Analyst Predicts Easing of Bitcoin Pressure from GBTC Outflows

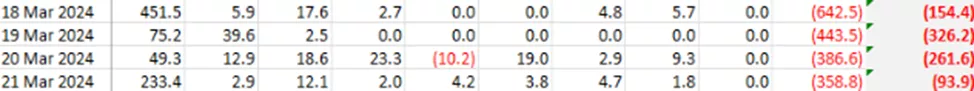

On March 21, outflows from Grayscale’s spot Bitcoin ETF, GBTC, amounted to $358.8 million, following a record $642 million on March 18. Bloomberg analyst Eric Balchunas has forecasted an end to this trend.

The more I think about it the more likely the uptick in flows is related to the bankruptcies bc of the size and consistency. The flows in Feb showed what retail outflows look like, smaller and random pattern. Also any Gemini/Genisis outflows likely buying btc w cash hence market…

— Eric Balchunas (@EricBalchunas) March 22, 2024

The chart below shows the net outflows from the Grayscale Bitcoin Trust.

Balchunas believes that most of the funds withdrawn from GBTC are due to the bankruptcy of crypto firms. The significant impact is linked to their “size and consistency [of sales].”

“Any outflow Gemini/Genesis is likely to lead to BTC purchases [with] cash, hence the market will hold. Conclusion: the worst [is likely] near the end. Once this happens, only [the influence of] retail traders will remain. Flows should resemble February’s trickle,” he added.

Between March 18 and 21, outflows from the product increased to $1.83 billion. This figure exceeded inflows into competing ETFs. As a result, the net outflow from the entire category amounted to $836.1 million.

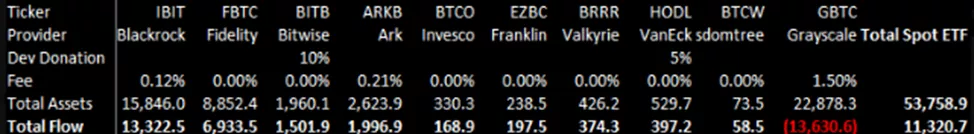

According to BitMEX Research, since the product’s approval, the net outflow from GBTC has reached $13.63 billion, comparable to the net inflows into IBIT from BlackRock ($13.32 billion). AUM of the instrument has fallen to $22.88 billion.

Analyst Ergo from The OXT Research concurred with Balchunas’s observations. The expert linked the $1.1 billion outflow from Grayscale Bitcoin Trust to actions by Genesis.

Genesis is back from the dead, taking down more than ~16.8k BTC (+$1.1B) in the last few weeks to 2 new addresses.

Likely these coins are primarily sourced from GBTC outflows. pic.twitter.com/19ALn1jyTs

— ?∴boxes full of pepe∴? (@ErgoBTC) March 21, 2024

“The final transaction volumes and withdrawal timings align well. There aren’t many 2000 BTC transactions per day, so the GBTC outflow and Genesis inflow are likely connected,” he noted.

Trader WhalePanda reached similar conclusions. The expert referred to a statement from Genesis on March 19, which mentioned that the firm would return assets to creditors “in kind.” In other words, it was assumed that the reorganizing platform would receive bitcoins for GBTC.

Couple of people reach out to me.

Seems like this week Genesis are finishing selling their $GBTC shares.

The statement said they will be returning digital assets “in kind” which means they’re selling GBTC shares for BTC. The BTC isn’t hitting the market.https://t.co/C1QzHw3cke— WhalePanda (@WhalePanda) March 22, 2024

Back in February 14, Genesis received court approval to liquidate Grayscale Bitcoin Trust worth $1.3 billion to satisfy claims.

In January, FTX sold 22 million GBTC for ~$908 million to settle obligations to creditors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!