AAVE Holders Reject Transfer of Brand Control to DAO

Aave holders reject brand control transfer to DAO; highlights deeper governance issues.

Participants in the Aave ecosystem voted against an initiative to transfer the protocol’s brand control to a decentralized organization.

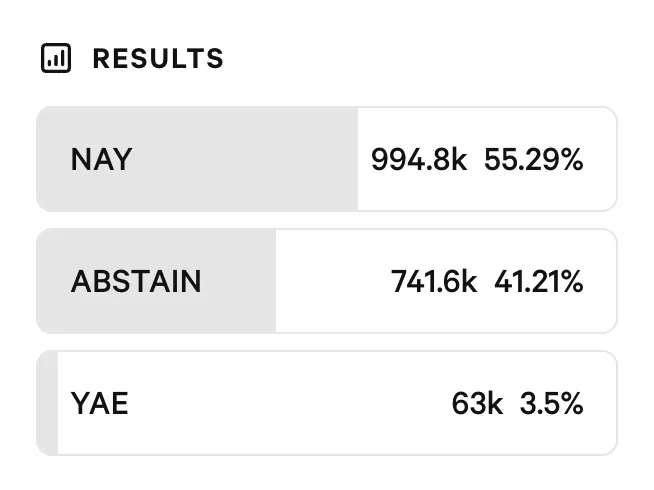

The vote concluded on December 26. A total of 55.29% of AAVE holders opposed the proposal, 41.21% abstained, and only 3.5% supported it.

The proposal’s authors advocated for transferring intellectual property—domains, social media accounts, and trademarks—under the management of a legal entity controlled by the DAO. This was presented as a necessary step towards brand decentralization.

The conflict between the developer company and token holders began after a controversial deal. On December 4, Aave Labs announced a partnership with CoW Swap to “improve swap pricing and integrate MEV protection into the protocol interface.”

On December 11, a delegate known as EzR3aL claimed that fees from the updated swap contracts were now directed to a private wallet controlled by Aave Labs. The decentralized organization lost a significant portion of its revenue, angering the community.

Amid this “civil war,” AAVE lost 19% over the week, dropping to around $150. At the time of writing, the asset has slightly recovered and is trading at approximately $154.

A Deeper Issue

The voting results highlighted a deeper issue—discontent among major investors regarding protocol governance and revenue distribution.

Evgeny Gaevoy, founder and CEO of market maker Wintermute, whose company voted against the initiative, urged the Aave Labs team to engage in serious dialogue about aligning long-term interests of all parties.

6) Wintermute would be voting NO on the proposal (for the reasons outlined above), but we do expect AAVE labs to approach this seriously as we figure out how to solve the token valuee capture in the long run. If AAVE can figure this out, there is hope for all other tokens too

— wishful_cynic (@EvgenyGaevoy) December 25, 2025

According to him, this issue is critically important not only for Aave but for the entire market. Successfully resolving it could set a precedent for many other protocols in similar situations.

Lido advisor Hasu described the situation as a symptom of a “fundamentally unworkable” model—the coexistence of a governance token and a commercial company.

I’m just gonna say this much about the Aave situation, something I have repeated in many other contexs: token/equity dual structures are fundamentally unworkable. Not just hard to structure, but fundamentally broken.

Investing in businesses inherently requires trust in the…

— Hasu⚡️🤖 (@hasufl) December 22, 2025

He stated that such dual structures inevitably create conflicting incentives, making effective protocol governance nearly impossible.

“Investing in a business inherently requires trust in the project’s management, and despite existing legal norms on paper, this management practically has unlimited rights to dismantle the business. But when conflicting incentives from equity structures are added, the complexity becomes insurmountable,” noted Hasu.

The expert acknowledged that such hybrid structures emerged a few years ago as a necessary response to hostile regulatory stances. However, he believes long-term investors have always viewed them as a temporary compromise.

“As a long-time Aave investor, I hope all involved parties can reach an agreement and develop a solution that leads us to a clear model—either where everything is governed by the token or where everything is governed by traditional equity,” he concluded.

An analyst known as Milli described the situation as a “bullish signal.”

My take on the Aave proposal drama is that it is all extremely bullish.

There is an old saying —

“Everyone dies two deaths: Once when they pass away, and once when their name is mentioned for the last time.”

The very fact that Aave governance is still heated and active years…

— MilliΞ (@llamaonthebrink) December 26, 2025

“The very fact that Aave governance still sparks heated debates and activity years after the DAO concept was written off—in an era where governance is largely ignored—indicates that there is significant value here and that Aave is doing something right,” he commented.

Previously, Aave founder Stani Kulechov was accused of vote-buying with $10 million to gain control over the protocol.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!