The funding rate: how it helps anticipate price reversals in bitcoin and Ethereum

What is the funding rate?

Funding rate (Funding Rate) is a mechanism of periodic payments between traders in the perpetual-futures market. It ensures that the contract price (“perp”) does not drift away from the true market value of the underlying asset (spot).

Unlike traditional futures, perpetual contracts have no expiry date. Traders can hold positions for years, and funding is what keeps the derivative anchored to spot.

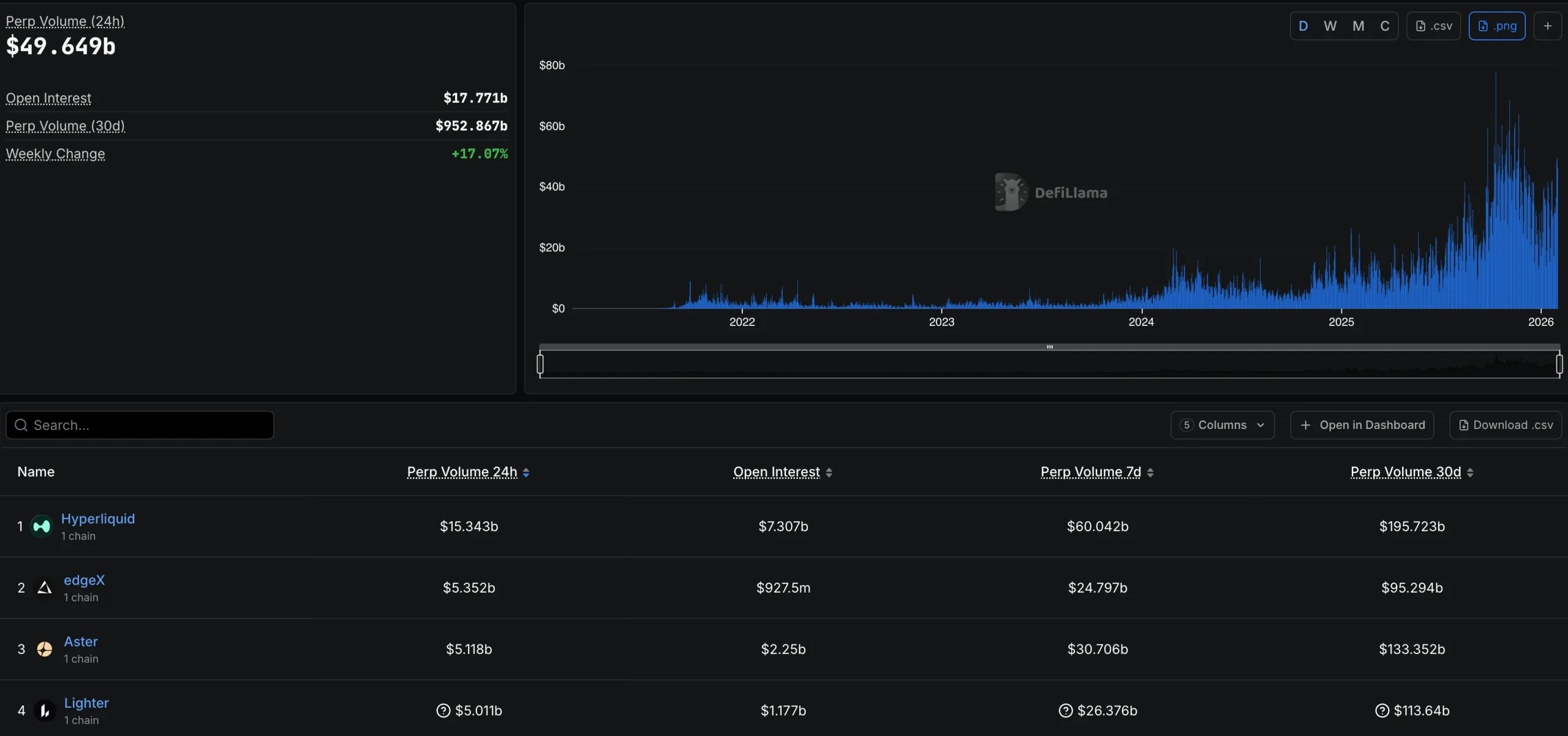

Today the tool is associated not only with large CEX but also with the growing segment of decentralised derivatives (perp DEXs). Venues such as Hyperliquid and Aster already rival traditional exchanges in trading volumes and open interest (OI).

How does the funding rate work?

The mechanics are simple: one side pays the other depending on market conditions:

- positive rate: the futures price is above spot. Buyers (longs) pay sellers (shorts). This encourages opening short positions and pushes the contract price lower;

- negative rate: the futures price is below spot. Sellers pay buyers, motivating traders to open longs and nudge the price higher.

Thus, the mechanism keeps perpetual futures close to spot. When prices diverge, incentives arise to open offsetting positions, helping the market return to equilibrium.

The metric is calculated from two components:

- Interest rate. The difference in the cost of borrowing the base asset (for example, BTC) and the quote currency (USD). Usually stable and small.

- Premium index. Reflects the deviation of the futures price from spot. A positive premium signals bulls’ dominance; a negative one, bears’.

Formulas and values vary across venues, so it is vital to study a specific exchange’s mechanics before opening positions.

Binance Futures uses a fixed interest component of 0.03% per day. It is split into three intervals of 0.01%, with payments every eight hours. The current value and the countdown to the next reset are shown at the top of the trading interface.

Why does the funding rate matter?

Funding is the key mechanism of the perpetuals market. It links the contract price to spot, spurs trader activity and serves as a valuable analytical tool.

Main functions:

- price parity: keeps the futures price near the asset’s real price;

- rebalancing: when dislocations are large, the rate motivates positions that pull prices back to equilibrium;

- sentiment gauge: positive funding signals bullish dominance (buying), negative funding, bearish (selling).

Understanding funding is essential for trading perpetuals. Three points to keep in mind:

1. Carry cost. Funding directly affects a trade’s outcome. Over longer horizons, a high rate can eat into profits or deepen losses. These costs should be built into the plan in advance.

2. Trading strategies. The metric opens opportunities for arbitrage — earning on the gap between futures and spot — and for using delta-neutral strategies. Traders also use funding dynamics as a sentiment indicator to help time entries and exits.

3. Risk management. In volatile periods, funding can shift rapidly, creating hidden risks. Monitoring rates regularly helps adjust portfolios in time and avoid unexpected fee outlays.

How to use the funding rate to analyse the market?

Extreme readings often flag overheating: abnormally high rates point to exuberance; deeply negative ones, to panic. In such conditions, the odds of a price reversal rise. Peaks in funding are therefore often used as signals to open countertrend positions.

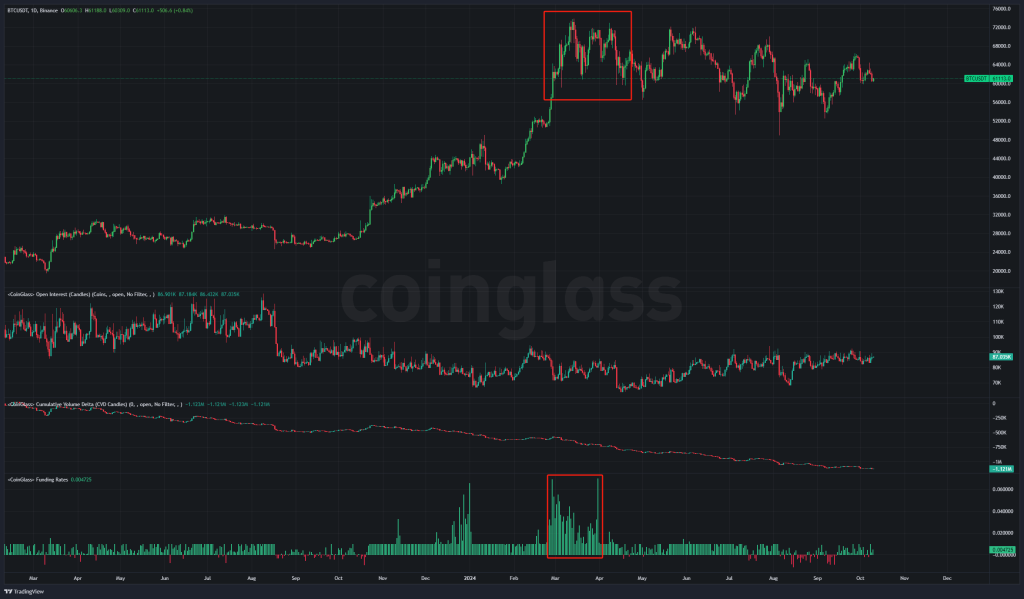

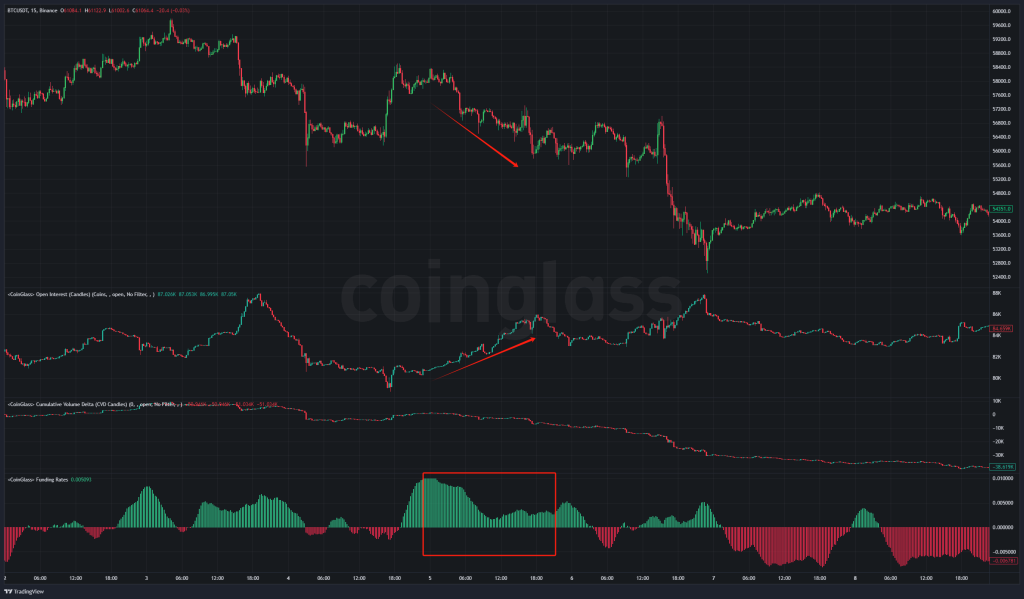

The chart below shows bitcoin reaching local highs alongside extremely elevated funding. That pointed to overheating and excessive optimism — typical precursors to prolonged corrections.

In the next chart, rising OI and price as the funding rate returns to positive territory suggest perp prices are aligning with spot and longs are being added aggressively. After such patterns, futures often start trading at a premium.

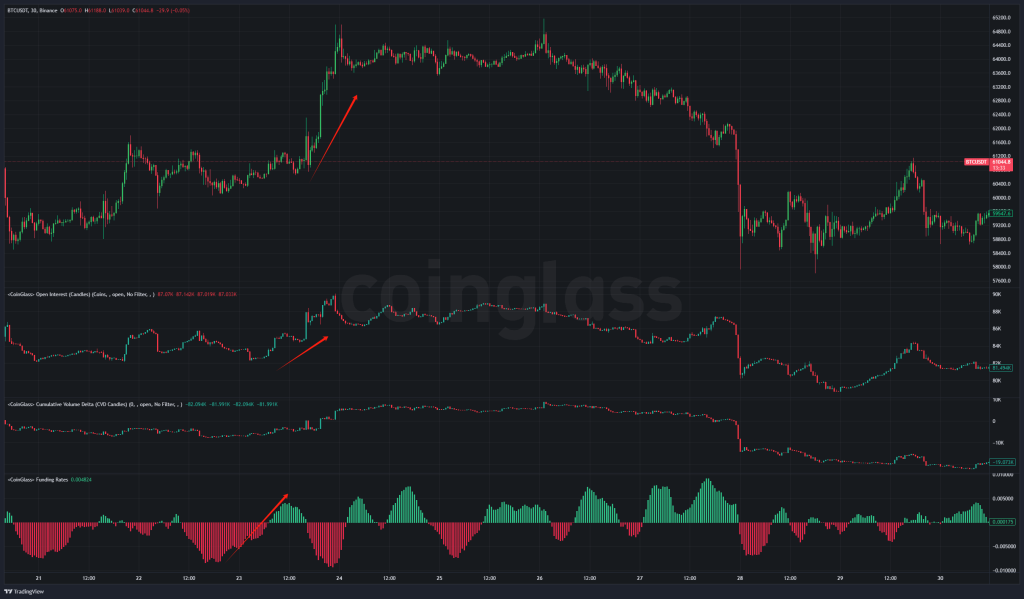

The following chart illustrates a classic long-squeeze cascade:

The simultaneous fall in price and OI is directly tied to funding turning negative.

The mechanics are as follows: mass forced long closures create excess sell pressure specifically on the futures market. That briefly pushes the contract below spot (a discount). Negative funding combined with a sharp drop in OI is therefore the most reliable signal of bull capitulation and the purging of leverage.

Another example: rising open interest alongside falling price and funding indicates sellers are in control. Market participants are adding shorts en masse.

Tracking funding dynamics alongside technical analysis helps spot turning points and refine trading strategies.

The tool’s role is growing with perp-DEXs, where significant liquidity now resides, influencing price formation and the dynamics of both spot and DeFi segments. Former BitMEX chief Arthur Hayes is convinced that by the end of 2026 the global financial market will look not to Nasdaq but to perp charts.

Funding, however, is no silver bullet. To avoid errors, use it alongside other metrics such as trading volumes and pay attention to price trends.

A systematic approach to funding and sentiment helps traders act more confidently in volatile periods, lowering risks and improving execution.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!