Anthony Pompliano Sees a Steadier 2026 for Bitcoin Price

Pompliano says muted December may steady bitcoin into 2026 amid falling volatility.

The absence of a “crazy” December surge in the price of the leading cryptocurrency could help avert a sharp drop in the first quarter of 2026, investor Anthony Pompliano told CNBC.

Short-term disappointment among holders of digital gold who expected a rally to $250,000 this year is obscuring the broader picture, he said.

“We must remember that bitcoin is up 100% over two years, and 300% over three. It keeps compounding in value. This thing is a real monster in financial markets,” the expert stressed.

Pompliano ruled out a 70%–80% drawdown. His central argument is a “compression” of volatility that has gone largely unnoticed amid the focus on bitcoin’s correction.

Declining swings frustrate market participants waiting for an “explosive” move, he noted. Yet, in his words, this provides “some degree of safety” against major corrections.

At the time of writing, bitcoin trades around $87,300, down 0.4% over the past 24 hours.

Two problems

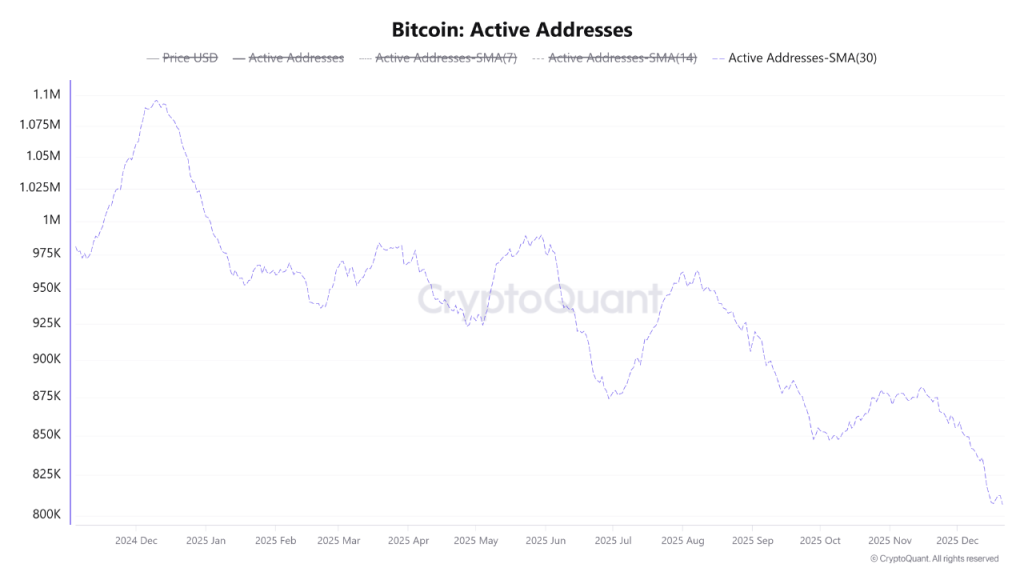

Analysts at CryptoOnchain say digital gold risks getting stuck below the key $90,000 level unless two market conditions change: on-chain activity and exchange liquidity.

The 30-day moving average of active addresses has dropped to roughly 807,000 — the lowest reading in a year. That points to falling participation from both retail users and short-term traders.

Network dynamics are corroborated by exchange flows. On Binance, two key metrics simultaneously hit yearly lows: the number of addresses depositing and the number withdrawing assets.

According to the experts, the synchronicity “reflects a market stalemate”. On the one hand, low deposits mean long-term holders are not sending coins to exchanges to sell. On the other, slower withdrawals hint at a pause in big players’ buying and in moving funds to cold wallets.

Separately, the analyst known as Darkfost noted that in December the monthly volume of bitcoins flowing to Binance from whales halved. The metric fell from $7.88bn to $3.86bn.

🐳 During December, whale inflows on Binance were cut in half !

The latest data shows a clear decline in Bitcoin inflows to Binance coming from whales over the month of December.

💥 Specifically, monthly whale inflows dropped from around $7.88 billion to $3.86 billion,… pic.twitter.com/Z2GP3M02bk

— Darkfost (@Darkfost_Coc) December 24, 2025

In his view, the trend is helping to stabilise the price of the leading cryptocurrency as selling pressure eases.

Earlier, CryptoQuant said that realised losses among large investors were one of the drivers of the drop in digital gold’s price from $124,000 to $84,000.

Levels to watch

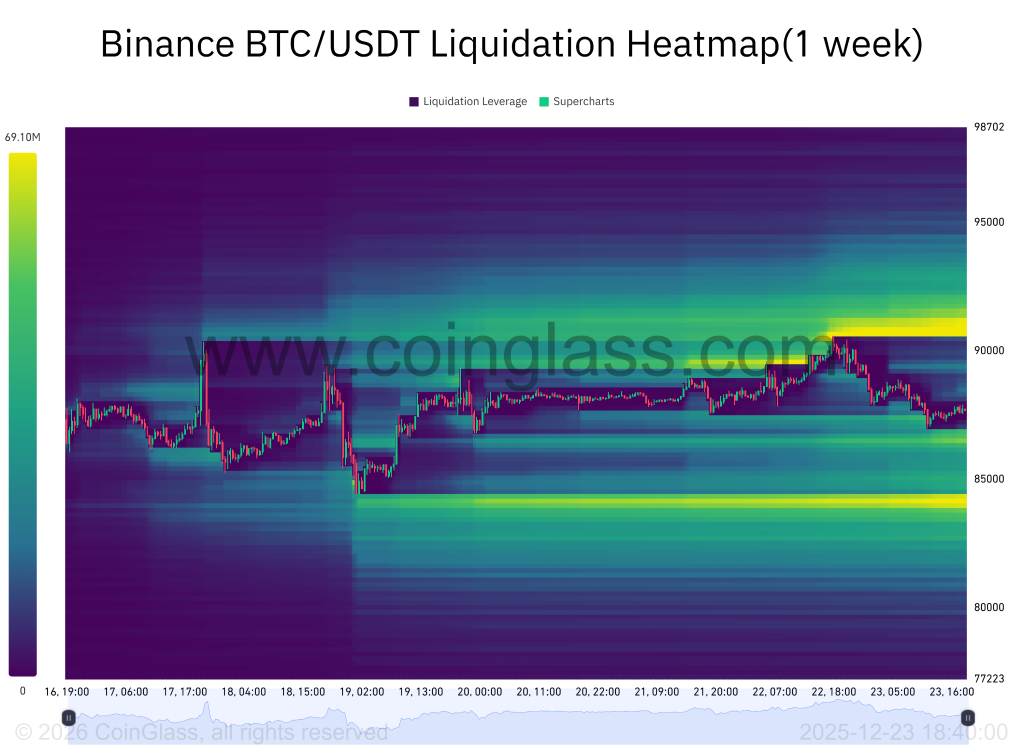

Bitcoin remains range-bound between $85,000 and $90,000, despite repeated attempts to breach the upper resistance. On Binance, the technical picture highlights two zones where liquidity is most concentrated:

- Lower support ($85,800–$86,500): a dense cluster of leveraged longs has formed here. A drop into this band would threaten liquidations exceeding $60m, making it an attractive target for large players.

- Upper resistance ($90,600–$92,000): an unfilled gap also remains here with shorts “trapped”. A breakout would put roughly $70m of shorts at risk of liquidation.

Analyst Michaël van de Poppe called the current price action “a waiting game”. In his view, the bitcoin price will “surge” when the commodities market peaks and the Nasdaq hits a new all-time high. He expects this next week.

#Bitcoin currently stalls between $85-90K for multiple weeks.

It’s a waiting game.

For me, it feels like we’re waiting before commodities are peaked and the Nasdaq breaks to a new ATH for $BTC to surge again.

Likely next week, I would assume, as the Christmas week is over.… pic.twitter.com/rWSXejwh9H

— Michaël van de Poppe (@CryptoMichNL) December 24, 2025

If $86,000 holds as support, a gradual rise toward $90,000 is possible, van de Poppe concluded.

Earlier, CryptoQuant analysts warned of the onset of a “crypto winter”. According to their forecast, the bottom will form near the realised price — around $56,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!