CryptoQuant flags the onset of an early bitcoin bear phase

Investors are locking in losses on bitcoin

After the leading cryptocurrency slipped below $90,000, profitability metrics turned negative, signalling an “early bear market,” according to CryptoQuant analysts.

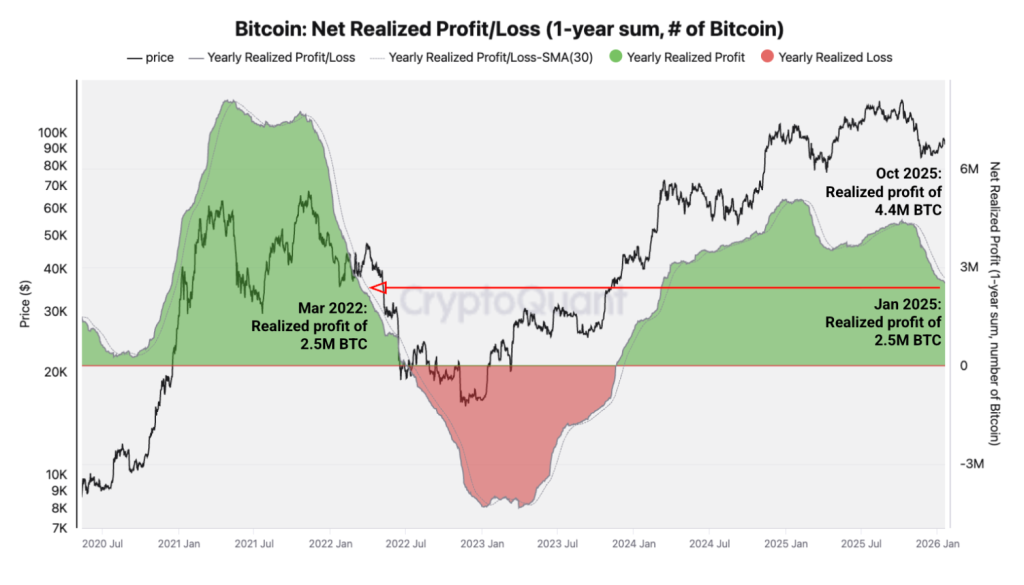

Annual net realized profits are trending down.

They’ve fallen to 2.5M BTC, the lowest level since March 2024 and similar to March 2022, when the last bear market started.

Net realized losses are following the same pattern, signaling weakening strength in Bitcoin’s price. pic.twitter.com/HOI4xHEsDz

— CryptoQuant.com (@cryptoquant_com) January 22, 2026

Over the past month, the Net Realized Profit/Loss metric fell to 69,000 BTC.

“Bitcoin holders have begun to realize net losses for the first time since October 2023. Peaks in realized profits have been declining since March 2024, indicating a loss of price momentum as the bull market draws to a close,” the experts noted.

Annual net realized profits have shrunk sharply—from 4.4m BTC to the current 2.5m BTC. Similar levels were last seen in March 2022.

According to the analysts, current conditions mirror the previous shift from bull to bear.

The metric peaked in January 2021 and went on to form lower highs over the next 12 months. Ahead of the downturn, investors likewise began locking in losses en masse, as the chart below shows.

Some participants expect 2026 to be a bear‑market year. Earlier, Material Indicators co‑founder Keith Alan noted a “death cross” on the bitcoin chart, and trading veteran Peter Brandt forecast a drop to $58,000.

Analyst Titan of Crypto pointed to another negative signal for digital gold—a MACD crossover on the two‑month timeframe.

#BITCOIN JUST FLASHED A BEAR MARKET SIGNAL.

The 2-month LMACD turned bearish. A major signal.

Historically, similar set-ups were followed by 50% — 64% drawdowns. pic.twitter.com/CCNzN8oXON

— Titan of Crypto (@Washigorira) January 9, 2026

“Historically, similar set-ups were followed by 50%–64% drawdowns,” the expert wrote.

Key levels

At the time of writing, bitcoin trades around $89,200, down 1% over the past 24 hours.

After the latest drop, the asset lost key support levels, including the 75th percentile of cost basis, now at $92,940.

Bitcoin has lost the 0.75 supply cost-basis quantile and failed to reclaim it. Spot now trades below the cost basis of 75% of supply, signalling rising distribution pressure. Risk has shifted higher, with downside dominant unless this level is recovered.

📈https://t.co/TicbyydmZE pic.twitter.com/8vhemNBFqf— glassnode (@glassnode) January 22, 2026

“[Bitcoin] now trades below the cost basis of 75% of supply, signalling rising distribution pressure,” Glassnode stressed.

Experts say the cryptocurrency will remain in a downtrend unless it recovers the cost‑basis level.

The trader known as Merlijn The Trader pointed to support between $89,000 and $90,000. If it fails, bitcoin risks falling to $84,000.

BITCOIN IS SETTING UP A DOUBLE FAKEOUT.

First:

break above resistance (~$96k)… then rejected.Now:

price is back at the rising trendline support.Bullish fakeout case:$BTC reclaims the trendline and squeezes back up.

Bearish case:

We likely revisit the range lows.Markets… pic.twitter.com/725fghbDrm

— Merlijn The Trader (@MerlijnTrader) January 23, 2026

According to Glassnode, investors bought about 941,651 BTC at this level over the past six months.

The next important support sits at $80,000, where more than 127,000 BTC were acquired.

As reported earlier, Bitwise analysts believe that the fourth quarter of 2025 marked the end of the bear cycle.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!