Kaiko Analysts Elucidate Causes of Cryptocurrency Market Plunge

Bitcoin's price fell below $70,000, a two-year low, as Kaiko analysts report systemic market declines.

The price of the leading cryptocurrency has fallen below $70,000—a level unseen in the past two years. Analysts at Kaiko have recorded a systemic decline in market indicators.

— Kaiko (@KaikoData) February 6, 2026

The decline in prices is accompanied by reduced liquidity, a surge in volatility, and a decrease in investors’ risk appetite.

The bearish trend, which began back in October 2025, accelerated at the end of January. In just one week, from January 29 to February 4, the market lost a significant portion of its capitalization.

Causes of the Collapse

Experts identified several pressure factors. Bitcoin failed to become a “safe haven” amid the weakening dollar. The situation was exacerbated by geopolitical uncertainty and a fragile macroeconomic environment.

The trigger for the accelerated sell-off was the actions of the Fed. The regulator’s decision to keep rates unchanged and the potential appointment of financier Kevin Warsh, known for his hawkish stance, dashed investors’ hopes for monetary policy easing. The market reacted by fleeing to fiat.

Analysts noted a deterioration in market microstructure:

- Increased volatility. The indicator for Bitcoin exceeded 30%, returning to levels seen during market shocks.

- Correlation with stocks. During times of stress, cryptocurrencies once again began moving in sync with the S&P 500 and NASDAQ indices.

- Liquidity decline. Market depth is shrinking. For instance, liquidity in pairs with DOGE fell from $12 million to $10 million in just a month.

The derivatives market is witnessing a classic capitulation scenario. Trading volumes are rising, while open interest is plummeting. This indicates mass deleveraging—forced closure of leveraged positions, rather than the opening of new trades.

Bitcoin’s Bottom Level

CryptoQuant analyst known as GugaOnChain suggested a drop in the leading cryptocurrency’s price to $54,600. According to the expert’s calculations, it is at this level that the market will transition from the capitulation phase to the accumulation stage.

The Indicator That Mapped the Bottom of the Last Bear Market

“The current price convergence toward the band signaling the start of the accumulation phase, situated around $54.6K, suggests we are in the critical transition.” – By @GugaOnChain

Link ⤵️https://t.co/IWvzP3620Q pic.twitter.com/VarhjZSMTL

— CryptoQuant.com (@cryptoquant_com) February 6, 2026

The forecast’s author highlighted key pressure factors on prices: a 17% price drop since the beginning of the year, a $12 billion outflow from crypto-ETFs over three months, and a general retreat from risk by investors. However, massive sell-offs by major players often precede a trend reversal.

To determine the bottom, the analyst used the Market Cycle Signals indicator, based on monthly Bollinger Bands. The tool divides the market cycle into three stages:

- Distribution — the price touches the upper band (euphoria zone).

- Capitulation — prices fall below the 20-month moving average to the lower boundary (panic zone).

- Accumulation — conditions most favorable for opening positions.

According to the analysis, the chart is now moving towards the $54,600 level. GugaOnChain considers this zone a “critical transition point” and the main candidate for a local bottom, where selling pressure will abate.

What’s Happening with DEX?

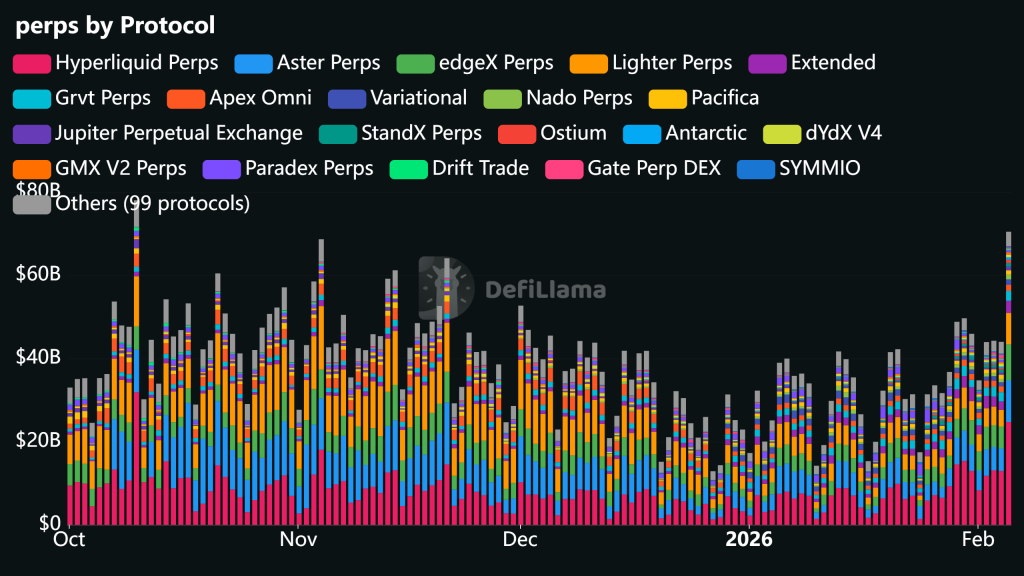

On February 5, daily trading volume on DEX reached $70 billion. This is the second-largest figure in recorded history, according to DeFiLlama.

According to CoinMarketCap, the total market capitalization has fallen to $2.27 trillion. The downward trend has continued since January 14, 2026.

In the past 22 days, the industry has lost over $1 trillion, shrinking by an average of $45 billion daily.

On February 6, the price of the leading cryptocurrency dropped to $60,000, marking a new low since September 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!