Stop Guessing, Start Earning: Mastering Delta Neutral Strategies with Bitcoin

Delta-neutral strategies that earn regardless of market direction.

Most traders lose money over the medium and long term. Psychology is often to blame: neither experience nor intellect nor deep knowledge of technical analysis prevents mistakes.

Forecasting price moves is fiendishly difficult. The dominance of algorithms and market makers makes it harder still. Big players often jostle the market and trigger stop-losses, wrong-footing even seasoned professionals.

This article explains what delta-neutral strategies are and how they help earn regardless of trend and price dynamics.

What does “delta-neutral” mean?

Start with the term itself. The first part is “delta”, a coefficient that shows how much a derivative’s price changes for a given move in the underlying asset.

For call options, delta ranges from 0 to 1. A value of 0.6, for example, means that if the asset rises by $1, the option’s price increases by $0.6.

“Neutral” here denotes independence from market direction. The strategy is built so that the portfolio’s overall value remains unchanged amid price swings.

The effect is achieved by balancing exposures: a trader opens offsetting positions (for instance, buys spot and shorts futures). Profit on one leg fully offsets loss on the other.

Below we examine one such approach—funding-rate arbitrage. This lets investors earn steady passive income from periodic funding payments while stripping out the asset’s price volatility.

Perps, funding rates and cash-and-carry arbitrage

First, some terms.

Perpetual futures (perpetuals, “perps”) are contracts with no expiry date. Unlike traditional futures, they use a funding-rate mechanism to tether prices to the spot market.

Traders can profit from them by correctly calling direction, as with standard futures. Funding also opens avenues for arbitrage and passive income.

What is a long?

By opening a long position in a perpetual contract, a trader bets on the asset’s price rising.

If demand is strong, the derivative trades at a premium—above the spot price. When sellers dominate, the contract trades below spot, creating a discount.

Example: spot Bitcoin is $83,000, while the perpetual trades at $83,500. The $500 gap is the premium, reflecting buyer dominance. The trader does not pay it separately; it is embedded in the quote.

For the trade to profit, price must clear the entry level ($83,500) and hold above it. Understanding this basis is essential for working with the funding rate discussed next.

What is a short?

By opening a short position, a trader bets on a decline by selling a perpetual contract.

Mechanically, the user opens a futures account at an exchange and posts margin. Suppose own capital is $1,000. With 10x leverage, the trader can open a $10,000 position.

Example: short 0.2 BTC at $50,000. If the price drops to $45,000, the contract is bought back.

Result calculation: (50,000 − 45,000) × 0.2 = $1,000

Profit is $1,000 (excluding trading fees and funding).

What is the funding rate?

The funding rate is a mechanism of periodic payments between traders holding long and short positions in perpetual futures. Its value shifts with market conditions.

Funding keeps perp prices aligned with spot. If the future trades above the underlying, longs pay shorts. If the contract is below spot, shorts pay longs.

Example: spot Bitcoin is $50,000. In a bullish market, the perpetual may trade well above that.

In that case, buyers (longs) pay shorts a fee—typically every eight hours. This raises the cost of holding longs, encourages selling and nudges the perp back toward equilibrium.

The mechanism works in reverse too: if selling pressure pushes the contract below spot, shorts pay longs.

This helps curb distortions and keeps futures prices reflecting underlying market conditions, minimising dislocations.

Arbitrage opportunities

Funding creates scope for delta-neutral income: buy the asset on spot and simultaneously short the perp. The strategy earns the positive funding rate.

Consider a passive-income setup using this approach:

- You buy the asset (say, Bitcoin) at $83,000.

- At the same time, you open a short in the perpetual for the same notional at the same price.

While perps trade above spot, shorts receive funding every eight hours. If bearish sentiment takes hold and the perp drops below spot, shorts must pay instead.

Scenario 1: Bitcoin rises above $83,000

Assume price reaches $85,000. The 1 BTC spot position is now worth $85,000 (a $2,000 gain).

Perp short: a $2,000 loss (entry was $83,000).

Price P&L: $0 (profit offsets loss).

Outcome: you receive funding.

Assume the rate is 0.03%, paid every eight hours, and the position size is $10,000:

Payment per period: 0.03% × $10,000 = $3.

Daily income: $3 × (24/8) = $9.

Monthly income: $270.

Scenario 2: Bitcoin stays at $83,000

The spot position remains $83,000, as does the futures notional.

Price P&L: $0 (no change in quotes).

Income: $9 per day or $270 per month from positive funding.

Scenario 3: Bitcoin falls below $83,000

Suppose the price drops to $80,000. The spot is valued accordingly, producing a $3,000 loss.

Short: a $3,000 gain (entry $83,000, current $80,000).

Price P&L: $0 (loss offset by gain).

You still earn so long as funding stays positive.

Why it works

The strategy neutralises price risk and lets you monetise the funding rate. It is most effective in bull or range-bound markets.

The key condition is a positive funding rate: when longs dominate and perps trade at a premium to spot.

Risks

If the future trades below spot, funding turns negative. Shorts then owe payments—a bear-market scenario.

Also factor in costs. Exchange fees eat into returns. Using leverage introduces liquidation risk: a large move can wipe out a position if risk limits are ignored.

Hence the approach is justified only when a persistently positive funding rate prevails.

Automated strategies

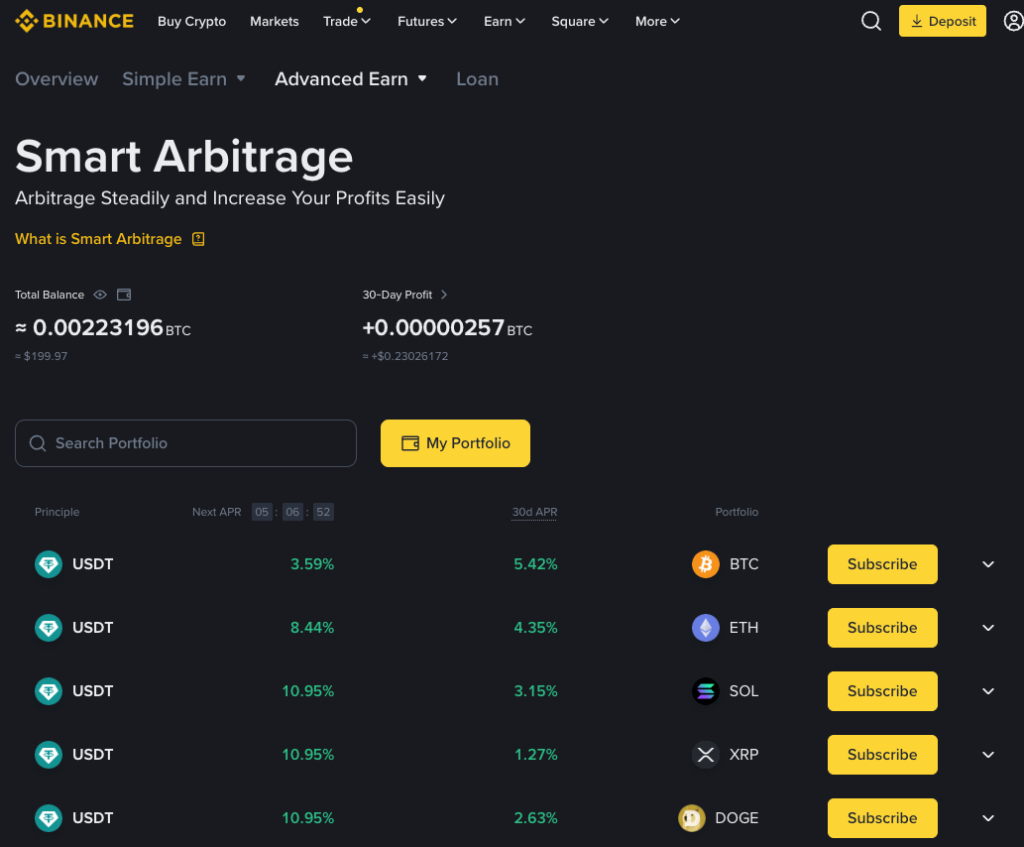

Some platforms offer ready-made tools to automate delta-neutral strategies. Binance, for instance, has Smart Arbitrage.

The algorithm opens offsetting positions automatically: it buys spot and shorts the matching future, sparing investors manual work. While funding remains positive, the bot accrues payments from longs.

The exchange warns, however, that sharp price moves or a turn to negative funding can affect returns.

Starting is simple: pick an asset (BTC, ETH, SOL, XRP or DOGE), enter the USDT amount and click Subscribe. You can monitor status or close via Redeem in the Earn menu.

BFUSD

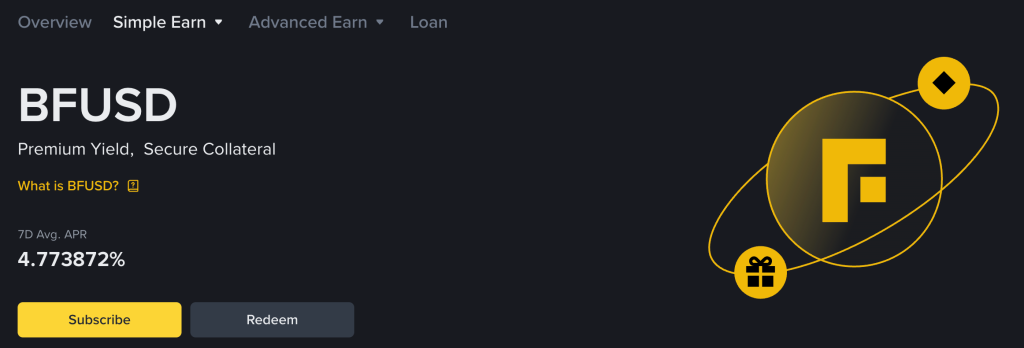

Some instruments are built on delta-neutral strategies from the outset. One example is BFUSD—a yield-bearing stablecoin for Binance Futures users.

It helps traders boost capital efficiency: funds can serve as margin for positions while earning passive income.

To receive daily USDT accruals, simply hold BFUSD in the USDⓈ-M Futures wallet. Using the asset in trading increases the yield.

Payouts are funded by the exchange’s investment strategies. Proceeds from BFUSD issuance are used to purchase and staking Ethereum, with price risk neutralised via delta hedging.

Rewards come in two tiers:

- base rate: paid for merely holding the asset;

- boosted rate: available to active traders who use BFUSD in trading.

A dedicated BFUSD Reserve Fund exists to protect users during periods of negative funding (when hedging turns loss-making).

You can swap USDT for BFUSD in the Binance futures section. To use it as collateral for positions, enable Multi-Asset Mode.

A simple DeFi strategy: hedging farming

The approach applies, for instance, to “hot” market newcomers. Such tokens often offer a high APR in staking but typically suffer from high inflation and selling pressure from regular unlocks.

Suppose there is a liquidity pool or a staking option for a coin (say, TOKEN) paying 50% annually while its price falls.

A rough playbook:

- the investor buys TOKEN—say, for 1,000 USDT;

- deposits the coins into the pool at 50%;

- opens a short on the “hot” asset on an exchange for the same 1,000 USDT (with 1x leverage).

Outcome

The investor earns 50% in project tokens. Any loss from the principal’s depreciation is offset by profit on the short.

Risks

If prices drop sharply, the short’s funding rate can spike. The cost of carrying the position may then exceed farming income, turning the strategy unprofitable.

Before entering, ensure the staking APR exceeds the annualised funding rate.

An alternative approach

Instead of buying the asset, use lending. Lock collateral in a lending service, borrow the target token and deploy it to earn yield.

Finally, repay the principal and withdraw the collateral, keeping the earned rewards.

***

The strategies outlined can deliver steady income even amid volatility. But delta-neutrality hedges only price movements.

This approach reduces risk, but does not eliminate it. Investors may still face liquidations, impermanent loss and the need for complex rebalancing.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!