Gold’s Surge Above $5000 Shifts Crypto Investors’ Focus

Precious metals outshined cryptocurrencies in January, drawing investor focus.

In January, precious metals surpassed cryptocurrencies in social media popularity. Investors’ attention shifted to gold and silver due to their rising prices, noted Santiment.

😴 Are crypto traders & investors checked out? Based on social data across crypto social media circles, the focus in January has turned from:

💤 Week 1: Minimal discourse as traders return from holidays (Crypto rises while traders sleep)

🥇 Week 2: Gold discussions erupt as the… pic.twitter.com/U5X0VzAGPb— Santiment (@santimentfeed) January 26, 2026

The peak of gold discussions occurred in the second week of the month after it reached a new all-time high above $5000. The asset maintained its lead in the information space from January 8 to 18.

From January 19 to 22, the focus temporarily shifted to digital assets as traders attempted to buy the market dip.

Later, audience interest returned to silver, which also reached its ATH. The “devil’s metal” had already led in mentions in the first week of the year.

“Crypto traders are known for their habit of switching between different sectors of digital assets following the latest hype cycle—be it meme coins, blue chips, or AI tokens,” noted Santiment.

According to social metrics, audience interest shifts to gold, silver, or the stock market, following the “latest pumps.”

Peak Hype?

On January 27, the price of silver once again reached a new all-time high.

Santiment analysts warn: a sharp increase in mentions of an asset and FOMO among retail traders often signal the formation of a market top.

Experts cited an example where, at the peak of retail hype, silver soared to $117, only to fall below $102.70 within two hours.

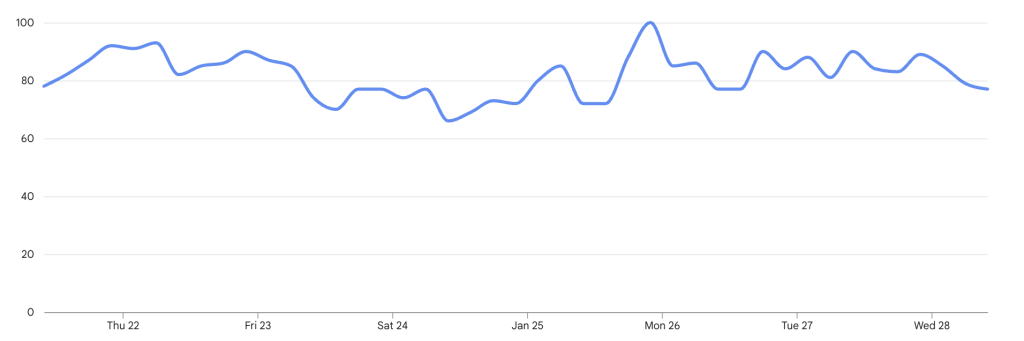

However, Google Trends data confirm sustained interest in the crypto industry. The peak popularity of the “crypto” query occurred on January 25, reaching a maximum score of 100.

Top queries also included “best crypto,” “what is crypto,” and “crypto price.”

Earlier, Santiment analysts linked the decline in stablecoin capitalization to the gold rally.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!