CryptoQuant sees scant evidence of a Bitcoin bottom

CryptoQuant sees scant evidence of a Bitcoin bottom as on-chain signals remain weak.

CryptoQuant analysts doubt that bitcoin’s correction has run its course. Despite heavy loss realisation, on-chain metrics have yet to confirm a structural bottom.

On February 5, bitcoin holders realised $5.4bn in losses—the most since March 2023. In coin terms, however, losses totalled just 0.3m BTC, compared with 1.1m BTC during the late‑2022 capitulation.

Analysts highlighted several factors that point to further downside risk:

- Share of coins in profit. The current level is 55%. Historical cycle lows formed when the metric fell to 45–50%.

- Behaviour of long-term holders (LTH). This cohort is selling at break-even. Market bottoms typically coincide with LTH realising losses of 30–40%.

- Cycle phase. The Bull-Bear Market Cycle indicator is in bear territory but has not yet fallen into the “extremely bearish” zone associated with the start of reversals.

Bitcoin trades 18% above the realised price ($55,000). In past cycles, prices fell 24–30% below that level before a 4–6 month accumulation phase.

Bearish risks

CryptoQuant analyst Woominkyu flagged another warning: the Bitcoin Combined Market Index (BCMI) has fallen to 0.2. Historically, such readings have aligned with the early stages of bear cycles, as in 2018 and 2022.

Bitcoin BCMI — How Close Are We to a Buy Zone?

“The data increasingly supports a bear market transition scenario, not a simple correction… From a cycle perspective, true bottom conditions may still be ahead.” – By @Woo_Minkyu pic.twitter.com/8hNnXOkZF3

— CryptoQuant.com (@cryptoquant_com) February 12, 2026

He noted that current market action differs from a typical mid‑cycle correction. In October, the metric held a neutral 0.5, but that structure broke down. There was no rebound from 0.3—declines continued without recovery phases. The pattern resembles a shift to risk‑off behaviour.

Historically, cycle lows formed at lower BCMI readings:

- 0.10–0.15 in 2019;

- around 0.15 in 2022–2023.

Current prints remain above capitulation zones. That suggests the conditions for a final bottom have not yet materialised, even if the market has already entered a bear phase.

The BCMI aggregates valuation (MVRV), profitability (NUPL), participant behaviour (SOPR) and sentiment. A drop to 0.2 reflects shrinking unrealised profits and realised losses. The “extreme panic” stage (around 0.1) has not been reached.

According to Woominkyu, the data support a trend‑transition scenario. Without a rebound of the index to 0.4–0.5, the probability of further bitcoin weakness remains high.

Bitcoin approaches the undervalued zone

CryptoQuant analyst Crypto Dan reached similar conclusions. He noted that bitcoin has been trending lower for roughly four months and is nearing the “undervalued zone.”

Bitcoin Approaching the Undervalued Zone

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.” – By @DanCoinInvestor pic.twitter.com/msSUdNDwk3

— CryptoQuant.com (@cryptoquant_com) February 13, 2026

He based the view on the MVRV indicator, now around 1.1. Historically, a dip below 1 has signalled undervaluation.

Crypto Dan pointed to a key difference in the current cycle: during the last rally, bitcoin did not reach an extreme overbought zone. As a result, the present correction may differ structurally from past bottoming episodes.

He added that for long‑term allocations, accumulating during drawdowns increases the odds of success.

Outflows from bitcoin ETFs

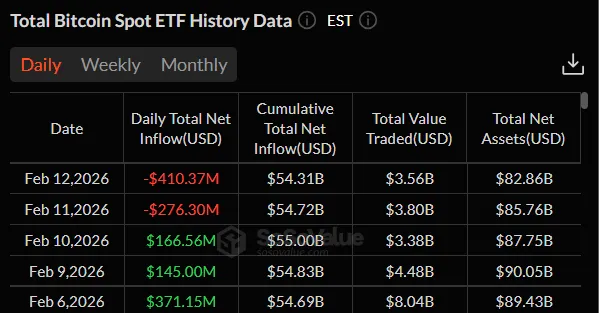

On February 12, net outflows from U.S. spot bitcoin‑ETFs totalled $410.37m.

Over two days, investors pulled $686.67m from the products. Notably, none of the 12 funds saw inflows.

BlackRock’s IBIT led outflows with $157.56m, followed by Fidelity’s FBTC with $104.13m. Grayscale and Bitwise funds shed a combined $65m, while WisdomTree and Hashdex posted flat flows.

Despite the setback, cumulative net inflows over two years have reached $54.31bn. ETFs now hold 6.34% of bitcoin’s market capitalisation.

Options

On February 13, bitcoin and Ethereum options expired with combined notional nearing $2.9bn, according to Greeks.live.

February 13 Options Expiration Data

38,000 BTC options expired with a Put-Call Ratio of 0.71, maximum pain point at $74,000, and notional value of $2.5 billion.

215,000 ETH options expired with a Put-Call Ratio of 0.82, maximum pain point at $2,100, and notional value of $410… pic.twitter.com/07TKfJxmMi— Greeks.live (@GreeksLive) February 13, 2026

Investors closed 38,000 BTC option positions worth $2.5bn. The put/call ratio was 0.71. The “maximum pain” point was $74,000.

For Ethereum, 215,000 contracts expired with $410m notional. The put/call ratio reached 0.82. The “maximum pain” point was $2,100.

The total expired notional equalled 9% of overall open interest.

Sentiment and volatility

Analysts noted a decline in implied volatility: to 50% for bitcoin and 70% for Ethereum. The downtrend has slowed, but market confidence remains low. The “maximum pain” level continues to fall rapidly.

Put options still dominate trading. However, after yesterday’s drop there were signs of dip‑buying, with call options appearing more often in large prints.

Analysts believe the most aggressive phase of the decline has passed. Even so, the lack of fresh liquidity argues against a durable reversal or the start of a bull cycle.

Standard Chartered did not rule out a fall in bitcoin to $50,000 followed by a rebound.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!