Week in review: Zcash infighting and Morgan Stanley crypto-ETF filings

Zcash turmoil, Truebit hack, bitcoin stalls, Morgan Stanley files crypto ETFs

Bitcoin tried to clear $95,000, Zcash’s core developers quit, the Truebit token sank after a hack, Morgan Stanley filed to launch crypto ETFs, and other events of the week.

Post-holiday moves

The first full week of 2026 was relatively calm for crypto. Bitcoin started Monday by rising above $93,000.

The upswing was tied to a global “everything rally”. Digital-asset moves were in sync with Asian exchanges.

Another factor was the situation in Venezuela. Investors watched developments closely, especially amid signs of a potential “strategic entry” by the US into the country’s oil sector.

An additional impulse came from reports about the capture of Venezuelan president Nicolás Maduro and his transfer to New York. According to CoinEx Research chief analyst Jeff Ko, the event triggered a chain reaction: oil prices dipped slightly, and tensions in the Middle East rose—Israel’s opposition urged Iran to learn lessons from the Venezuelan scenario.

By Tuesday the first cryptocurrency had climbed to almost $95,000, but that proved a local peak.

From midweek bitcoin slipped into a correction and fell back to around $90,000.

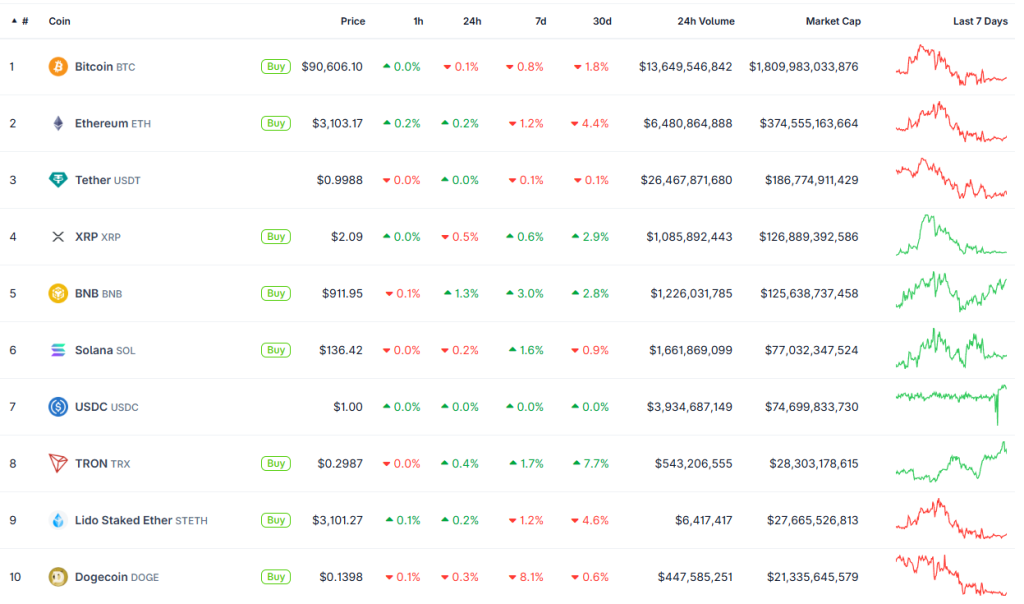

At the time of writing the digital gold trades at $90,700, little changed over seven days. Its market capitalisation is $1.8trn.

Other top-10 assets by market value followed the flagship. Exceptions were BNB (+3% on the week) and DOGE (-8%).

The crypto Fear and Greed Index moved out of the “extreme fear” zone, recovering to 29.

By the end of the week the total crypto market capitalisation stood at $3.18trn. Bitcoin’s dominance index was 56.9%, Ethereum’s 11.8%.

Rift at Zcash

On January 7 it emerged that the core developers of the privacy coin Zcash—the Electric Coin Company (ECC) team—had left the project en masse. According to former CEO Josh Swihart, the decision was driven by an internal conflict.

He said that most members of the board of the Bootstrap non-profit acted at odds with the mission of the privacy-focused cryptocurrency.

“In short, the terms of our employment were changed in such a way that it became impossible for us to perform our duties effectively and in good faith,” added Swihart.

Former ECC employees plan to create a new organisation while keeping the original goal—building “unstoppable private money”. The Zcash protocol itself will not be affected by the departure and will continue to operate as usual.

Helius Labs co-founder Mert Mumtaz called the development a “bullish signal” for the asset and forecast ZEC at $10,000.

“The most competent people in Zcash (along with Tachyon, of course), are now free from the stifling inefficiency of foundation policy,” he added.

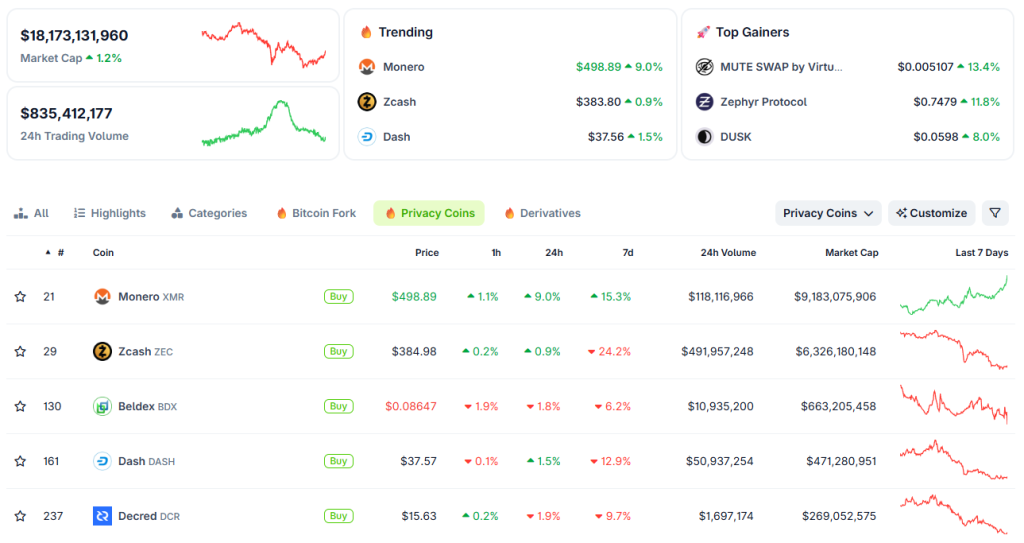

Even so, the privacy coin sold off on the news. ZEC slid from $530 to $385, losing almost 30% over the week.

Amid the weakness, Monero (XMR) took the lead among privacy coins. The cryptocurrency’s price reached $500, up 15% in seven days.

What to discuss with friends?

- Bitcoin mining difficulty fell by 1.2%.

- Downloads of the BitChat messenger surged by 400,000 amid protests in Iran.

- Illicit crypto-asset volumes increased by 162% over the year.

- OpenAI launched ChatGPT Health.

Truebit wiped out

On January 8 attackers targeted the Truebit verification protocol on Ethereum and siphoned 8,535 ETH (~$26.4m at the time).

The team said only one smart contract was affected. Developers have not yet disclosed the cause of the breach or the exact losses. The company is working with law enforcement.

According to independent researcher Weilin (William) Li, the hackers exploited a vulnerability in a token-minting function with an incorrectly set price in an outdated contract deployed about five years ago.

This enabled purchases of native TRU at an artificially depressed rate. The expert believes two independent groups took part in the attack: the first profited by $26m, the second by about $250,000.

The attack crushed TRU—the token virtually went to zero, plunging 100%. At the time of writing it trades around $0.000071.

Morgan Stanley’s crypto funds

On January 6 investment bank Morgan Stanley filed with the US Securities and Exchange Commission to launch two spot ETFs.

According to the filings, one product will track the price of bitcoin, the other of Solana. If approved, more than 19m clients of the firm’s wealth-management division would gain access.

ProCap investment director Jeff Park believes the bank will benefit from launching its own crypto ETFs even if returns are low. In his view, Morgan Stanley is betting on long-term reputational gains as well as capital inflows.

Park considers having a spot bitcoin ETF a sign of an asset manager’s “foresight and courage”. It creates the image of a progressive firm—vital in the battle for talent.

“This is a positive external factor, which will help in recruiting top specialists against competitors,” the investment director stressed.

He also noted plans to monetise the ETRADE brokerage unit through partnerships in tokenisation and crypto trading.

Morningstar analyst Brian Armour suggested that Morgan Stanley’s “unexpected” move aims to shift existing clients into its own funds.

“The bank’s entry into the crypto-ETF sector will add legitimacy to the market, and others may follow this example,” the expert added.

Also on ForkLog:

- VanEck forecast bitcoin at $2.9m.

- A South Korean court allowed seizing bitcoins from exchanges.

- USDC overtook USDT in DeFi usage activity.

- Vitalik Buterin compared Ethereum to BitTorrent and Linux.

A new business model for Pump.fun

This week it emerged that the memecoin-launch platform Pump.fun will change its commission-reward system for creators. According to co-founder Alon Cohen, the existing model has proved insufficiently useful.

The Dynamic Fees V1 payout mechanism introduced last year attracted new builders and sparked on-chain activity, but “failed to materially change the behaviour of the average token user,” the representative stressed.

Cohen believes that “dynamic fees” encourage token creation but do not incentivise trading. He called this dangerous, since traders are “a vital element of the platform”.

The first announced changes will allow fees to be distributed among creators (up to ten wallets).

The feature will enable transferring coin ownership and revoking update permissions. In addition, creators and Community Takeover administrators will be able to change fee levels after a token’s launch.

Roll-out is planned for 2026. Cohen did not disclose exact dates, promising to stick to “market principles”.

On the announcement, the native token of the “memecoin factory”, PUMP, gained almost 7% on the week.

What else to read?

ForkLog’s editors summed up the past year across various areas of the crypto industry—find all the materials in the holiday section.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!