Tether’s Annual Profit Surpasses $10 Billion

Tether's 2025 profit exceeded $10 billion, with $6.3 billion in excess reserves.

In 2025, Tether International reported a net profit exceeding $10 billion. The issuer’s excess reserves of USDT reached $6.3 billion, according to an audit by BDO.

Tether Delivers $10B+ Profits in 2025, $6.3B in Excess Reserves, and Record $141 billion Exposure in U.S. Treasury Holdings

Learn more: https://t.co/XG3vgSoVeV— Tether (@tether) January 30, 2026

During the reporting period, Tether issued nearly 50 million USDT, marking the second-largest issuance in the company’s history. The pace accelerated in the second half of the year, with approximately 30 million USDT minted amid a sharp demand for dollar liquidity from emerging markets.

As of December 31, 2025, the circulation volume of the largest stablecoin exceeded 186 billion tokens, reaching an all-time high. The number of asset users worldwide reached 530 million.

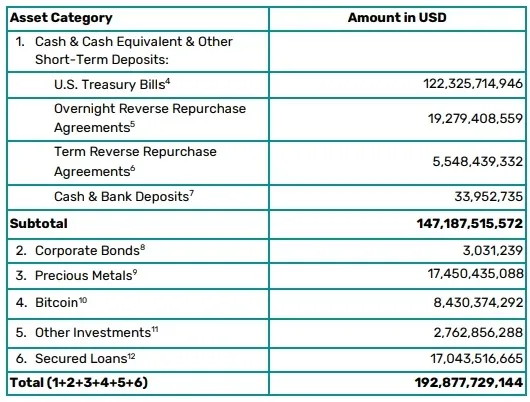

The total value of Tether’s reserves rose to approximately $192.9 billion. Liabilities amounted to around $186.6 billion, of which about $186.5 billion pertained to issued digital coins.

The company’s direct investments in U.S. Treasury bonds exceeded $122 billion.

“This places Tether among the largest holders of U.S. government debt globally, highlighting its growing role as a crucial channel for meeting global dollar demand,” the press release stated.

By the end of the year, the stablecoin issuer held precious metals worth approximately $17.5 billion and bitcoins valued at $8.4 billion. By the end of January, the company’s reserves in 140 tons of gold reached $23 billion, with Tether utilizing a former nuclear bunker in Switzerland for storage.

The firm’s investment portfolio reached $20 billion. Investments in promising sectors such as energy, AI, media, fintech, agriculture, and treasury companies were financed through profits and excess capital. The assets are managed by Tether SICAF SA, and their value is not included in the reserves.

In 2024, the company’s net profit was a record $13 billion, approximately 30% higher than the figure for the reporting period.

“In 2025, the significance lies not only in the scale of growth but also in the structure underpinning it. USDT expanded because global dollar demand increasingly extends beyond traditional banking systems, particularly in regions where financial systems are slow, fragmented, or inaccessible,” emphasized Tether CEO Paolo Ardoino.

Earlier in January, the company officially launched the USAT stablecoin, regulated in the U.S.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!