Analyst Identifies Key Support Level Before Potential Bitcoin Correction to $76,000

Bitcoin's key support level holds, risking a drop to $76,000 if breached.

The price of the leading cryptocurrency is maintaining a crucial technical threshold, the breach of which could lead to a significant drop in its value. This was highlighted by the analyst known as Daan Crypto Trades.

$BTC Still holding on to that .382 area from the entire bull market so far.

I think this is a key area for the bulls to defend. It’s also pretty much the last major support before testing the April lows again, which would break this high timeframe market structure.

So watch… https://t.co/SLfYs7VUEp pic.twitter.com/C2SzN4gG6S

— Daan Crypto Trades (@DaanCrypto) December 7, 2025

The level in question is the 0.382 Fibonacci retracement, which is slightly above $84,000. According to the expert, this point has historically served as an important zone of support and resistance in market cycles.

“I think this is a key area for the bulls to defend,” suggested Daan Crypto.

In his view, failing to hold this level could result in prices falling to $76,000.

“This is effectively the last significant support before retesting the April lows, which would disrupt the market structure on higher timeframes,” the analyst explained.

On December 7, the market experienced another “leverage flush,” triggering liquidations of bitcoin positions in both directions. The asset’s price briefly dipped below $88,000 but quickly recovered above $91,500.

“This is another example of manipulation amid low weekend liquidity aimed at liquidating both long and short leveraged positions,” noted the expert known as Bull Theory.

All Eyes on the Fed?

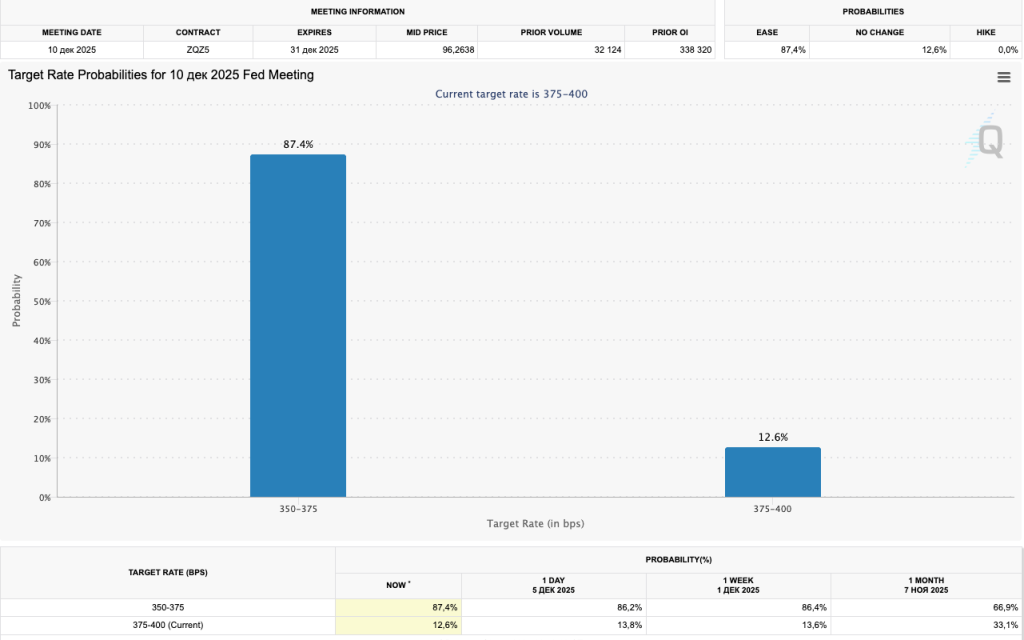

On December 9-10, the Federal Open Market Committee (FOMC) will meet, after which the regulator will announce its decision on the key rate Fed. Many market participants anticipate a 0.25% rate cut.

The crypto market lost momentum after the monetary policy easing in October. As noted by Markus Thielen, head of 10x Research, in a conversation with Cointelegraph, the regulator’s head, Jerome Powell, outlined “a nonlinear, data-dependent path of policy easing, rather than a clear rate-cutting cycle.”

According to the researcher, after the upcoming meeting, the rhetoric is likely to shift to a more restrained tone. This will echo the “hawkish” maneuver of mid-autumn and maintain moderate pressure until the year’s end.

“Given the already weak volumes and outflows from ETFs, engagement in the upward momentum remains limited as long as the $70,000–$100,000 range holds, and implied volatility continues to compress. This makes downside risks more apparent than the potential for growth,” Thielen noted.

Henrik Andersson of Apollo Capital expressed a similar view, suggesting that the anticipated rate cut is already priced in, but the future direction will be set by the economic outlook statement. Overall, the investor remains cautiously optimistic:

“However, with the change of the Commission’s head in May next year, further rate cuts are likely in 2026. This will support risk assets, including cryptocurrencies.”

In a discussion with the publication, Nick Ruck, head of LVRG Research, noted that employment and inflation data could stimulate liquidity inflows. If the figures meet expectations for further monetary policy easing, this will support market recovery.

Back in October, the Bitcoin “liveliness” indicator hinted at the return of a bullish trend.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!