BitMine Boosts Ethereum Staking to Record $3.7 Billion

BitMine boosts Ethereum staking to $3.7 billion, surpassing $3 billion in value.

The treasury firm BitMine has increased its locked assets in the Ethereum network to 1.08 million coins, with the portfolio’s value surpassing $3 billion.

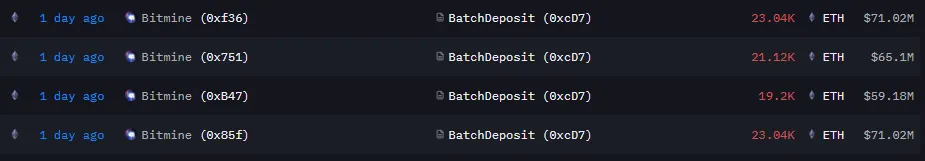

The firm has sent an additional 86,400 ETH into staking through four transactions. Lookonchain clarified that the company now holds $3.7 billion.

Tom Lee(@fundstrat)’s #Bitmine staked another 109,504 $ETH($340.6M) in the past 2 hours.

In total, #Bitmine has now staked 1,190,016 $ETH($3.7B).https://t.co/P684j5YQaG pic.twitter.com/HHUI11YsT7

— Lookonchain (@lookonchain) January 12, 2026

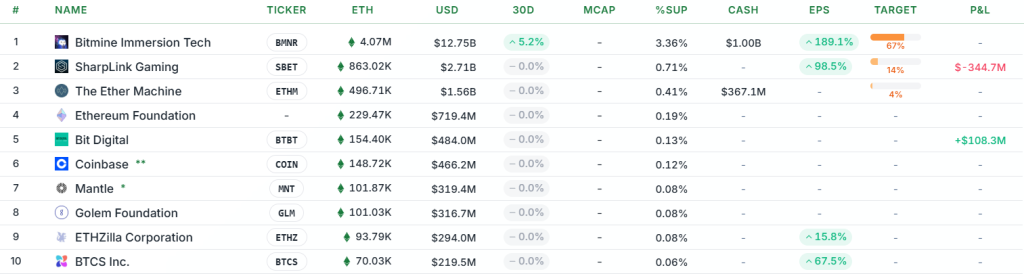

BitMine is the largest corporate holder of Ethereum, followed by SharpLink and The Ether Machine.

Analyst Nick Pakrin calculated that at the current yield of 2.81%, Tom Lee’s company would earn $94.4 million annually.

BitMine has now staked ~$3.3B worth of ETH.

At the current 2.81% yield, that generates roughly $94.4M per year in ETH.

Obviously, Bitcoin doesn’t produce cash flow.

If another crypto winter hits & debt comes due, does holding a stakeable asset change who weathers it better?

— Nic (@nicrypto) January 11, 2026

The expert noted that Ethereum, unlike Bitcoin, generates cash flow. This helps businesses service debt and endure a “crypto winter.”

Despite increasing its positions, BitMine shares are trading at $30.06, 80% below the all-time high reached in July 2025.

In early January, Lee proposed to shareholders to increase the share issuance limit from 50 million to 50 billion.

According to him, this is a technical measure for future splits. The company’s goal is to keep the share price in an accessible range around $25.

Back in December, BitMine reported the purchase of 44,463 ETH. The average acquisition price of the asset was $2,948 per coin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!