A tenth of all bitcoin transactions are attributed to residents of Eastern Europe

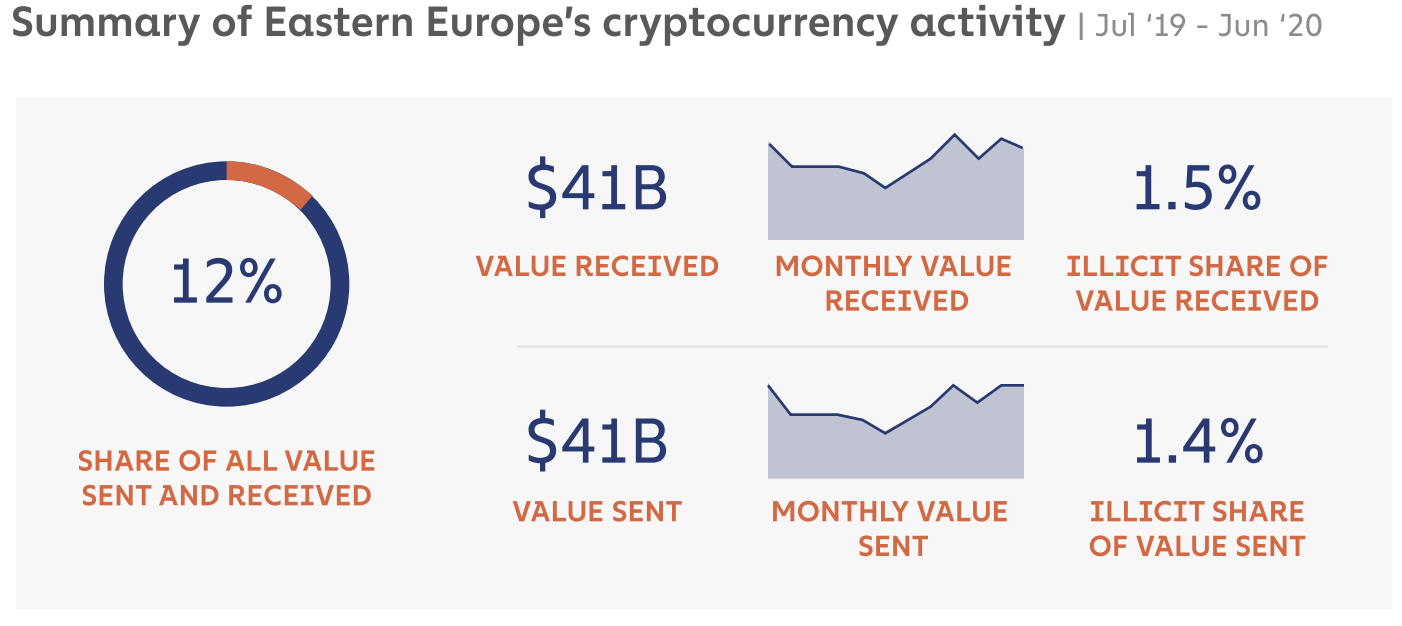

Eastern Europe accounts for 12% of all cryptocurrency transactions conducted between July 2019 and June 2020, according to Chainalysis.

Geography of Crypto by ForkLog on Scribd

The total value of sent and received funds during the period amounted to $82 billion.

86% of the digital assets received by the region were sent to exchanges, 35% to mining, 11% to illicit operations, 5% to smart contracts and wallets, and 4% to gambling.

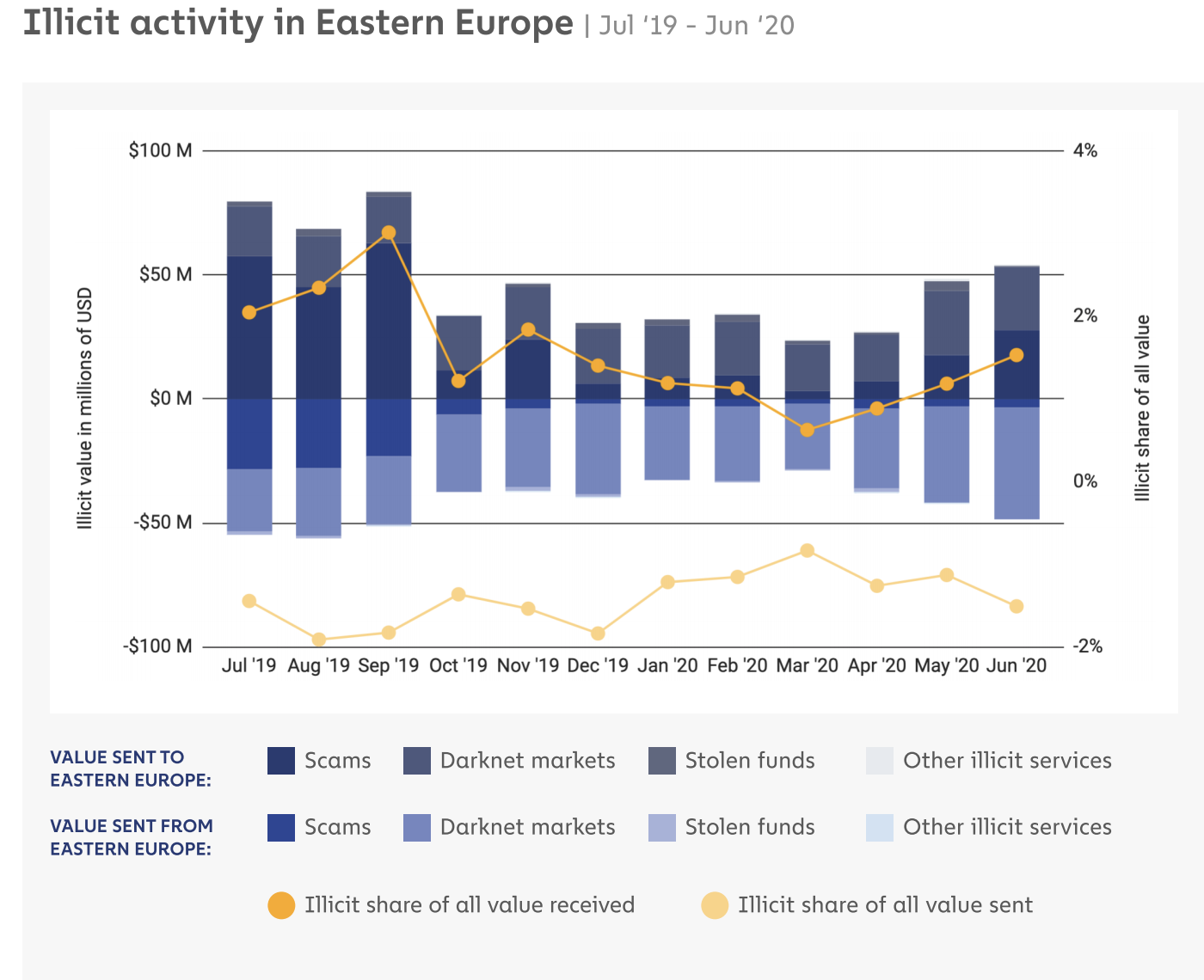

Meanwhile, 50% of illicit operations involved scam projects, 45% occurred in the darknet segment, and 4% consisted of stolen funds.

The cryptocurrency market in Eastern Europe ranks fourth by transaction volume, but the region is home to two countries leading the number of active users of digital assets — Ukraine and Russia.

According to Chainalysis, in the period from July 2019 to June 2020 Russia sent cryptocurrency worth more than $16.8 billion and received $16.6 billion. Ukraine in the same period sent $8.2 billion and received $8 billion.

“These figures are far lower than the corresponding figures for China and the United States, but given the populations and sizes of the two economies, they point to a much higher level of cryptocurrency adoption,” the researchers note.

Belarus ranked third in the region and 19th globally for activity in the peer-to-peer trading of cryptocurrencies.

Chainalysis explains the high popularity of cryptocurrencies in Russia and Ukraine by the population’s lack of trust in the government, banks, business, and media.

“Bribery, cronyism and other forms of corruption are widespread in both countries. Funds may be seized from enterprises and private individuals who have fallen out of favor with government officials,” cited Chainalysis to the National Public Radio.

Since the 1990s crisis, 56% of Russians do not trust banks. Similar sentiment is seen in Ukraine after the collapse of several large banks over the past decade.

The wider adoption of cryptocurrency was aided by the broad spread of electronic payments. A 2014 survey showed that 46% of Russians regularly use electronic money for online purchases, mainly through the Yandex, WebMoney and Qiwi platforms.

An additional stimulus for rising popularity of bitcoin in Russia and Ukraine was the lack of a reliable infrastructure for domestic and international money transfers.

Chainalysis researchers emphasize that cryptocurrency’s widespread use in both countries occurred amid the lack of regulatory framework for the market.

The Ukrainian legislative draft “On Virtual Assets” was registered in the Verkhovna Rada only in June 2020 and is set to be considered by parliament in September.

In Russia, the law “On Digital Financial Assets” was approved by the State Duma in July. It will take effect on January 1, 2021.

A large portion of cryptocurrency activity in Eastern Europe is concentrated on the professional market. Approximately 85% of all regional transaction volume during the study period consisted of large transfers of over $10,000.

“Although institutional investments in cryptocurrency in Eastern Europe have not yet reached the level of the United States and the European Union, some financial managers in the region have taken advantage of a new asset class,” Chainalysis notes.

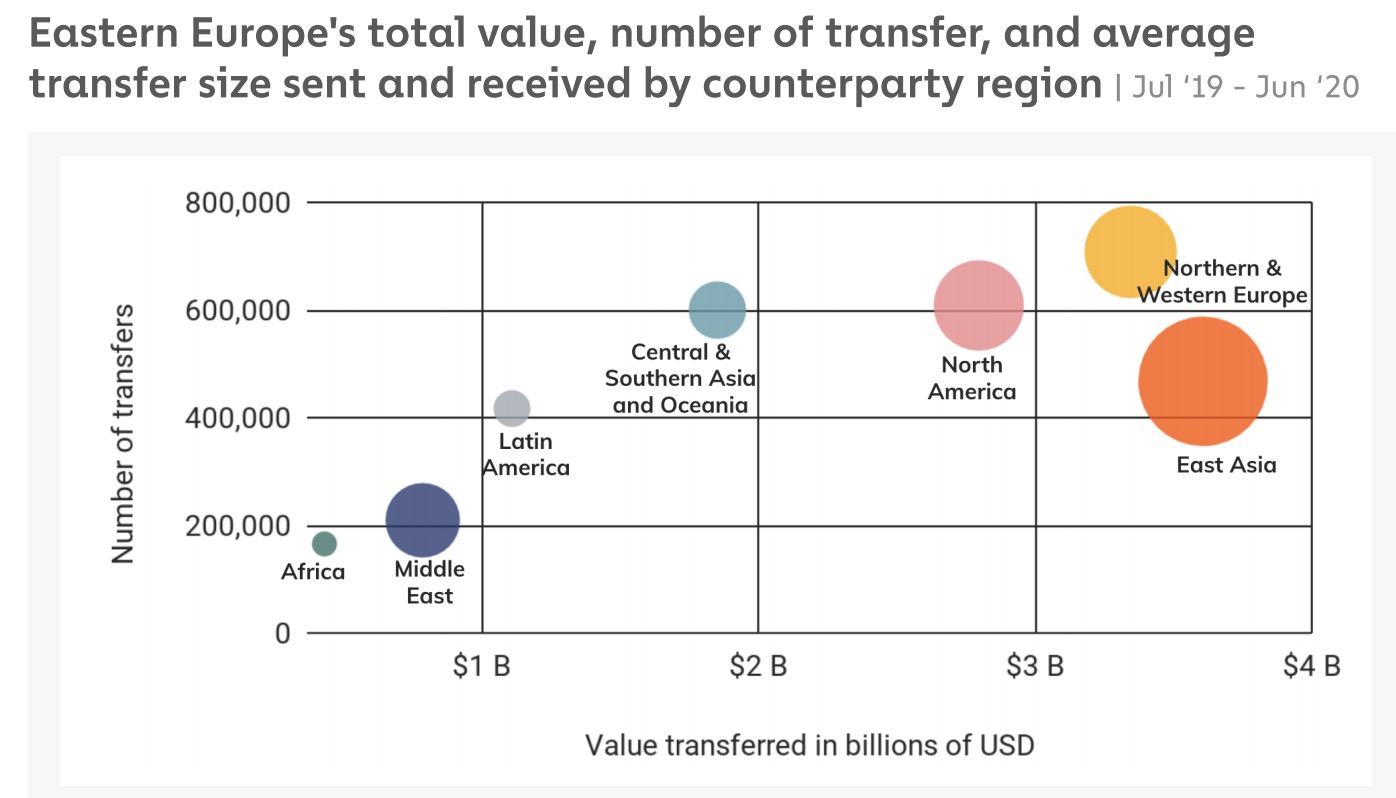

Among regional partners of Eastern Europe, East Asia leads, followed by the European Union and the United States.

A significant portion of funds moved between Eastern Europe and East Asia is accounted for by Chinese traders working in the region, for whom cryptocurrency is a preferred remittance method home. According to last year’s Coindesk report, Chinese buyers purchase up to $30 million daily in USDT tokens via Russian off-exchange crypto platforms.

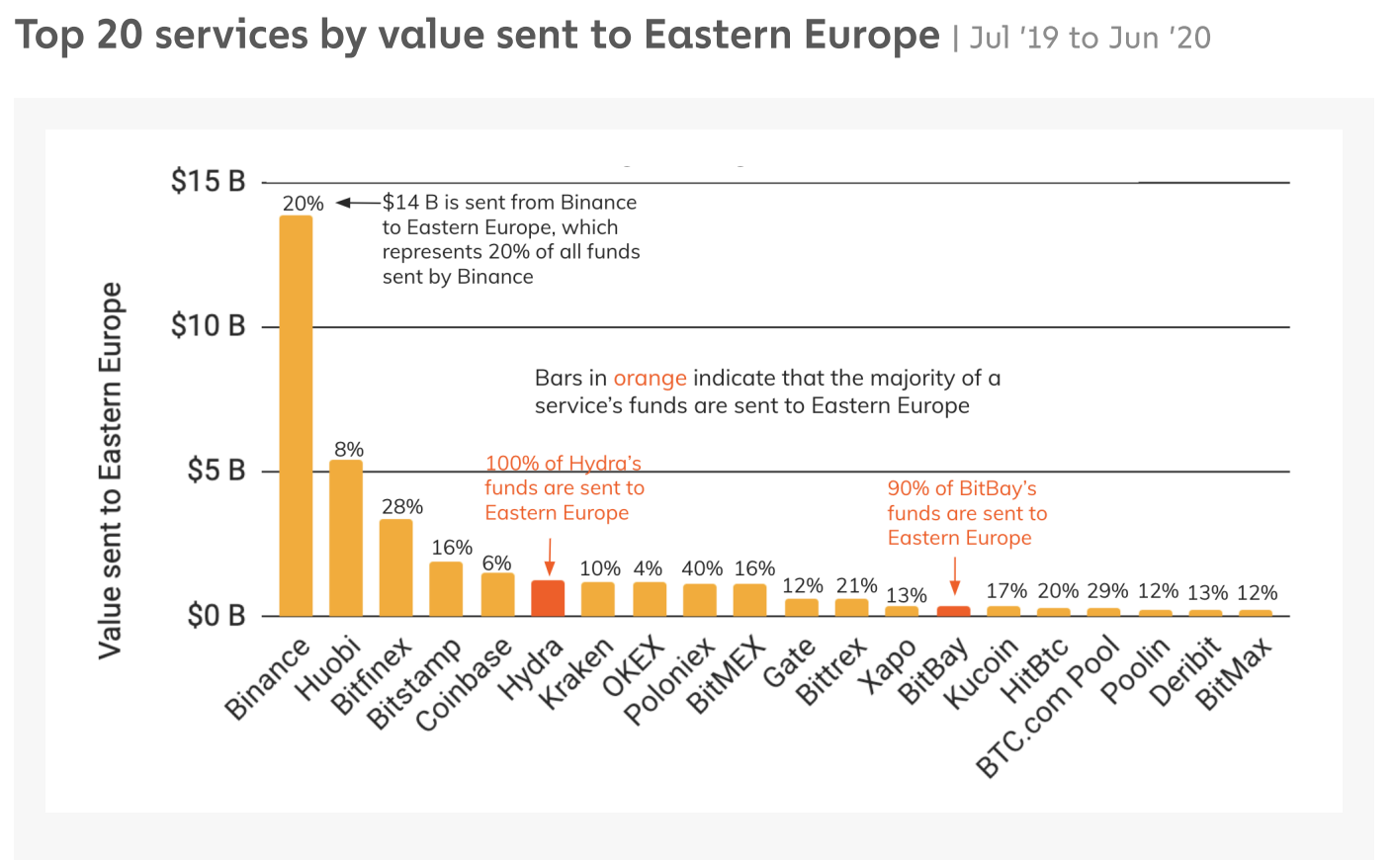

The chart above shows that cryptocurrency exchanges move large sums to addresses of users from Eastern Europe, yet regional transactions account for a small share of activity on these venues. Chainalysis researchers link this to the lack of regulatory framework for cryptocurrency in Russia and Ukraine.

Earlier ForkLog reported that Eastern Europe is leader in darknet markets activity among regions worldwide.

Follow ForkLog news on Telegram: ForkLog Feed — all the news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!