beneficial to option sellers.

Meanwhile, open interest of $1.2 billion in puts is concentrated at the $85,000 strike. If selling pressure intensifies, this cluster could drag the spot price down.

Mid-term strategies target the $100,000-125,000 range. However, the rising cost of short-term protective instruments indicates investors’ desire to hedge against a sudden collapse, Pekigno emphasized.

At the time of writing, digital gold is trading around $86,800, with its price down 0.7% over the past 24 hours.

Forecast

Wintermute described the current market phase as a period of consolidation and distribution. According to the specialists, the industry’s fundamental foundations remain strong.

Sharp fluctuations occur against the backdrop of seasonal liquidity deterioration and low trader activity ahead of the holidays.

“Towards the end of the year and during the holiday period, we expect a narrowing of the trading range, low volumes, and high investor selectivity. In the absence of external macro or regulatory catalysts, the market will be driven not by fundamental conviction but by technical positioning and local liquidity flows,” the experts stated.

Earlier, QCP pointed out the technical nature of current price movements. Historically, quotes tend to revert to average values by January, when full liquidity and participant activity return to the market.

As reported, analysts at XWIN Research Japan explained Bitcoin’s weakness amid the rise of metals.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!