Left Turn for New York Crypto: What Zohran Mamdani’s Win Means for Bitcoin

What a Zohran Mamdani victory could mean for New York’s bitcoin and broader crypto market.

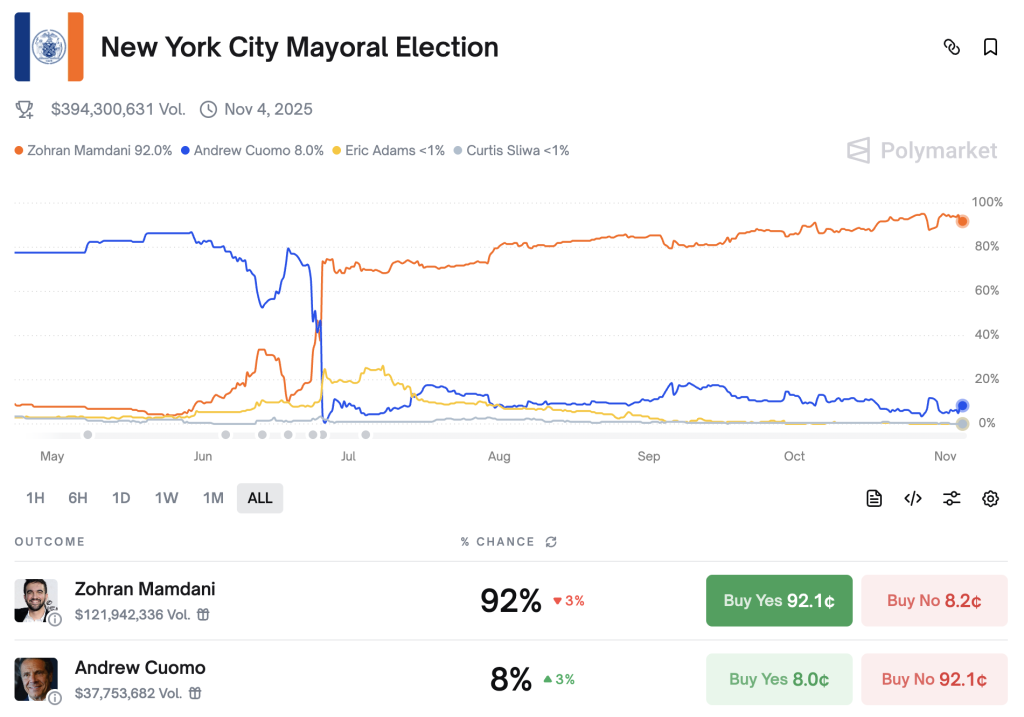

New York holds its mayoral election on November 4, with Democratic candidate Zohran Mamdani the frontrunner. According to Polymarket, at the time of writing 92% of users had bet on his victory.

Mr Mamdani’s platform, built on housing and social justice through a rent freeze and higher taxes on millionaires and corporations, has angered financiers and property developers.

His primary victory triggered a partial equity sell-off. On June 25th, CNBC reported that shares of Flagstar, a bank exposed to New York real estate, fell almost 4%. Sector funds also slid: SL Green Realty lost over 6%, Vornado Realty Trust about 7%.

Talk has turned to a potential exodus of wealthy investors, notably crypto whales, to states with friendlier business climates. ForkLog examines what the rise of a “far-left radical and crazy communist” (as President Donald Trump called Mamdani) might mean for the world’s financial capital.

Who is Zohran Mamdani and what is he proposing?

Zohran Kwame Mamdani was born on October 18, 1991, in Kampala, Uganda. He graduated from the Bronx High School of Science and earned a bachelor’s degree in African Studies from Bowdoin College. He practises Shia Islam.

Before entering politics, he worked in Queens as a counsellor helping households avoid foreclosure.

Since January 2021 he has served in the New York State Assembly for the 36th district (Astoria and Long Island City, Queens).

In 2025 he became the Democratic Party’s candidate for mayor.

His core policy planks include:

- housing justice: tighter rent regulation, support for landlords and tenants;

- transport: free bus routes, better public transit;

- economy and taxes: higher levies on corporations and the ultra-wealthy, resource redistribution;

- social justice: criticism of prevailing models of international policy, focus on the rights of Indigenous peoples and diasporas.

He proposes lifting the state’s top corporate tax rate to 11.5%, adding a 2% city income tax for residents earning over $1 million, and tightening oversight of public procurement and debt collection. According to his campaign’s estimates, these measures would raise about $10 billion a year.

The proceeds are earmarked for free childcare and buses, and the construction of 200,000 new units of permanent affordable housing.

Mamdani campaigns aggressively on social media, posting videos in languages of minority communities including Arabic, Hindi, Urdu and Bengali. One Bollywood-style TikTok, splicing clips from Indian films, has topped 3 million views.

@zohran_k_mamdani Billionaires ke paas already sab kuchh hai. Ab, aapka time aageya. Billionaires already have everything. Now, your time has come.

In another stunt, Mamdani, suited and booted, dives into the winter Atlantic, pledging to freeze New York rents.

I’m freezing… your rent as the next mayor of New York City.

Let’s plunge into the details. pic.twitter.com/KM0TAU4dde

— Zohran Kwame Mamdani (@ZohranKMamdani) January 2, 2025

The approach helped him go viral and capture the attention of immigrant communities and the working class.

Attitude to the digital economy

References to cryptocurrencies have become an integral part of election campaigns worldwide, and this race is no exception.

In mid-October, Mr Mamdani’s chief opponent — former New York governor Andrew Cuomo — announced the creation of a chief innovation officer to promote cryptocurrencies and Web3 technologies.

“The next mayor must ensure that we also lead in the technologies that will define the next century — artificial intelligence, blockchain, and biotechnology. The goal of this position is to keep New York not just competitive, but dominant in the global innovation economy. I look forward to the future,” the statement said.

Mamdani responded sceptically, citing reports that as a consultant to exchange OKX Mr Cuomo may have played a key role in the platform’s settlement with the US government for $504 million in February.

“Cuomo’s ties to the world of crypto represent a conflict of interest. He is not just a candidate; he is a lobbyist for the crypto industry,” the politician said.

Mamdani criticised the bitcoin market in May 2023, pointing to the high social risks if it were to crash.

When crypto companies collapse, it isn’t the rich who suffer, it’s small investors who disproportionately come from low-income and communities of color.

@NewYorkStateAG has a bill to address this and protect New York investors.Let’s do it! https://t.co/z0lCuPzkK9

— Zohran Kwame Mamdani (@ZohranKMamdani) May 11, 2023

“When cryptocurrency companies collapse, it is not the rich who suffer, but small investors, among whom there are disproportionately many from low-income and communities of color,” he wrote.

He is also troubled by the unrestrained use of artificial intelligence. He was himself the subject of a fake video portraying him as the ideal candidate for criminals of every stripe.

In an interview with Wired, the politician acknowledged the role of digital technologies in democratic governance while stressing the need to regulate them. He also voiced readiness to engage with Big Tech to attract investment and talent to the city.

Why is Wall Street spooked?

New York remains America’s biggest city economy. In 2023 the metro area generated $2.3 trillion of GDP. According to the Department of City Planning, as of July 1, 2024, the city’s population was 8.47 million. Henley & Partners counted 349,500 millionaires — the highest tally in the world.

In fiscal 2024 the city collected $15.9 billion of personal income tax. By some estimates, 40% of that comes from the top 1% of earners. The assessed value of taxable property over the same period was above $1.5 trillion.

The unemployment rate in January 2024 stood at 5.4%, versus 3.7% nationwide. The poverty rate in 2022 was 18%.

These figures underscore wide social inequality amid vast economic heft — a setting sensitive to tax and rent reforms.

Business and finance have voiced a raft of concerns about Mr Mamdani’s programme:

- Tax burden and corporate levies. Proposed rate hikes are seen by the business elite as a direct threat to profits and to companies’ incentive to keep headquarters and operations in the city, undermining New York’s competitiveness.

- Risk to business activity. Pushy reforms could drive talent to jurisdictions with more predictable tax and regulatory regimes.

- Weaker investment climate. In the short run, private investment may slow, M&A deals may be delayed and major commercial projects postponed.

- Rent policy and real estate. A rent freeze would hobble the economics of new projects and curb developer spending on building and refurbishment, shrinking supply over time.

- Municipal-bond yields. Political uncertainty could force the city to pay a risk premium, raising borrowing costs for a spell.

- Political and geopolitical rhetoric. Mamdani backs the Boycott, Divestment, Sanctions movement and has publicly called for ending city pension funds’ investments in Israeli bonds.

According to trader Vladimir Koen, Wall Street’s fears are understandable, since the stock market “traditionally feeds New York”.

“A high concentration of wealthy people provides the bulk of the city’s tax revenues. At the same time, there is a trend of large capital moving to low-tax states — Texas and Florida. Since 2020, more than 150 companies with a combined market capitalisation of more than $1 trillion have already left New York. Mamdani’s rise to power will only accelerate this process,” the expert told ForkLog.

He called higher taxes risky for crypto firms too:

“Doing business in New York is already expensive due to high rents and wages. Corporations will find it unprofitable to stay if taxes rise. That applies to crypto companies, of which there are quite a few in the city.”

He noted that in 2015 New York state became the first to introduce BitLicense, a business licence issued by the Department of Financial Services (NYDFS). Holders include exchanges Gemini, bitFlyer and Bullish; Paxos, Circle, Bakkt, Block (Square) and Robinhood Crypto; platforms Ripple, NYDIG and Fidelity Digital Assets; and payments firm PayPal.

The state is actively advancing crypto initiatives. In September the NYDFS expanded requirements for banks to use blockchain-analytics tools when handling virtual currencies. The regulator also updated guidance for financial institutions that provide crypto custody.

New York City has created an Office of Digital Assets and Blockchain Technologies.

Under consideration are:

- bill A7788, which would allow state agencies to accept payments, fines and fees in cryptocurrencies;

- bill A8966, introducing a 0.2% tax on transactions in digital assets and NFTs.

Given Mamdani’s cautious stance on digital innovation, a victory would likely bring tighter compliance oversight of crypto, with public inspections of major platforms possible. Web3 projects that demonstrate clear benefits for residents (for example, blockchain for rights verification, benefits delivery, or subsidy accounting) could find support. New taxes would lift operating costs for local services.

It is important to note that New York’s mayor wields considerable administrative influence over city offices, procurement, pilots and payment practices, but cannot unilaterally change state-level rules.

Is the panic overdone?

Analysts at GW&K Investment Management and JPMorgan argue that the mayor’s limited powers and robust fiscal controls cushion the impact of Mr Mamdani’s rhetoric.

They point to the New York City Financial Emergency Act, which requires a balanced budget and forbids deficit spending. It mandates financial planning and reporting, limits taxation, and bans borrowing for operating purposes.

This framework reduces the risk of unilateral mayoral moves. Major changes to taxes and spending need approval from the city council, the state and, in some cases, the courts.

JPMorgan has stressed that even if Mr Mamdani’s campaign ideas become policy, it will not happen overnight, and the impact on the city’s credit should remain limited.

Market reaction, Bloomberg argues, has been more emotional than rational. While some wealthy residents loudly vow to leave, a mass exodus is unlikely: the rich are tied to the city by property, business, infrastructure and family.

In September Governor Kathy Hochul endorsed Mr Mamdani, stating she intends to keep New York the world’s economic centre. She noted that she differs with the candidate on some issues and reserves the right “to openly disagree and argue vigorously.”

“However, given the appalling and destructive policies that Washington is pursuing on a daily basis, I needed to know that the next mayor would not be someone who will cede even an inch to President Trump,” Hochul said.

City hall history suggests that after elections, bold declarations turn into compromise — partial reforms, limited reallocations and local pilots.

Analysts concur that the risks to the city’s economy are more political-psychological than mechanical, and counsel against panic.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!