Robinhood Launches L2 for Asset Tokenization Amid Revenue Decline

Robinhood launches public testnet for Robinhood Chain, an L2 solution on Arbitrum for RWA and DeFi.

The online broker Robinhood has launched a public testnet for its own network, Robinhood Chain. This L2 solution is based on Arbitrum, focusing on RWA and DeFi.

The Robinhood Chain public testnet is live 🛠️

Developers can now build on a financial-grade Ethereum Layer 2 built on @arbitrum— designed to support tokenized real-world and digital assets.

Start building with the core foundation of Robinhood Chain: https://t.co/yHCQRh5x3j…

— Robinhood (@RobinhoodApp) February 11, 2026

Johan Kerbrat, General Manager of Robinhood Crypto, described the blockchain as a foundation for integrating traditional financial services into the on-chain space.

Developers now have access to test assets, including tokenized stocks, as well as tools for interacting with Robinhood Wallet.

Steven Goldfeder, CEO of Offchain Labs (developer of Arbitrum), noted that the launch will help the industry move to the next stage—launching financial services without intermediaries.

Financial Performance and Market Reaction

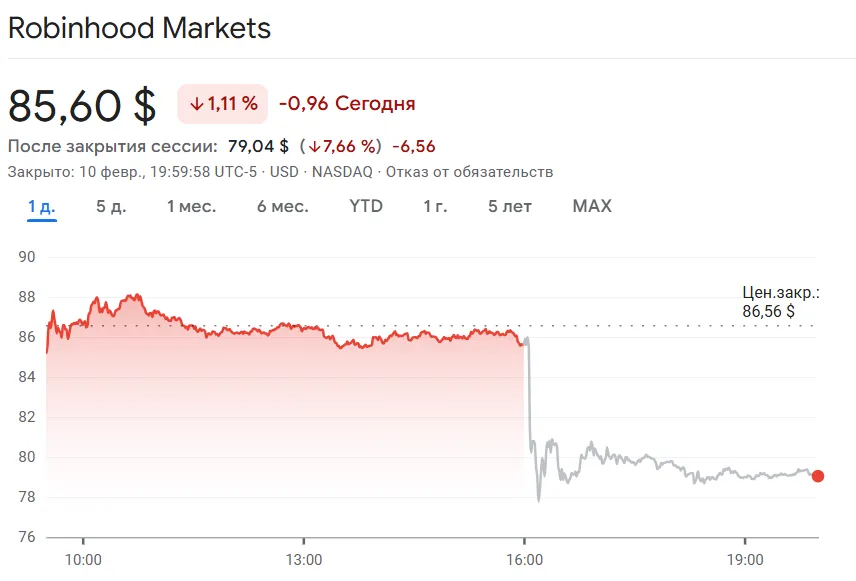

On February 10, Robinhood released its fourth-quarter report. In post-market trading, HOOD shares fell by about 8%, dropping from $85.6 to $79.04.

The company’s revenue from cryptocurrency operations decreased by 38% year-on-year, amounting to $221 million. In comparison, the figure reached $268 million in the third quarter.

Trading volumes on the Robinhood app fell by 52%. A significant portion of the total turnover of $82 billion was provided by the Bitstamp exchange, acquired by the company in June 2025.

Despite the decline in the crypto segment, the platform’s total net revenue grew by 27% to a record $1.28 billion. Growth was driven by other areas:

- options — $314 million (+41%);

- stocks — $94 million (+54%);

- net interest income — $411 million (+39%).

The number of Robinhood Gold subscribers increased by 58%, reaching 4.2 million. Total assets on the platform rose by 68% to $324 billion.

The broker’s CEO, Vlad Tenev, confirmed plans to launch tokenized stocks. The company plans to implement 24/7 trading and instant settlements on the blockchain.

Back in November 2025, Robinhood announced the creation of its own derivatives exchange and clearinghouse.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!