Bernstein predicts a $60,000 floor for bitcoin

Bernstein sees a 2026 recovery, with bitcoin bottoming around $60,000.

Analysts at Bernstein expect the current slump in crypto markets to give way to a recovery in the first half of 2026, The Block reported.

They estimate the present bear phase will end when bitcoin revisits the previous cycle’s highs near $60,000.

On February 2 the price of the leading cryptocurrency slipped below $75,000. At the time of writing it had rebounded to around $79,000, about 38% below the October ATH of $126,080.

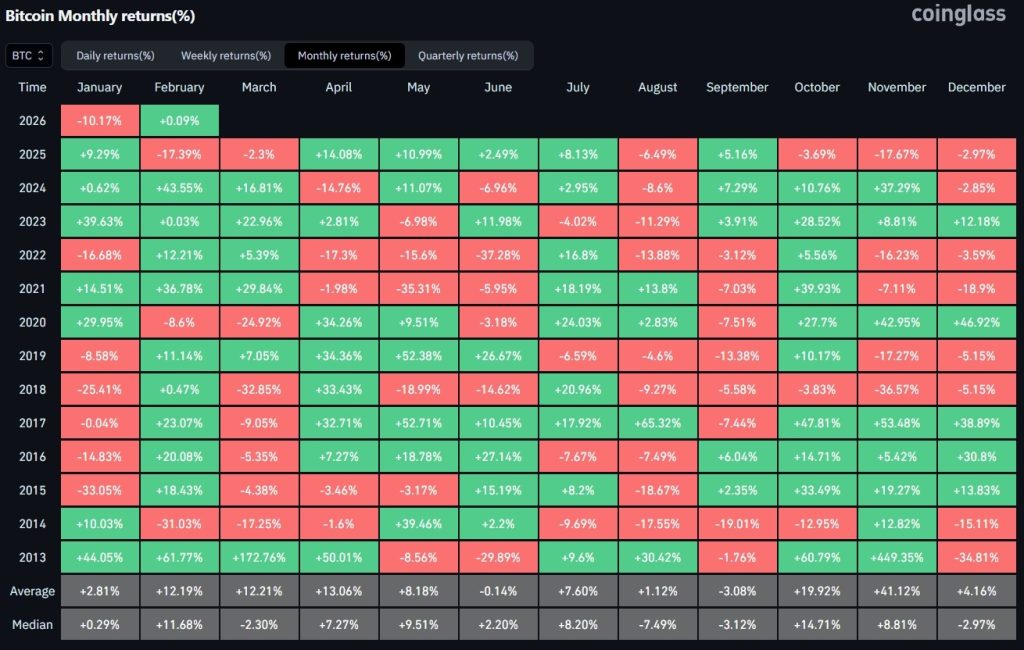

Bitcoin’s slide has extended into a fourth consecutive month. According to CoinGlass, January marked the cryptocurrency’s worst start to a year in five years.

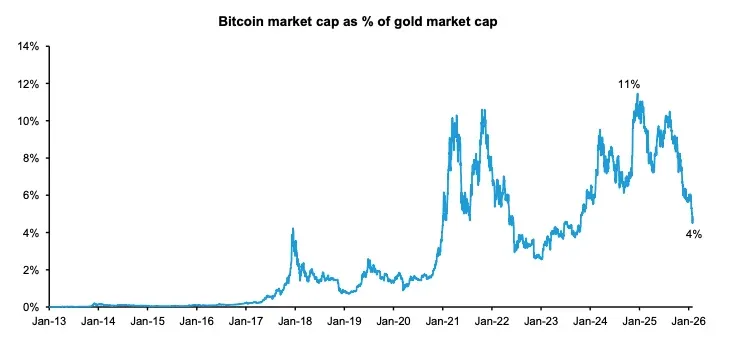

Bernstein attributed the decline to underperformance versus gold. The digital asset’s market value relative to the precious metal has fallen to 4%, nearing a two-year low.

Gold has surged as central banks, including those of China and India, accumulated reserves. By the end of 2025, the metal’s share of global reserves had reached roughly 29%.

Bernstein’s analysts also linked bitcoin’s correction to gains during the “institutional cycle”. Over the past two years, assets under management have climbed to about $165bn, a period that also saw the emergence of numerous corporate BTC treasuries.

In their view, the durable participation of financial institutions in crypto will persist; recent outflows from exchange-traded funds represent a small share of aggregate assets. Miners show no signs of capitulation.

Potential drivers for bitcoin also include the course of US policy. They flagged the creation of a strategic crypto reserve from seized assets and the possible appointment of Kevin Warsh as head of the Fed.

Bernstein reckons these factors confirm that current weakness in digital-asset markets is a late-stage correction, not the start of a protracted crypto winter. The firm expects short-term volatility to persist, but a 2026 reversal to lay the groundwork for “the most significant cycle” for bitcoin.

The drop could go much deeper

Bloomberg Intelligence senior commodity strategist Mike McGlone reiterated his forecast that the leading cryptocurrency could fall to $10,000 this year.

He named $50,000 as the first target on that path. In an updated base case for the coming months, the analyst cited the potential for rising volatility across major assets.

“A paradise for traders, 2026 will resemble 2008 and 2000-2001,” McGlone stressed.

Kraken’s global economist Thomas Perfumo told Cointelegraph that appointing Warsh as Fed chair would be a “mixed” signal for bitcoin and other cryptocurrencies. The potential head of the central bank may favour cutting the policy rate but is sceptical of expanding liquidity, to which digital assets are more sensitive, he noted.

Coin Bureau co-founder Nick Pakrin voiced similar concerns.

“Markets are parsing Warsh’s views on future Fed policy, primarily the central bank’s balance sheet, which, in his words, is ‘trillions larger’ than necessary,” he noted.

Pakrin stressed that potential measures to shrink the Fed’s balance sheet would primarily weigh on risk assets and precious metals.

Analysts at QCP Capital also noted that markets fell in unison after Warsh’s recent comments—the risk-off tilt even extended to defensive assets. Bitcoin has stabilised above the technically important $74,500 level; however, a sustained close below $74,000 would raise the risk of a drop back into its 2024 price range, they said.

In their view, institutional flows and Warsh’s stance will be the key signals for the crypto market.

Earlier, Cantor Fitzgerald suggested that digital assets are entering the early stage of a prolonged downturn. A CryptoQuant author under the alias Crazzyblockk posited a shift to an “extremely bearish” phase.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!