Cipher Mining to raise $2bn to expand AI computing

Cipher unit to raise $2bn in notes for an AI-focused data centre.

Black Pearl, a subsidiary of bitcoin miner Cipher Mining, will conduct a private placement of $2bn in senior notes due 2031.

The issuer will use the proceeds to complete a data centre focused on high-performance computing (HPC) services in Wink, Texas.

The capital will also allow Cipher to reimburse about $232.5m previously advanced to the subsidiary from its own funds under a credit facility.

The miner is guaranteeing the debt obligations of its wholly owned Black Pearl.

In December 2023 Cipher closed the purchase of the site for Black Pearl, with initial interconnection capacity of up to 300MW. In June 2025 the company commissioned the facility for bitcoin mining. The plant delivered ~2.5EH/s on 150MW. It planned to scale by replacing older rigs with newer ones, including Avalon A15Pro by Canaan.

At that time Cipher operated five data centres with total capacity of 2.6GW.

In the second half, the company broadened its diversification into AI. In September the firm leased a data centre in Colorado City (Texas) to UK startup Fluidstack. Google helped broker the deal, taking a stake in Cipher in return for $1.4bn in guarantees.

In November the miner signed a lease agreement with Amazon Web Services worth $5.5bn to support HPC services.

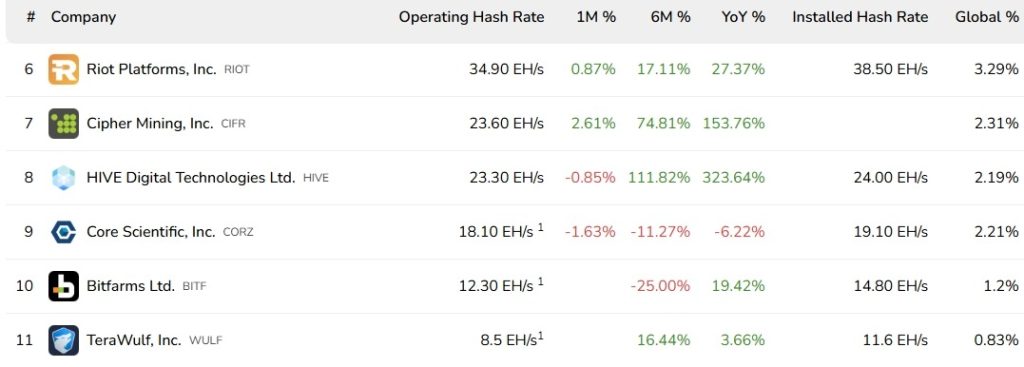

According to BitcoinMiningStock, Cipher has a deployed bitcoin hash rate of 23.6EH/s — the seventh-highest among public companies in the industry. Over the past 12 months the firm has increased its crypto-mining capacity by roughly 1.5 times.

TeraWulf to add 1.5GW of AI capacity

Bitcoin miner TeraWulf is buying two sites in Hausville (Kentucky) and Charles County (Maryland) that could add 1.5GW to the company’s power portfolio. The combined figure would reach 2.8GW.

TeraWulf just expanded its development pipeline in a big way with strategic infrastructure acquisitions in Kentucky and Maryland.

Here’s what you need to know.

— TeraWulf (@TeraWulfInc) February 2, 2026

In Kentucky the plan centres on an industrial site with:

- access to developed power infrastructure;

- 480MW of connected capacity;

- room for further expansion.

The site is several hundred kilometres from Midwest metro areas, making it suitable for latency-sensitive workloads such as HPC, the company said.

In Maryland TeraWulf is buying an operating power plant producing 210MW. An initial refurbishment phase will lift output to 500MW, with a longer-term goal of 1GW. The firm added that higher load will be paired with expanded battery-storage capacity to ensure uninterrupted power supply.

“The proximity of the site to the Washington metropolitan region and other Mid-Atlantic markets increases its attractiveness for resource-intensive computing tasks, where scale and reliability are valued,” the company said.

In August 2025 Google increased its stake in TeraWulf to 14% by expanding financial guarantees for the deal between the miner and Fluidstack.

In September TeraWulf announced raising $3bn through a Google-backed structure, with proceeds earmarked for data-centre construction.

TeraWulf’s installed hash rate is 8.5EH/s, up about 16.5% over the year.

In January, Bit Digital said it would exit crypto mining entirely and focus on AI-related strategies and investments in Ethereum.

Back in November, Bitfarms announced a gradual exit from the industry and a pivot to AI infrastructure.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!