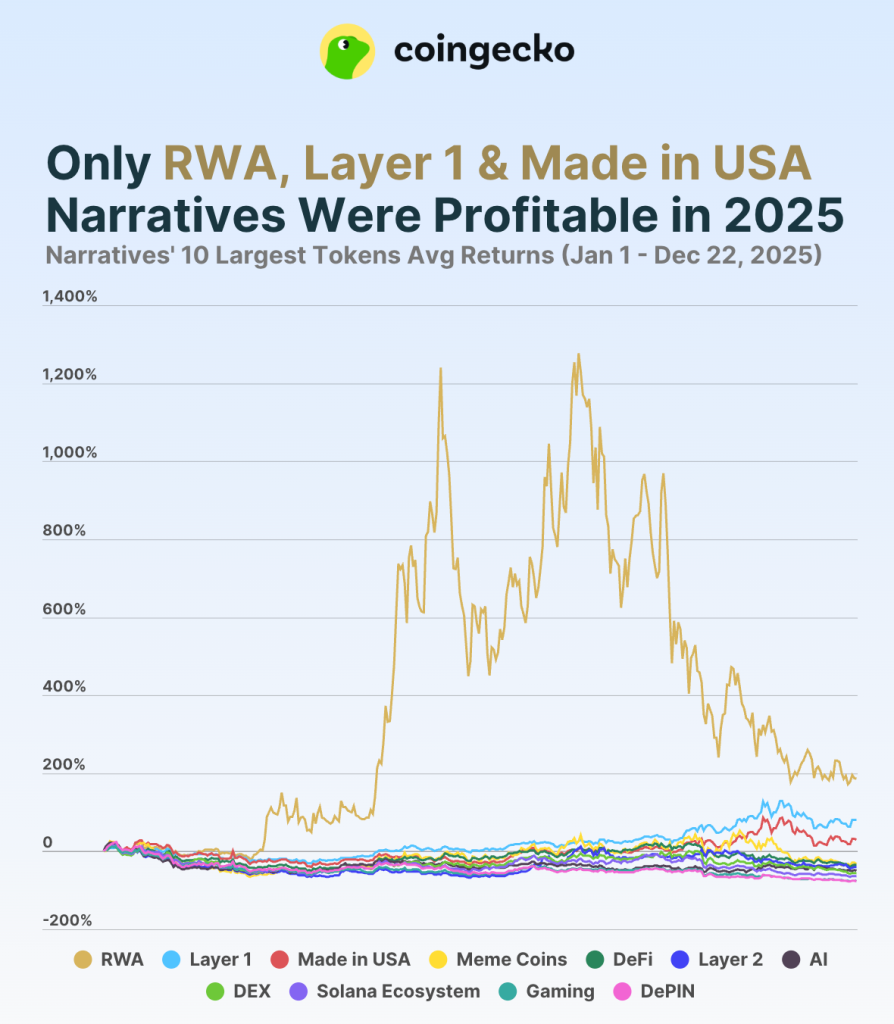

CoinGecko Identifies Most Profitable Sectors in the Crypto Market

RWA tokens led with a 185.8% increase, CoinGecko reports.

Since January, RWA tokens have shown the highest increase in value at 185.8%, according to a study by CoinGecko.

The narrative of tokenized real-world assets emerged as the most profitable. Keeta Network (+1794.9%), Zebec Network (+217.3%), and Maple Finance (+123%) were the main contributors to this result.

In 2024, RWA tokens ranked third in profitability. However, the current figure is four times lower than the previous one — 819.5%.

The average growth of first-layer blockchain coins was 80.3% — this segment rose from fourth to second place in the rankings over the year. The leaders were privacy cryptocurrencies from Zcash and Monero. Since the beginning of the year, ZEC has increased by 691.3%, and XRM by 143.6%.

Bitcoin Cash, BNB, and Tron also showed positive dynamics. This year, the coin associated with the Binance ecosystem reached a new all-time high above $1300.

Another profitable narrative was Made in USA — tokens launched by American crypto projects. The average profitability reached 30.6%. According to analysts, this achievement was “entirely due to the strong performance of Zcash.”

Underperformers

Meme coins and artificial intelligence remained the most popular directions, but ended the year with losses of -31.6% and -50.2%, respectively.

The largest “funny coins” plummeted by up to 82.5%, except for Ribbita from the Virtuals project.

Similarly, the most capitalized AI tokens fell by up to 84.3%. Only Alchemist AI and Kite recorded positive returns.

Earlier, experts also calculated that the combined value of AI-related coins plummeted by 75% over the year. The sector lost more than $53 billion.

The average profitability of the DeFi sector was -34.8%, while DEX was -55.5%. Last year, tokens from the decentralized finance segment brought investors 101%.

The narrative of second-layer solutions dropped to -40.6%, which is twice as bad as the previous year.

Third from the bottom was the blockchain ecosystem Solana, showing a negative return of -64.17%. The worst results were demonstrated by the GameFi and DePIN sectors, losing about 75-77%.

Back in 2025, Solana maintained its status as the most popular network among global investors for the second consecutive year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!