Week in review: bitcoin slips below $88,000 and Ethereum mainnet revives

Bitcoin slips under $90,000 as Ethereum mainnet surges; Iran buys $500m in stablecoins.

Digital gold failed to hold above $90,000; activity on Ethereum’s mainnet surpassed L2s; Iran’s central bank bought over $500 million of stablecoins—and other events of the week.

Selling pressure

On Monday the leading cryptocurrency began with an overnight pullback. The asset sliced through support around $95,000 and headed for $90,000.

The slide did not end there—heavy selling weighed on bitcoin for most of the week, compounded by declines in US and Japanese equities.

By Wednesday digital gold hit a local bottom at $87,000.

Towards the weekend the market’s bellwether traded between $88,000 and $91,000. At the time of writing the coin is around $89,000.

Glassnode analysts noted a persistent supply overhang: recent buyers are creating resistance and capping upside. Short rallies are being used for exits (distribution).

Attempts to establish a foothold higher encounter selling by investors who accumulated in Q1–Q3 2025.

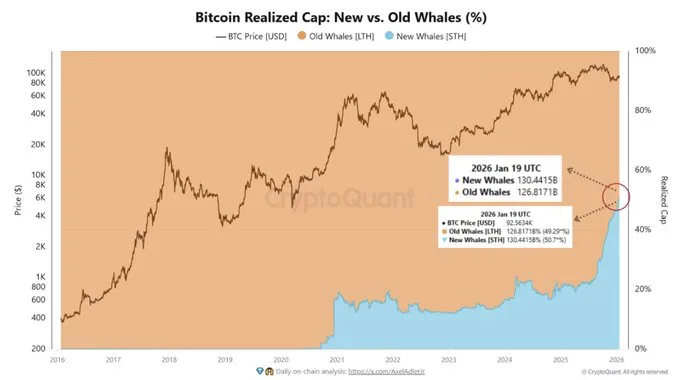

CryptoQuant researcher Julio Moreno noted that, for the first time ever, the share of “new” whales in the first cryptocurrency’s realised capitalisation has surpassed that of long-term holders.

Their average purchase price is around $98,000. With spot quotes below that level, investors are sitting on a combined unrealised loss of $6 billion.

The broader crypto market tracked bitcoin’s moves. Ethereum slipped below $3000 (-12% for the week), while BNB fell under $900 (-7.5%).

Crypto Fear & Greed Index returned to “extreme fear” at 25 points. A week earlier it hovered around 50.

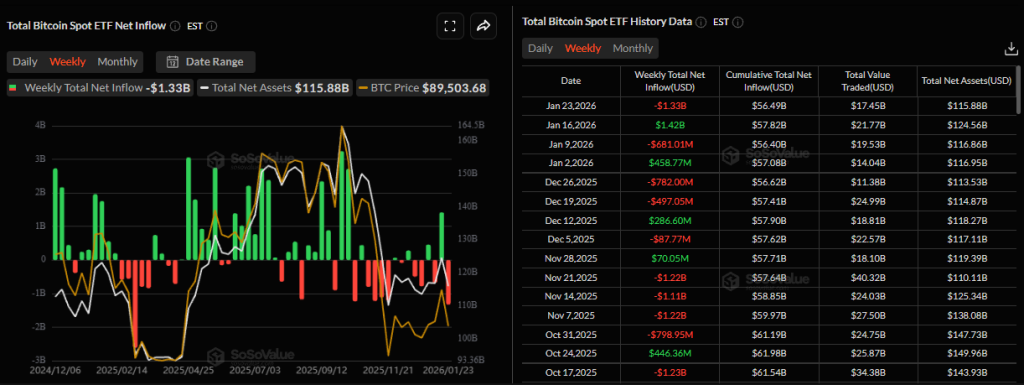

Flows into crypto ETFs were negative too. Investors pulled out $1.33 billion from spot bitcoin funds and $611 million from Ethereum products.

Total crypto market capitalisation fell to $3.08 trillion. BTC dominance stands at 57.5%, ETH at 11.5%.

Activity on Ethereum

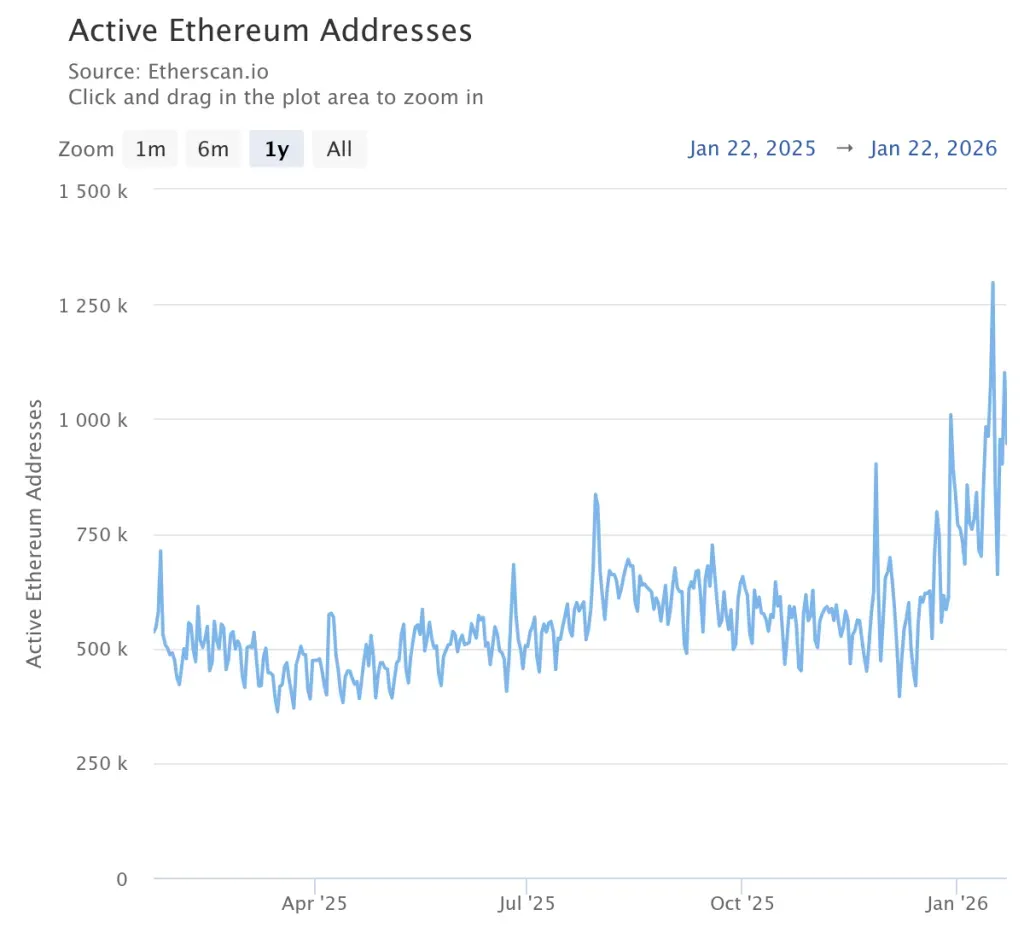

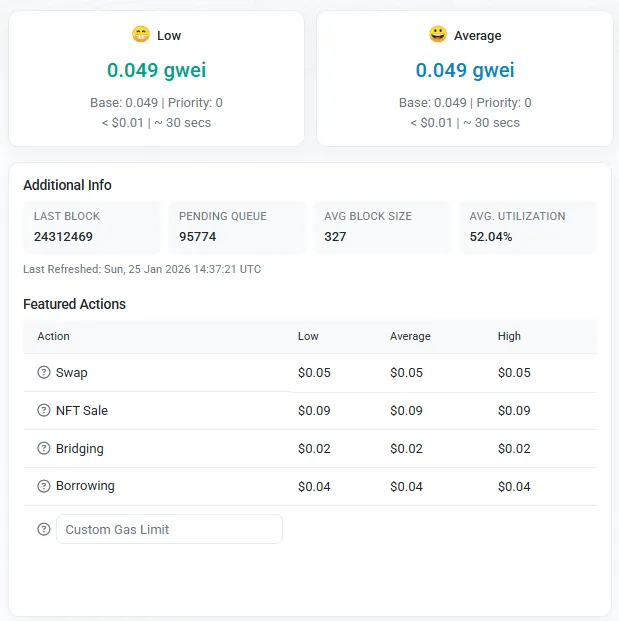

Token Terminal analysts recorded the start of an “Ethereum mainnet return”. Amid record-low fees, activity on the base layer surpassed layer-2 solutions.

Mainnet overtook L2 protocols by daily active users. On January 16th the figure peaked at roughly 1.3 million addresses. After a pullback it stabilised at 945,000 per day—still above Arbitrum, Base and OP Mainnet.

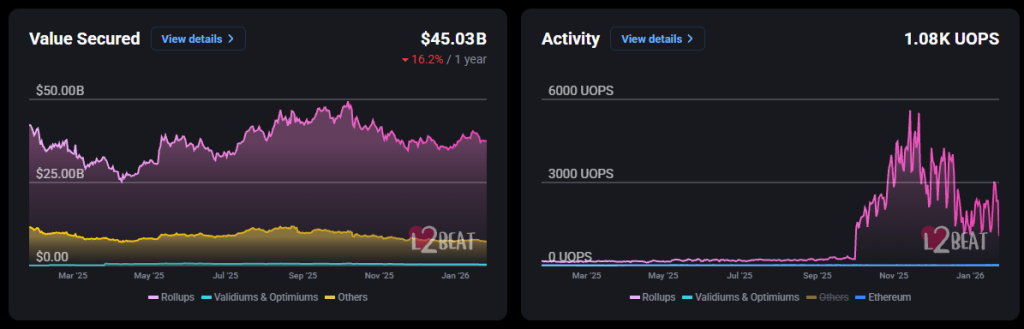

At the same time liquidity is leaving the second layer. According to L2Beat, the combined TVL of the rollup ecosystem has fallen 16% year-on-year to $45 billion.

Experts linked the burst of activity on Ethereum to December’s Fusaka upgrade, which significantly reduced gas costs. However, much of the traffic may be “artificial” and not reflect actions by real users, they warned.

Blockchain-security expert Andrey Sergeenkov suggested the spike stems from a wave of address “poisoning”, calling it a mass spam attack.

After Fusaka, fees dropped by more than 60%. That made fraud schemes profitable: attackers can remain in the black even with conversion rates of 0.01%.

Meanwhile JPMorgan analysts questioned the long-term durability of Ethereum’s gains.

“Historically, successive blockchain upgrades have failed to materially boost activity on a sustained basis for a variety of reasons,” the bank said.

What to discuss with friends?

- A billionaire called bitcoin an easy target for confiscation.

- Bitwise declared the bear market over.

- The Winklevoss twins donated $1.16 million to Zcash developers.

- The Ethereum Foundation formed a post-quantum security team.

Blockchain initiatives in Bhutan and Bermuda

Bhutan’s sovereign fund Druk Holding and Investments (DHI) and the Sei Development Foundation agreed to deploy a validator on the Sei network in the kingdom.

The partnership aims to expand national blockchain infrastructure. The parties plan to explore asset tokenisation, test new economic models, and venture into data valuation and DeSci.

DHI InnoTech, the fund’s innovation arm, will implement the initiative with support from venture firm Sapien Capital. The node is expected to go live in the first quarter of 2026.

Bhutan currently ranks seventh globally among sovereign bitcoin holders. The government owns 5,985 BTC (~$529 million), acquired largely through mining.

Also this week, the authorities of Bermuda announced a state-level blockchain initiative. The government plans to create the “world’s first fully on-chain economy”.

Circle and Coinbase are technical partners. The rollout will proceed in stages:

- Government agencies will pilot acceptance of payments in stablecoins.

- Financial institutions will implement tokenisation tools.

- Businesses will gain access to global finance via digital wallets.

The shift to blockchain is meant to tackle costly bank transfers. Traditional payment gateways are often uneconomical for island jurisdictions and dent local businesses’ margins. Using USDC should enable fast, cheap settlements.

Iranian stablecoins

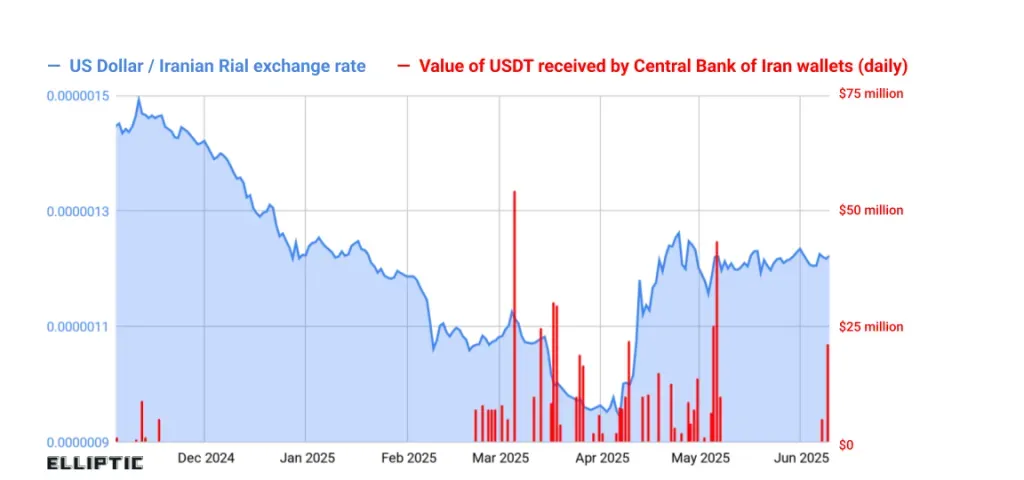

Elliptic specialists found that Iran’s central bank acquired USDT worth $507 million.

The bulk was bought in spring 2025. With sanctions in place and access to SWIFT cut off, cryptocurrencies have become the country’s only alternative to international bank transfers.

According to the researchers, until the June hack the central bank routed most funds to Nobitex, then Iran’s largest crypto exchange for buying and selling digital assets against the rial.

After the attack the regulator switched to a more complex scheme using decentralised cross-chain bridges and DEXs, chiefly on TRON and Ethereum.

Elliptic attributed the purchases to economic instability amid the rial’s depreciation.

“The primary motivation for acquiring USDT is a desire to control currency markets. This aligns with the blockchain activity. Routing funds to Nobitex indicates a strategy of injecting dollar liquidity into the local market to support the rial,” they noted.

Experts believe the central bank sought to stem the currency’s decline by buying fiat with USDT on the exchange. The regulator is also building a “sanctions-resistant” banking mechanism.

Also on ForkLog:

- OpenAI introduced age filtering in ChatGPT.

- Vitalik Buterin criticised today’s DAOs and urged change.

- Ripple predicted a tight integration of stablecoins with the banking system.

- A solo miner earned $289,191 for mining a bitcoin block.

NYSE tokenisation

The New York Stock Exchange (NYSE) said it is developing a platform for trading and on-chain settlement of tokenised securities.

The service, which requires regulatory approval to launch, will offer 24/7 market access, instant settlement and the ability to place orders in dollar terms.

The new NYSE project will support stablecoins.

Technically, the platform will combine the NYSE Pillar matching engine with blockchain-based post-trade systems, enabling settlement across multiple networks.

The venue will handle tokenised shares fungible with traditional securities as well as native digital assets. Token holders will retain rights to dividends and corporate governance.

Only qualified broker-dealers will be admitted.

NYSE president Lynn Martin said the exchange aims to marry the trust of traditional markets with modern on-chain solutions and high investor-protection standards.

The exchange’s parent, Intercontinental Exchange, is in parallel adapting clearing infrastructure to round-the-clock operations via tokenised deposits.

What else to read?

We analyse Ethereum developers’ plans and assess prospects ahead of forthcoming upgrades.

The suitably paranoid Elena Vasilieva on why crypto people believe in a conspiracy (and why they are sometimes right).

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!