Kaiko Identifies Midpoint of Bitcoin Bear Market

Kaiko sees Bitcoin's $60,000 test as bear market midpoint.

The decline in the price of the leading cryptocurrency in early February, with testing of $60,000, signals the midpoint of the bear market, according to Kaiko.

Analysts noted that the 32% correction is the most significant drop since the last halving in April 2024.

“Analysis of on-chain metrics and comparative token dynamics indicates that the market is approaching critical technical support levels that will determine whether the four-year cycle remains intact,” they added.

The company’s specialists highlighted several signals confirming the bear market phase:

- a 30% drop in the total spot trading volume on the top 10 centralized exchanges from ~$1 trillion in October 2025 to $700 billion in November;

- a decline in open interest in Bitcoin and Ethereum futures from $29 billion to $25 billion over the past week.

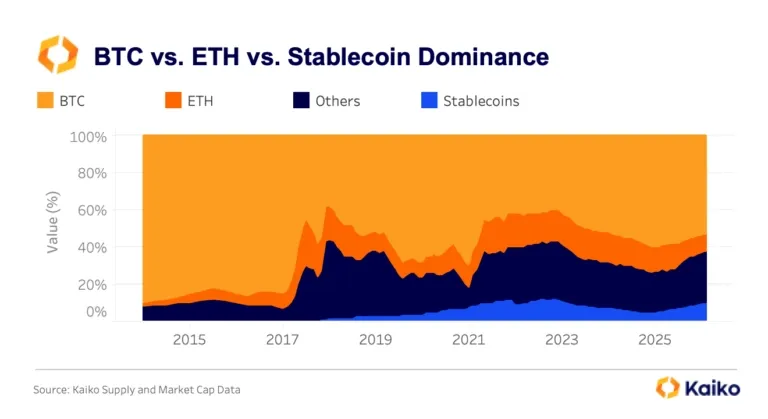

They also noted the growth in the share of stablecoins, with a net inflow of approximately $22 billion over the past three weeks. Historically, capital accumulates in pegged tokens during downturns and returns to riskier assets amid recovery.

Analysts compared the situation to the market downturn in 2022. At that time, the dominance of “stablecoins” peaked at 11.5%, followed by a reversal when cryptocurrencies hit bottom in the fourth quarter.

“The current level of 10.3% suggests that we are approaching the maximum defensive position, but may not have reached it yet. A key signal to watch is the stabilization or decline in stablecoin dominance, which will indicate the beginning of capital redistribution as a necessary condition for sustainable recovery,” the experts stated.

Is $60,000 the Bear Market Bottom?

Kaiko noted that Bitcoin’s 52% correction from its all-time high was “unusually shallow.” A drop of 60-68% would be more in line with historical trends, indicating a minimum around $40,000-50,000.

Sean Young, Chief Analyst at MEXC Research, confirmed to Cointelegraph that the leading cryptocurrency has returned to its historical four-year cycle associated with halvings since the beginning of the year. However, he believes it is difficult to determine the depth of the current bear market because “many catalysts that fueled the rally to $126,000 are still in play.”

“Given the emergence of oversold indicators on multiple timeframes, discussions about Bitcoin’s recovery are more a matter of time than probability,” Young added.

The $60,000 level roughly coincides with Bitcoin’s 200-week moving average, historically a strong long-term support, noted Nansen analyst Nikolai Sondergaard. In his view, in the absence of crypto-specific catalysts, market volatility will continue.

“And yet, it is still very difficult to say whether this means a return to the traditional four-year cycle. I have seen many prominent figures express this idea, but at the same time, several others do not share this view,” the analyst stated.

Experts have diverged in opinions regarding whether Ethereum has reached its price bottom in the current bear market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!