USDe Capitalisation by Ethena Plummets by $8.3 Billion Since October

USDe supply by Ethena drops over $8 billion post-October.

Following “Black Saturday,” the supply volume of the synthetic dollar USDe from Ethena has decreased by more than $8 billion.

As of October 9, the supply volume of the stablecoin was estimated at approximately $14.7 billion. Over two months, this figure has fallen to $6.3 billion.

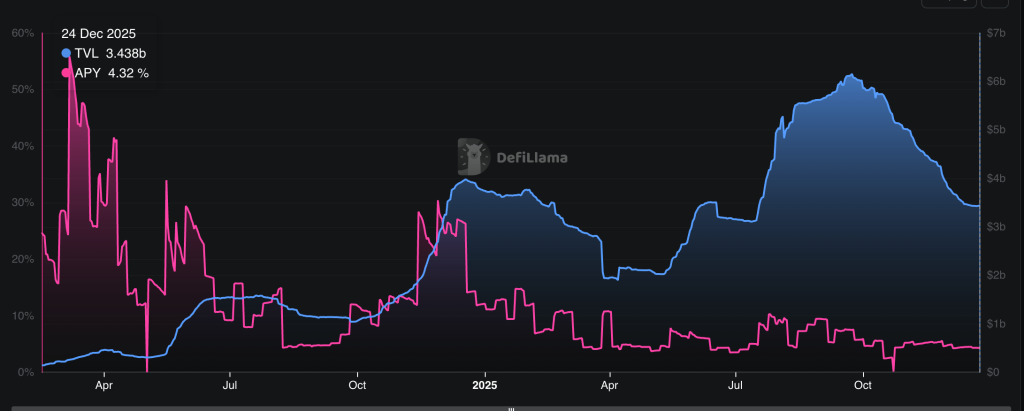

The chart below illustrates the significant predominance of redemptions over the issuance of USDe in recent months:

The asset ranks 27th in market capitalisation, standing fourth among the largest “stablecoins.”

The annual yield of USDe is far from its previous levels—only 4.3%.

Echoes of “Black Saturday”

In an analytical report by 10x Research, the October crash was described as a turning point: the bull phase was replaced by a sudden deleveraging. The sharp correction “erased” about 30% ($1.3 trillion) from the total capitalisation of the cryptocurrency market.

After Crypto’s October 10 Crash: Are We Entering the Final Stage of Deleveraging?

October proved to be the most consequential month for Bitcoin in 2025, marking the point at which the bull market decisively turned bearish amid a convergence of overlapping shocks.

Understanding… pic.twitter.com/W6iAKdCAA3

— 10x Research (@10x_Research) December 23, 2025

“In this case, the fragile interaction between Binance, Ethena, and Hyperliquid was disrupted on October 10. This broke the momentum, and unlike previous pullbacks, the market could not recover,” noted 10x Research.

According to analysts, after the crash, the total trading volume of crypto assets fell by approximately 50%. This is a “clear signal” that many traders and market makers have taken a wait-and-see approach.

“Collectively, these factors indicate a gradual reduction in risk exposure by US institutional investors,” experts added.

Overall, the company is convinced that the current stagnation is not due to speculators capitulating, but rather “a deliberate reduction of positions by regulated capital.”

Earlier, analysts at The Block linked the decline in demand for USDe to the closure of leveraged strategies in DeFi protocols like Aave.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!