Analyst Observes Shift of Major Capital Towards Ethereum

Futures and options markets indicate a growing interest from large investors in Ethereum compared to Bitcoin. This suggests a potential shift in focus within the crypto market, according to Omkar Godbole, co-managing editor at CoinDesk.

Data from the Deribit exchange shows traders are more actively purchasing call options on Ethereum. The risk reversal indicator for Ether is higher than that for the leading cryptocurrency, the analyst noted.

Open interest (OI) in Ethereum futures on the Chicago Mercantile Exchange is also showing a leading growth. Since the beginning of April, OI for ETH contracts has increased by 186%, reaching $3.15 billion. Godbole highlighted that the growth has accelerated over the past two weeks. In comparison, OI for Bitcoin futures rose by 70% to $17 billion but stabilized over the last week.

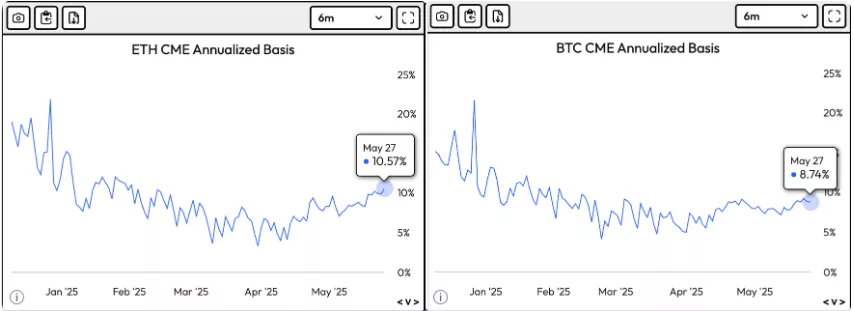

Premiums on Ethereum futures confirm this trend. According to Velo, monthly ETH futures are trading at an annualized premium of 10.57%—the highest since January. Bitcoin derivatives show 8.74%.

A similar situation is observed with funding rates for perpetual futures on offshore exchanges. For Ethereum, they have approached 8%, whereas for digital gold, they remain below 5%.

Earlier, on May 14, analysts at Bernstein identified three main factors driving Ethereum’s growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!