Bitcoin’s Correction Linked to Profit-Taking by Holders, Say Analysts

The 18% pullback in Bitcoin over the weekend, following its rise to multi-year highs, was attributed to profit-taking, including from derivatives, after ETF news. This conclusion was reached by Glassnode.

2024 has opened with a roller-coaster ride for #Bitcoin, as ten new spot ETFs begin trading in US markets.

The event was historic and chaotic, with BTC prices setting both new multi-year highs, and YTD lows. Bitcoin has welcomed traditional finance into it’s world.

Find… pic.twitter.com/1bC8gcv5Rf

— glassnode (@glassnode) January 16, 2024

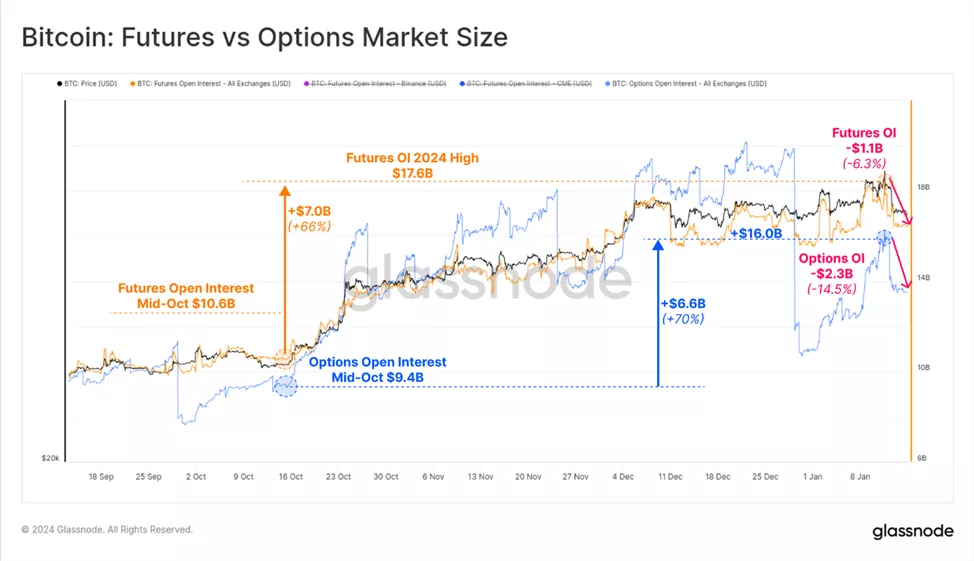

Experts noted a significant increase in open interest (OI) in futures and options since mid-October:

- ? OI in futures rose by 66% ($7 billion), but decreased by $1.1 billion this week;

- ? OI in options increased by 70% ($6.6 billion), with a $2.3 billion drop this week, partly due to expiration.

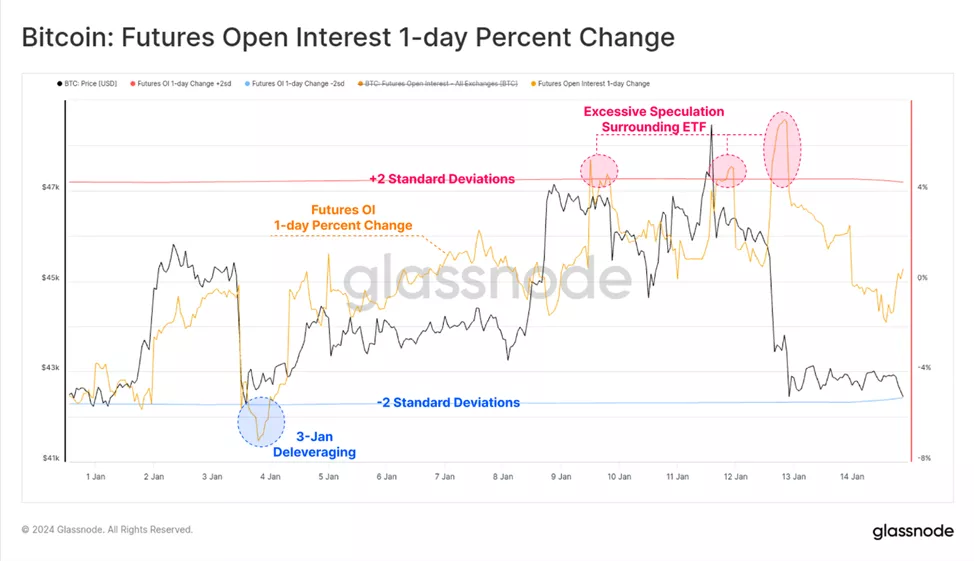

The chart below shows the oscillator of percentage change in futures OI. This metric is used to identify periods of rapid leverage change:

- ? High values indicate an increase in OI by two standard deviations;

- ? Low values indicate a decrease in OI by two standard deviations.

On January 3, there was a significant reduction in OI, with investors closing positions worth ~$1.5 billion in a day. From January 9 to 11, as ETF speculation peaked and the price of digital gold neared $49,000, the indicator rose significantly, only to fall sharply again after news from the SEC.

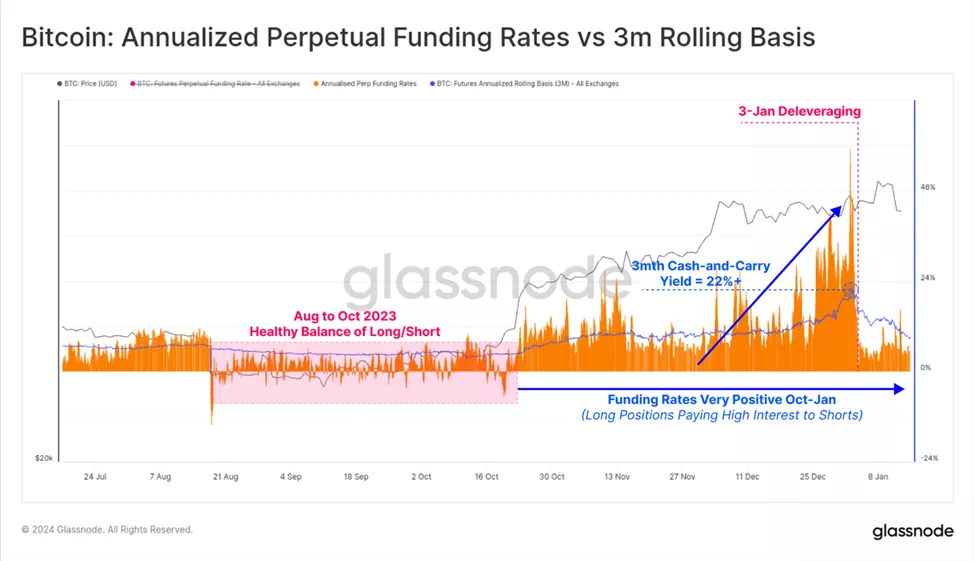

Funding rates for perpetual contracts, annualized, reached 50% at one point, indicating traders were “overloaded” with long positions. This week, the rate fell but remained positive.

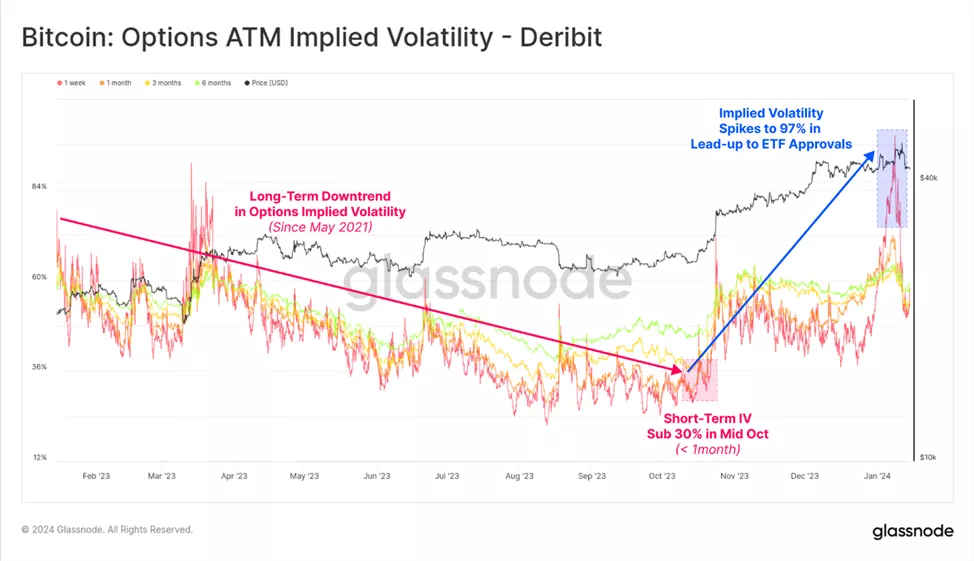

In options, implied volatility spiked during the chaotic events of the week. The trend of rising metrics also began in mid-October.

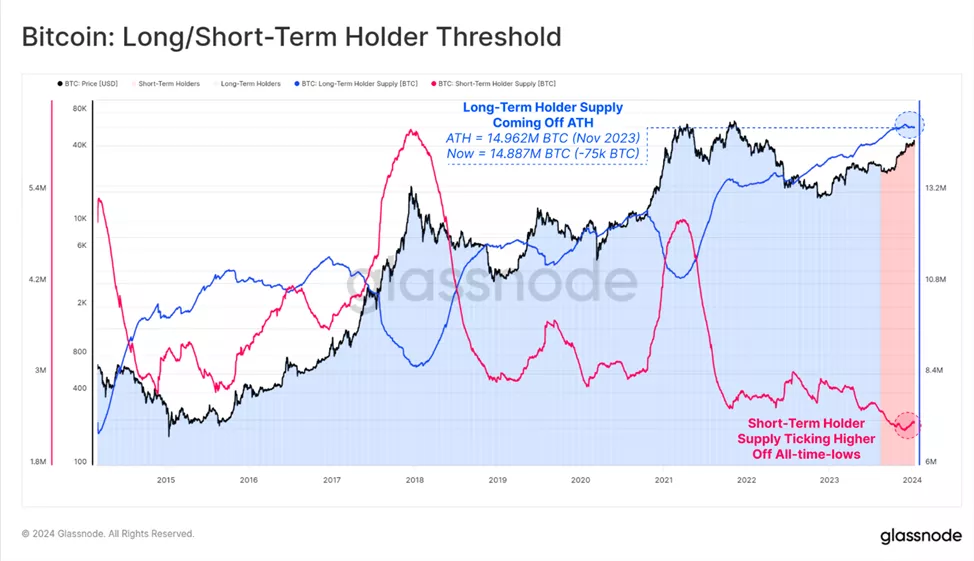

Amid volatility triggered by ETF news, experts found a reduction in positions by long-term Bitcoin investors. In November, the indicator reached ATH. Since then, it has decreased by 75,000 BTC as profits were taken. Hodlers still control 76.3% of the available supply of digital gold.

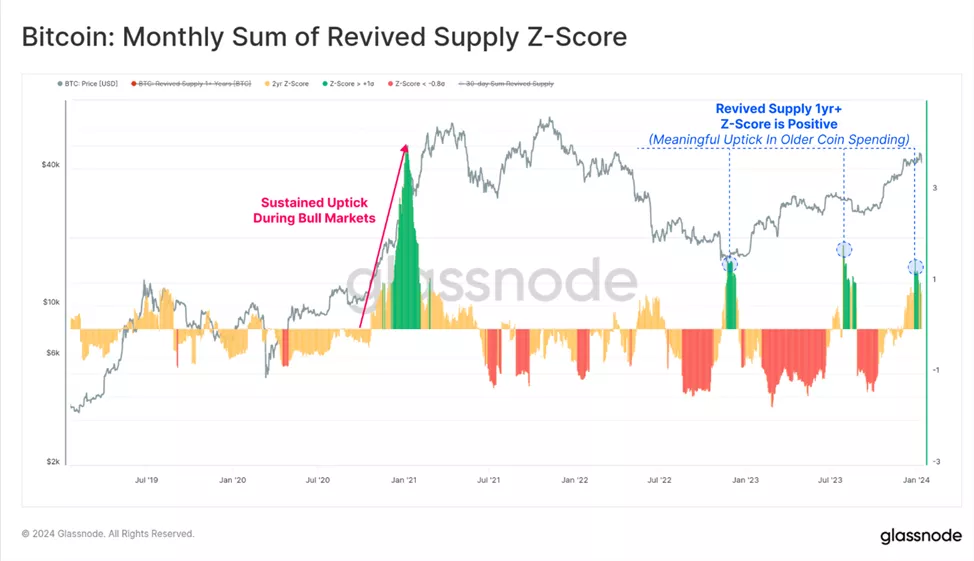

The spending by long-term investors is statistically significant—the number of “unlocked” coins older than a year increased by more than one standard deviation. The chart below shows that such events are rare and coincide with upward trends facing significant resistance.

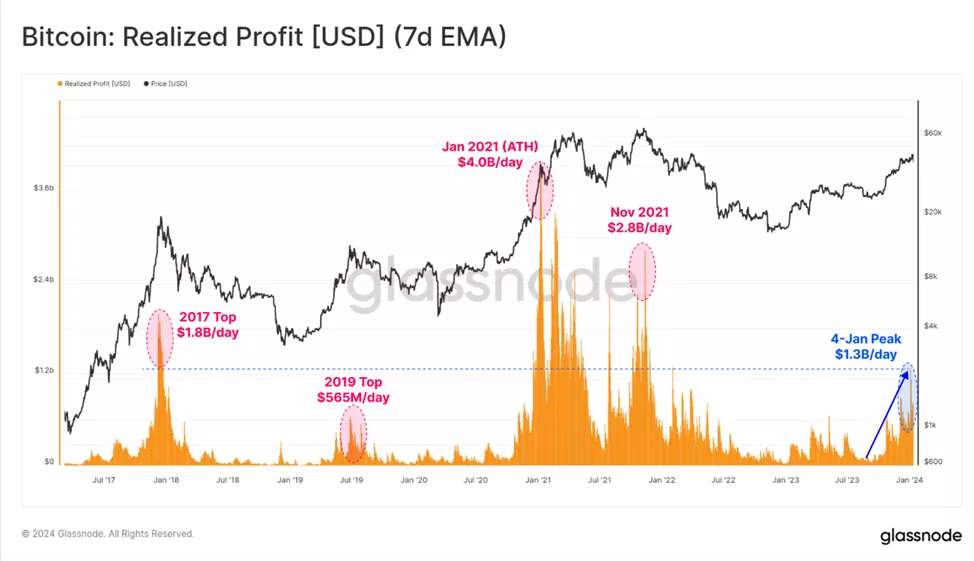

Amid hodlers’ sales on January 4, realized profits reached $1.3 billion.

“Profit-taking is normal during a market uptrend. The real question — will the influx of new demand be sufficient to absorb it,” concluded the experts.

Earlier, former BitMEX CEO Arthur Hayes warned of a 20-30% Bitcoin correction due to declining dollar liquidity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!