Analyst Predicts Final Corrections Before Bitcoin Bull Run

- Bitcoin is poised for “final corrections” before the onset of a two-year bullish cycle, reminiscent of 2019, according to experts.

- The CPI report will be crucial for the market’s trajectory.

During the current rebound, Bitcoin is expected to reach $55,500 before returning to $53,000, which will serve as a launchpad for upward movement, stated analyst and MN Trading founder Michaël van de Poppe.

Liquidity was taken & #Bitcoin is back up to $54.8K.

Expect a max of $55.5K on this run and then we could be revisiting $53K before clearly breaking back upwards.

Final corrections & then 2 years bull. https://t.co/wjtAv96VaX

— Michaël van de Poppe (@CryptoMichNL) September 7, 2024

“[We are facing] final corrections and two years of bullish growth,” he wrote.

The expert acknowledged the impact of macroeconomic conditions on the dynamics of the leading cryptocurrency and predicted a turning point.

Don’t be mistaken.

The equity markets are running up on weakness.

The equity markets are fragile in terms of liquidity, and people are very eager to put their money away towards these assets due to fear of inflation.

That’s going to reverse really soon.

— Michaël van de Poppe (@CryptoMichNL) September 8, 2024

“Equity markets are fragile in terms of liquidity. Investors are eager to put their money into these assets due to fear of inflation. Very soon, everything will change,” he warned.

Van de Poppe noted the nearing end of the “final run” in the stock market and drew parallels with 2019 when Bitcoin found support at $6,000. For the current situation, he identified $45,000-50,000 as a similar benchmark.

“Considering the upcoming rate cuts by the Fed, economic weakening, and increased global liquidity in China, it seems almost inevitable that we are on the brink of the largest bull cycle in history,” he added.

Cubic Analytics founder Caleb Franzen also highlighted the importance of resistance at $55,500. In his view, breaking this level would support the upward trend of the leading cryptocurrency.

If price can stay above $54.5k, I’m looking for a break above this green zone to see if #Bitcoin can regain some upward momentum. pic.twitter.com/70MsDWLIuk

— Caleb Franzen (@CalebFranzen) September 9, 2024

At the time of writing, Bitcoin has surpassed the psychological level of $55,000 and is trading at $55,200.

Parallels with 2019 and Hashrate

Julien Bittel, head of macroeconomic research at Global Macro Investor, noted the similarity of the current situation to 2019.

This year’s Bitcoin price structure is starting to look eerily similar to 2019…

Take a close look at the chart – it’s almost a perfect fractal of what we saw back then.

Bitcoin has been stuck in a consolidation phase, and interestingly, just like in 2019, this consolidation… pic.twitter.com/8p6tDTIBoL

— Julien Bittel, CFA (@BittelJulien) September 7, 2024

“Take a close look at the chart — almost a perfect fractal of what we saw back then. […] Bitcoin has been stuck in a consolidation phase […], just like in 2019, it has lasted exactly 175 days (so far). We are now approaching that critical moment when strong movements may occur,” the specialist wrote.

Presto Research pointed out that when analyzing the prospects of the leading cryptocurrency, network security should be considered alongside macroeconomic factors. They noted that the hashrate has reached a historic high, making Bitcoin “grossly undervalued,” according to CoinDesk.

Lucy Hu from Metalpha predicted in a conversation with the publication that the asset’s high volatility will persist until the Federal Reserve meeting on September 18.

On September 11, debates between two candidates for the US presidency will take place, and a report on consumer price dynamics will be released. The next day, the Labor Department will present data on the PPI.

ETF Dynamics

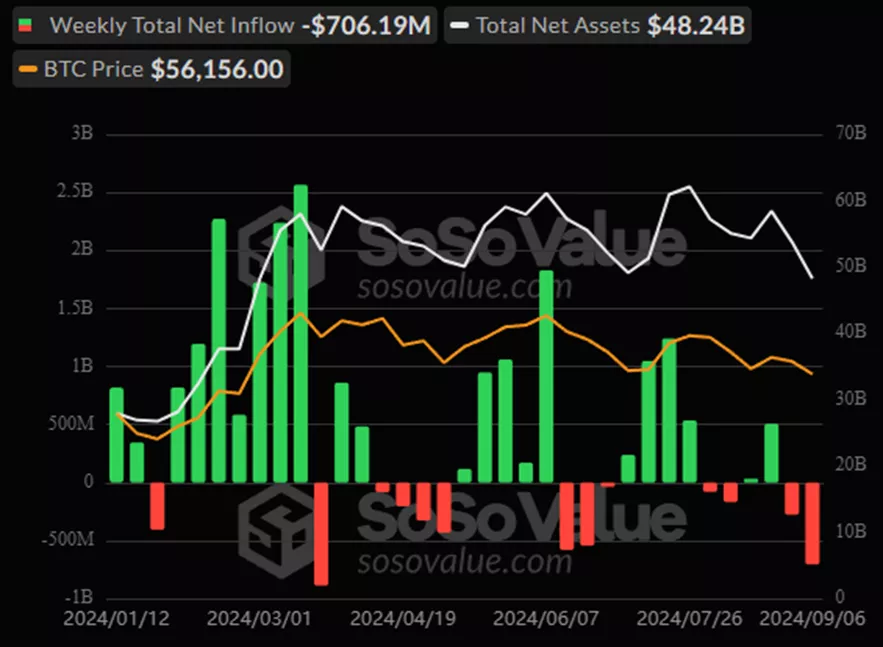

Outflows from spot Bitcoin ETFs from September 2 to 6 amounted to $706.2 million, compared to $277.1 million the previous week. On a daily basis, the negative trend continued for the eighth consecutive session, according to SoSoValue.

The volume of assets under management fell to $48.24 billion, the lowest since May 1. Cumulative inflows since the approval of BTC-ETFs in January have decreased to $16.9 billion.

A similar pattern was observed in Ethereum-ETFs. From September 2 to 6, investors withdrew $91 million from the products. The negative trend continued for the fourth consecutive week.

AUM fell to $6.1 billion. The figure plummeted by 41% from the first day of trading instruments ($10.24 billion).

Former BitMEX CEO Arthur Hayes reported closing a short on the leading cryptocurrency with a 3% profit. The expert did not rule out that Bitcoin might show growth this week.

Meanwhile, JAN3 CEO Samson Mow explained that prevailing bearish forecasts of the digital gold’s price dropping to $40,000 have no basis other than spontaneous fear.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!