All that glitters, again

What is happening in the precious-metals market

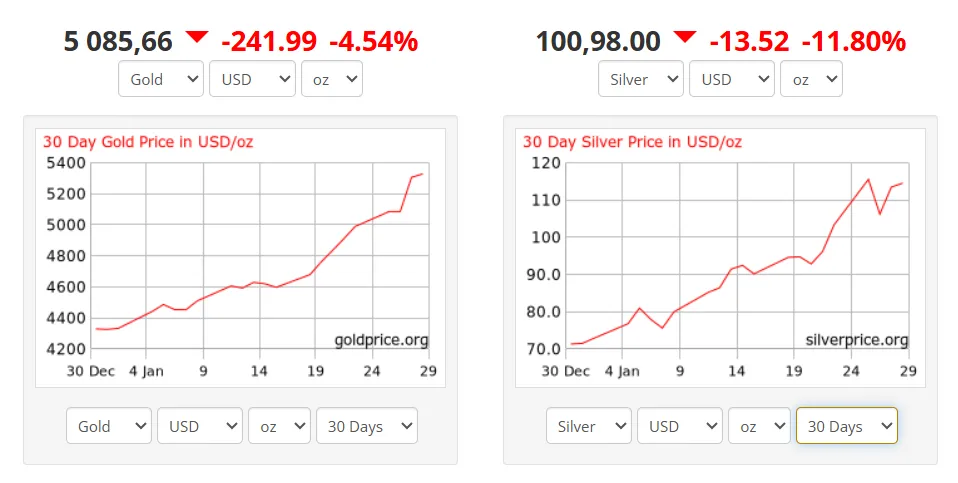

Gold has set a personal record for volatility against bitcoin. Within days the precious metal slid from a record $5,500 per troy ounce to around $4,500, before resuming its climb.

Why the supposed safe end of traditional markets is lurching—and why crypto investors should care—is unpacked by Elena Vasilieva.

From records to a “melt-up”

Late January brought a parabolic surge in precious metals. After clearing $5,000 early in the week, gold kept rising by momentum, reaching on January 28 a record high above $5,200 per ounce. Silver moved even more explosively, jumping to $117.69.

By Friday, January 30, however, the market cooled sharply: gold shed more than 4% to about $5,150, and silver fell 5% to $110 (data CNBC от 30.01.26). Ed Yardeni of Yardeni Research охарактеризовал the episode as a “melt-up”—a bout of frenzied, near-vertical gains typical at the end of a bull market. The abrupt correction on Friday was связали by analysts to a stopgap deal to avert a U.S. government shutdown, which prompted profit-taking.

Even so, the local pullback does not alter the trend: since the start of the year precious metals have posted double-digit gains. Why?

Expert view: when politics trumps economics

The main drama is in America, where the executive is leaning on the monetary authority (the Fed), pushing for rate cuts against the backdrop of a criminal investigation into Jerome Powell, the Fed chair.

On January 30 President Donald Trump announced the nomination of Kevin Warsh to be the next head of the central bank. Precious metals slipped again after the news.

Ruslan Khaitkulov, senior lecturer at HSE University’s Department of Theoretical Economics, explained the clash to ForkLog in plain terms:

“Trump is pressuring the Fed to lower the rate. That will echo in expanded business activity (which is good for him), but also in higher inflation. Containing inflation is a direct task of the Fed, so they resist.”

When investors see a risk that politicians will “bully” bankers, they realise the dollar may depreciate. Gold becomes more expensive not because more jewellery is being made from it, but because in such turbulent times investors traditionally turn to gold as a hedging asset.

Explainer: what the buzzwords mean

We hear “public debt”, “bonds”, “deficit” all the time. They often blur into anxious white noise. Here is the plain-English version—and why people run to gold:

- Budget deficit — when the state spends more than it collects in taxes.

- Public debt and bonds. To plug the gap, the state borrows—issuing bonds (IOUs). It is like taking a bank loan, except the creditor is the world.

- The Fed’s policy rate. The price of money. A high rate makes credit dear, slows the economy and cools inflation. A low rate cheapens credit, revs growth and stokes prices.

What is happening now? America has piled up a lot of debt. Servicing it with high rates (paying interest) is eye-wateringly expensive—eating a big chunk of the budget.

There are two possible ways out. The honest one is to cut public spending, trim social programmes and military bases or raise taxes. That is painful for the economy and deeply unpopular with voters. The second is the inflationary route, the one markets fear most. In that case the authorities may try to lean on the Fed to cut rates, even without economic grounds. Servicing old debts becomes easier as their real value erodes, but so do households’ savings—purchasing power slides.

Gold at $5,200 is the market’s wager on the second scenario. It signals mistrust in the state’s ability to pay its bills in honest money.

History rhymes

Today’s set-up rhymes with the 1970s. Then the United States abandoned the gold standard (converting dollars into gold), ushering in a decade of stagflation—high inflation with weak growth.

In 1971 gold cost $35. By 1980 it had vaulted to $850. That era also brought political crisis, an oil shock and a loss of faith in the dollar.

The difference now is an added dose of global “fragmentation”.

“The old trading system is not so much collapsing as ‘fragmenting’. It started during COVID; now it continues because of geopolitics,” Khaitkulov noted.

Trade wars (угрозы пошлинами), the конфликт Вашингтона с НАТО из-за Гренландии are pushing countries toward assets beyond others’ political whims. The dollar is an American asset. Gold is not beholden to anyone’s politics.

Silver: a double whammy

Silver is outpacing. The gold-to-silver ratio has tumbled from April’s 105 to 50, implying a fundamental re-rating of the “white metal”.

🔥This is HISTORIC:

The gold-to-silver ratio plunged to 50, the lowest in 14 YEARS.

This means it now takes just 50 ounces of silver to buy 1 ounce of gold, down from ~105 in April 2025.👇https://t.co/mkPv57Qlvz

— Global Markets Investor (@GlobalMktObserv) January 21, 2026

The market is confronting a real deficit. Stocks on COMEX (London) упали to their lowest since last March, down 114m ounces. Analysts point to an inability to replenish warehouses quickly even at high prices, owing to limited scrap-processing capacity.

“Silver’s story is similar—it historically moves with gold as insurance. But there is an added industrial factor that is boosting demand,” Khaitkulov added.

Silver is critical to electronics and “green” energy, creating a double squeeze on price: investment demand overlays industry’s need for metal.

Where gold can sit in vaults, much of silver disappears into hard-to-recycle industrial layers. The mix of investor panic and factories’ real hunger is a coiled spring.

Corporate responses and tokenisation

High prices are reshaping mining. China’s Zijin Mining объявил a $5.5bn purchase of Canada’s Allied Gold. Shares of the biggest miners (Newmont, Barrick Gold) are climbing as margins hit records.

Finance is meanwhile trying to marry gold’s reliability with modern rails. In Hong Kong, the запущен Hang Seng Gold ETF comes with tokenised units on Ethereum. It underscores the RWA trend as a way to open a “safe harbour” to the digital economy.

Goldman Sachs analysts повысили their gold forecast to $5,400, citing the “stickiness” of hedging flows: big money is reluctant to sell into dips, wary of long-term macro-political risks.

The digital-gold narrative under strain?

As physical gold storms record highs, crypto is flashing warnings. January’s metals rally exposed an awkward truth for bitcoiners: in bouts of genuine political fear, capital still opts for matter over math.

Decoupling and the loss of “safe-haven” status

The past week’s events punctured the myth of bitcoin as digital gold, a hedge against shocks. While bullion rallied on headlines about Greenland and the Fed, bitcoin slid below the psychological $80 000 mark, down 20% from January highs.

Analysts at Nansen and HashKey Group note that the first cryptocurrency is behaving not like a haven but like a risk asset—tracking tech stocks rather than bars in a vault.

Gold wins on the longer view

For the first time in a while, gold has outperformed bitcoin over five years: roughly 185% for the metal versus about 164% for the cryptocurrency.

On January 29 gold’s market value swelled by $1.5trn (akin to bitcoin’s entire capitalisation), the crypto market slipped below $3trn, and the fear-and-greed index fell to 26 (“fear”)—while gold’s hit 99 (“extreme greed”).

Risk of a deep correction

Losing support at $80,000 opens the way to a “double bottom” near $74,000. CryptoQuant’s analysts see signs of investor capitulation, and the RSI on the bitcoin/gold pair has dropped to lows last seen in the bear markets of 2015 and 2018. That could herald either an imminent bottom, or a prolonged crypto winter amid a commodities spring.

Investors may have to accept that bitcoin faces an identity crisis this cycle. The inflation-hedge story has cracked. Bulls’ best hope is a shift in paradigm, voiced by Changpeng Zhao and BlackRock: to back bitcoin not as “the next gold”, but as a future global reserve currency to replace a weakening dollar.

A mirror on reality

The precious-metals rally is not merely a traders’ opportunity. It is a warning siren.

Gold is not soaring so much as money is sinking. A price of $5,200 signals a rapid erosion of fiat purchasing power. What we are seeing is less the enrichment of metal-holders than a repricing of paper money.

The end of easy calm. Investors no longer trust U.S. Treasuries as a “safe harbour”. When a head of state attacks his own central bank, the very notion of a risk-free asset evaporates.

Technology meets antiquity. Ironically, in an age of AI and blockchains the world flees to its oldest asset. Markets adapt: tokenised gold ETFs are emerging, marrying metal’s reliability with crypto’s convenience.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!