Analyst calls the start of altcoin season

Veteran chartist Peter Brandt declared the start of an “altcoin season”.

It’s altcoin season pic.twitter.com/BShKyS6PDO

— Peter Brandt (@PeterLBrandt) July 16, 2025

In a post on X, he attached a chart of total crypto market capitalisation excluding bitcoin that shows a “cup with handle”. The bullish pattern points to a potential continuation of the uptrend after a consolidation phase.

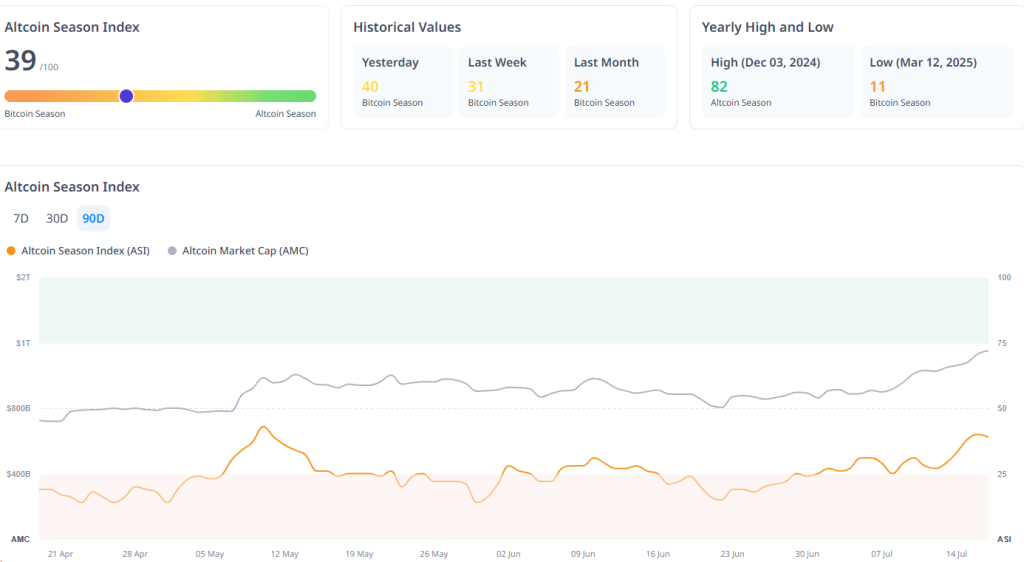

The Altcoin Season Index has yet to clearly signal the onset of an altseason, but its readings are rising fast:

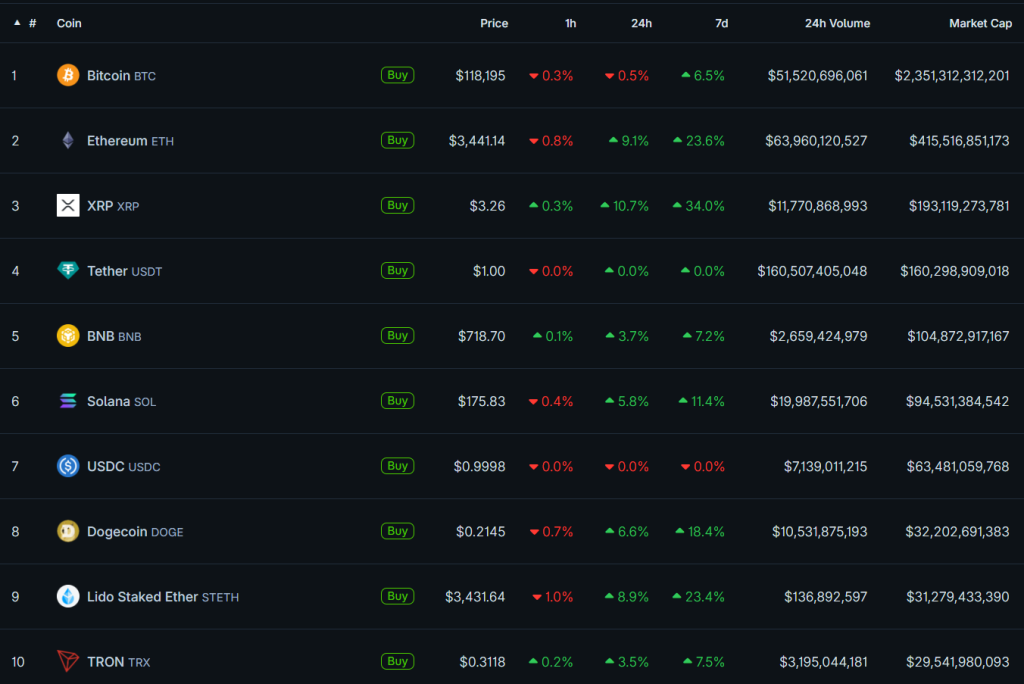

Over the past day, top alternatives to bitcoin have risen sharply, while the market’s bellwether slipped 0.5%:

Are ETH supplies depleted?

Evgeny Gaevoy, founder of market maker Wintermute, said ETH reserves on its over-the-counter platform for institutional clients are almost exhausted — a sign of strong demand for the asset.

there is (clearly) almost no #ETH available for sale on Wintermute OTC desk

— wishful_cynic (@EvgenyGaevoy) July 16, 2025

Founded in 2017 by Gaevoy and Harro Mantel, the London-based Wintermute is one of the key liquidity providers in the crypto market.

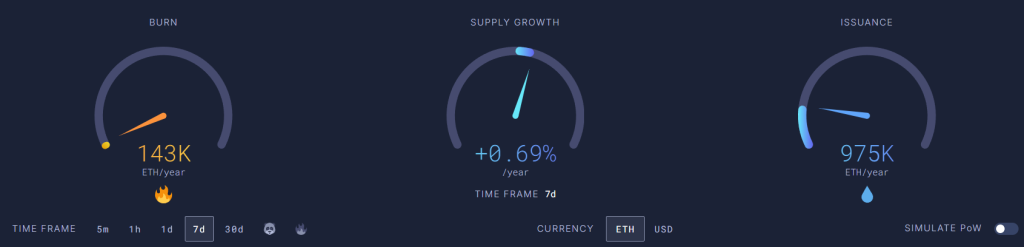

However, Ethereum remains inflationary — the ETH supply is growing by roughly 0.69% a year. That points to subdued on-chain activity.

Over the past 24 hours, the price of Ethereum rose 9.1%, crossing the $3,400 mark.

Renewed interest in the coin is also evident in record open interest in futures — above $50bn.

The rally is not over

An MVRV gauge tailored to short-term holders (STH) points to further upside, according to CryptoQuant contributor Darkfost.

In this cycle, he observed, the combined unrealised profit of short-term holders has not approached 42%.

“Every time STH MVRV reached a level around 1.35, which corresponds to a ‘paper’ profit of 35%, it led to profit-taking and a short-term correction. We are still far from that mark — the reading is around 1.15,” — Darkfost noted.

The analyst added that on July 11 the realised price for short-term holders “for the first time in bitcoin’s history” exceeded $100,000, and then surpassed $102,000.

“Thus, the digital gold still has 20–25% upside potential before reaching the critical MVRV level. In other words, the market maintains a bullish momentum until a new wave of profit-taking,” — the expert concluded.

For their part, Glassnode analysts detected an increase in the volume of bitcoin held by first-time buyers of the cryptocurrency — from 4.77m to 4.91m BTC (+2.86%).

Over the past two weeks, the supply held by first-time $BTC buyers rose by +2.86%, climbing from 4.77M to 4.91M #BTC. Fresh capital continues to enter the market, supporting the latest price breakout. pic.twitter.com/W95HSAMaHI

— glassnode (@glassnode) July 17, 2025

“Fresh capital continues to flow into the market, supporting the recent price breakout,” — the researchers emphasised.

Earlier, Glassnode analysts warned that bitcoin’s price had entered an “overheating zone”.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!