‘HODL’: Strategy reports $12.6bn loss

Strategy reports $12.6bn loss as bitcoin slump hits reserves; Saylor: "HODL".

A deep market correction has translated into multi-billion losses for Strategy, the largest corporate holder of bitcoin. That is according to the report from the company founded by Michael Saylor.

Operating loss reached $17.4bn, driven mainly by unrealised losses on bitcoin reserves. Net loss came in at $12.6bn, versus $671m a year earlier.

MSTR shares ended the session around $107, slipping in after-hours to about $100. The stock has fallen more than 70% from last year’s levels, shedding the premium investors had priced in.

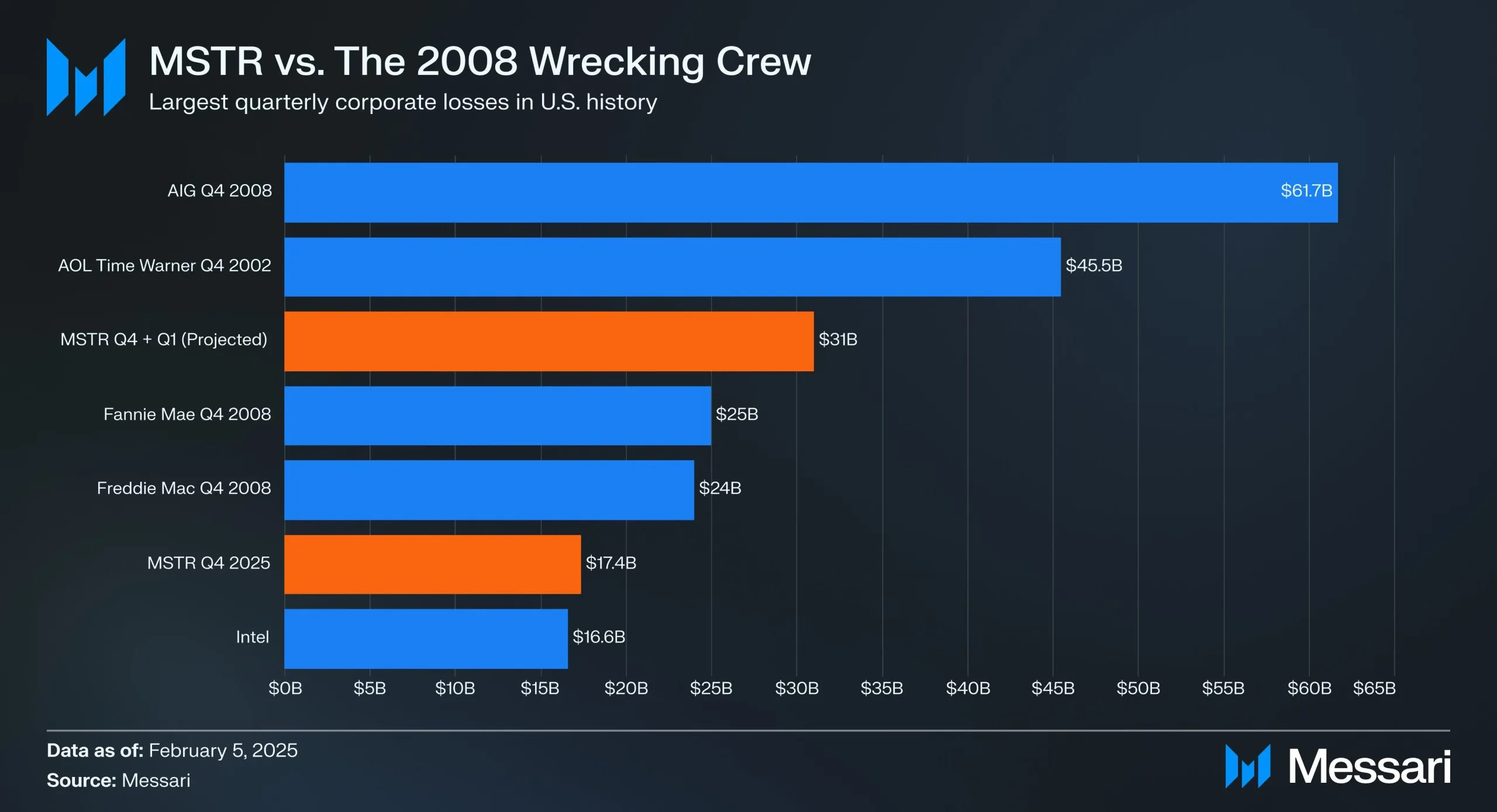

By Messari’s estimate, Strategy’s loss is on a par with those of giants such as AIG, Fannie Mae and Freddie Mac during the 2008 crisis.

The analyst added that February’s bitcoin plunge brought an additional $14bn in unrealised losses. In all, the decline in asset values since year-end approached $31bn.

As of early February, Strategy held 713,502 BTC on its balance sheet. The firm accumulated a large portion of its reserves during the late-2024 rally, when the price of digital gold briefly rose above $126,000. The average purchase price is about $76,000.

Just four months ago, when quotes were at record highs, the “paper” profit of the “treasury giant” reached $31bn.

Michael Saylor responded to the current situation with a laconic post on X: “HODL”.

Unless it drops to $8,000

Strategy’s CEO, Phong Le, assured investors of the company’s balance-sheet resilience amid the market correction.

On the fourth-quarter webinar, the executive clarified that risks to servicing debt would arise only under an extreme scenario: if bitcoin plunged to $8,000 and stayed there for 5–6 years.

“In the event of an extreme 90% drop in the bitcoin price—to $8,000—our reserves would equal our net debt. We would then be unable to redeem the convertible notes with bitcoin and would be forced to resort to restructuring, issuing additional shares or taking on new debt,” Le said.

CFO Andrew Kang emphasised the company’s commitment to a long-term approach, adding:

“Even amid volatility, we continue to execute the strategy.”

Saylor backed the point.

“Such quarterly swings can be sharp and unsettling. But it is important to stress that our strategy is long-term. It is designed to withstand short-term volatility and even the extreme conditions we are seeing today,” he said.

The founder of Strategy urged investors to focus on positive fundamentals, including favourable regulatory shifts.

The quantum threat

Saylor also addressed the quantum threat to bitcoin. The executive rejected the immediacy of the risks, calling them part of a “parade of horrible FUD”.

“The consensus is that it will take at least ten years before a real threat emerges. The technology is promising, but still at an early stage,” he noted.

He stressed that quantum computers pose risks not only to bitcoin. The threat also applies to the financial and defence sectors, which depend on traditional cryptography.

According to Saylor, significant funds are already being invested in protective protocols. The bitcoin network will receive the necessary upgrades through “global consensus”.

“Bitcoin is upgradable; it can be made more secure. We believe humanity will rise to the challenge and find rational technical solutions,” the founder of Strategy said.

To build consensus on quantum resilience, the company will launch the Bitcoin Security programme. The initiative envisages collaboration with cybersecurity experts and the crypto community.

Saylor also pointed to the firm’s “strong position”:

“We have effective governance, solid collateral and a responsible structure. This allows us to weather difficult months, quarters and even cycles lasting several years. We have done this before and are ready to continue in the future.”

In December, Strategy head Phong Le stressed that he did not worry much about bitcoin’s short-term moves.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!