Analyst Predicts a ‘Very Favorable’ Period for Bitcoin

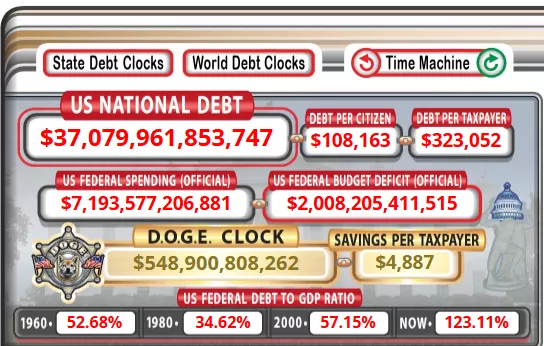

The extremely low dollar index (DXY) alongside the historical peak of the US national debt should serve as “fuel” for a rally in the leading cryptocurrency, according to CryptoQuant contributor known as Darkfost.

According to his observations, the DXY is trading 6.5 points below the 200-day moving average.

“This is the largest deviation in 21 years,” emphasized Darkfost.

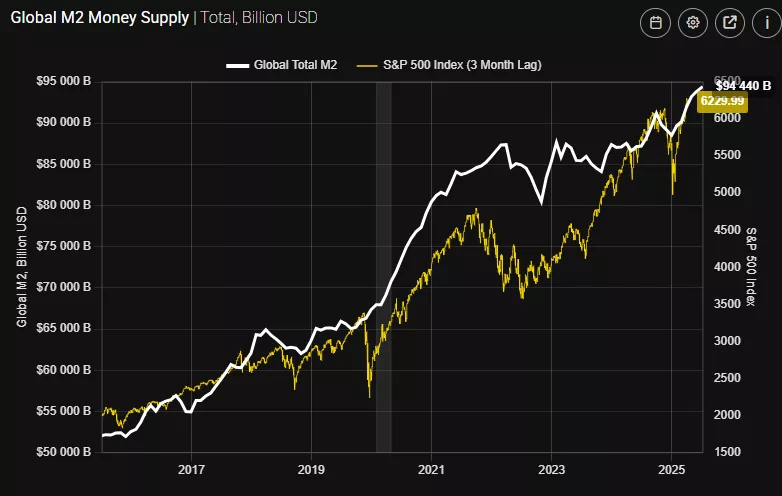

The analyst noted that such dynamics, “despite appearing alarming,” usually benefit risky assets like Bitcoin. He stated that in traditional finance, a correlation has long been observed: when the dollar weakens and “loses its appeal as a safe-haven asset,” investors reassess their portfolios and shift capital into alternative instruments.

The chart provided by Darkfost “illustrates this phenomenon,” showing periods when the DXY trades below its 365-day moving average.

“Historical data shows — such periods have been favorable for Bitcoin. Currently, the dollar index is weakened, which could support a new BTC rally, although the price has yet to react,” noted the researcher.

He added that the aforementioned tool allows for the recognition of early stages of a bullish trend and moments of euphoria “not so much through technical signals, but by reflecting the inflow of liquidity into the crypto market.”

A Rare Occurrence

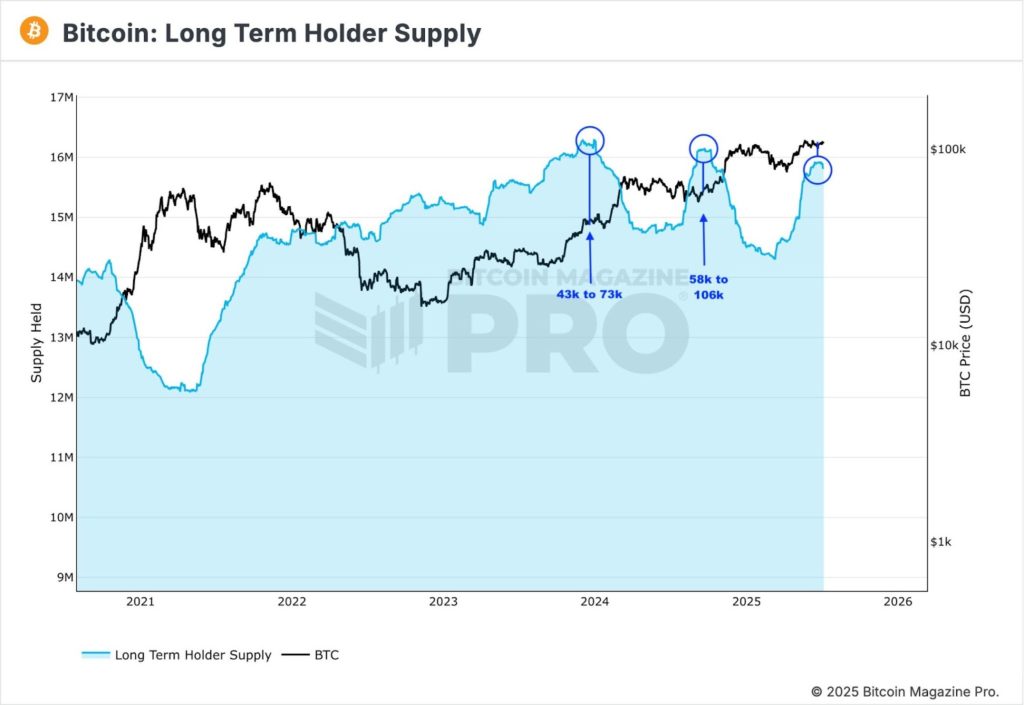

The share of long-term Bitcoin holders (LTH) has reached 80% of the total coins in circulation. This could signal a potential new growth phase if the previous scenario repeats. This group includes investors holding the asset for at least 155 days.

Previously, such levels were reached only twice — in February and October 2024. Following this, the price of the leading cryptocurrency rose by 72% and 84%, respectively.

In absolute terms, the LTH supply volume reached a historical high of 14.7 million BTC (about $1.6 trillion) on June 5.

“Amid stable purchases by institutions, the growing share of illiquid supply enhances Bitcoin’s upward potential with increasing demand,” noted Cointelegraph analysts.

Crypto analyst known as CrediBULL believes that with long-term holders dominating the supply structure of digital gold, even a small surge in excitement could trigger a rapid price increase.

According to him, the “excess” volume has once again ended up in the hands of those who are not in a hurry to sell. Companies with Bitcoin on their balance sheets play a leading role in this process.

He also does not rule out that the approaching “powerful market impulse” could surpass the previous two — the rate could reach $150,000.

Analyst Omkar Godbole highlighted long-term resistance levels for the current market phase — $115,000 and $223,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!