Analysts assess Binance’s market share after CFTC claims

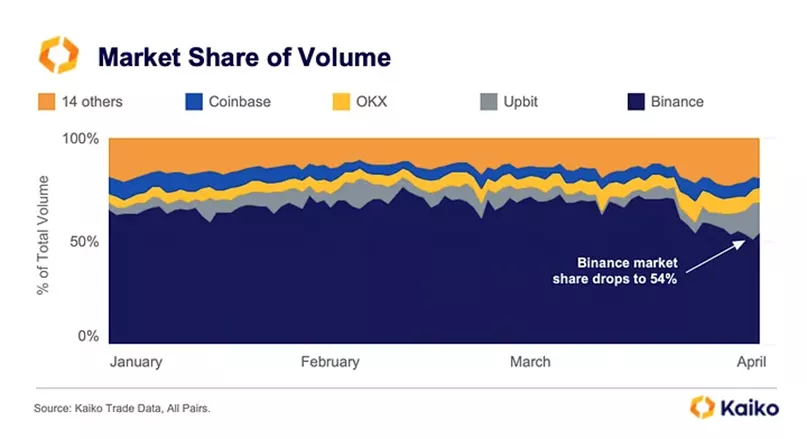

The cessation of zero-fee trading on a range of instruments and lawsuit CFTC during the first quarter contributed to the decline in Binance’s spot market share from 70% to 54%. Kaiko analysts say this.

#Binance lost 16% market share following a CFTC lawsuit and the decision to end its zero-fee trading program.

In today’s Data Debrief, we explore:

— the increasingly uncertain exchange environment

— #ETH liquidity

— #XRP volume on Korean markets— Kaiko (@KaikoData) April 3, 2023

Among the 17 platforms analyzed by experts, Upbit notably strengthened its market position. This followed high activity of retail traders from South Korea in XRP in anticipation of a favorable outcome of the SEC lawsuit against Ripple.

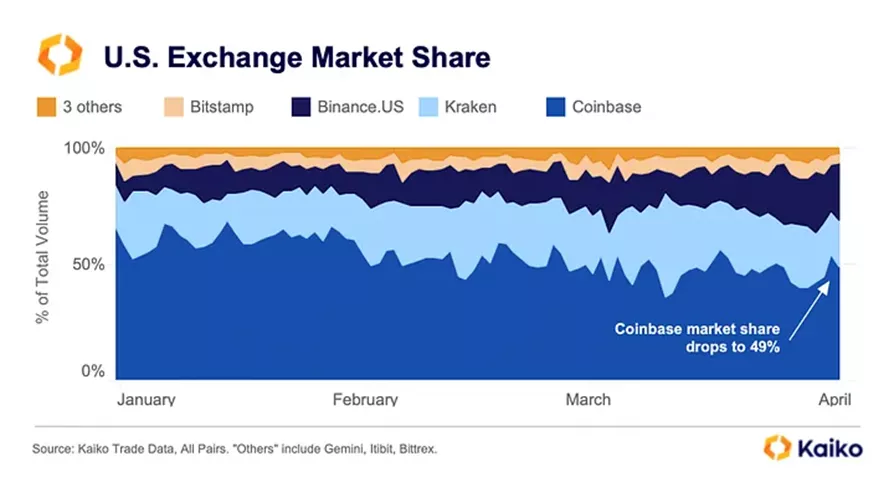

Across U.S. platforms, analysts recorded Coinbase’s share dropping from 60% to 49%. Despite regulatory pressure, Binance.US’s share tripled—from 8% to 24%.

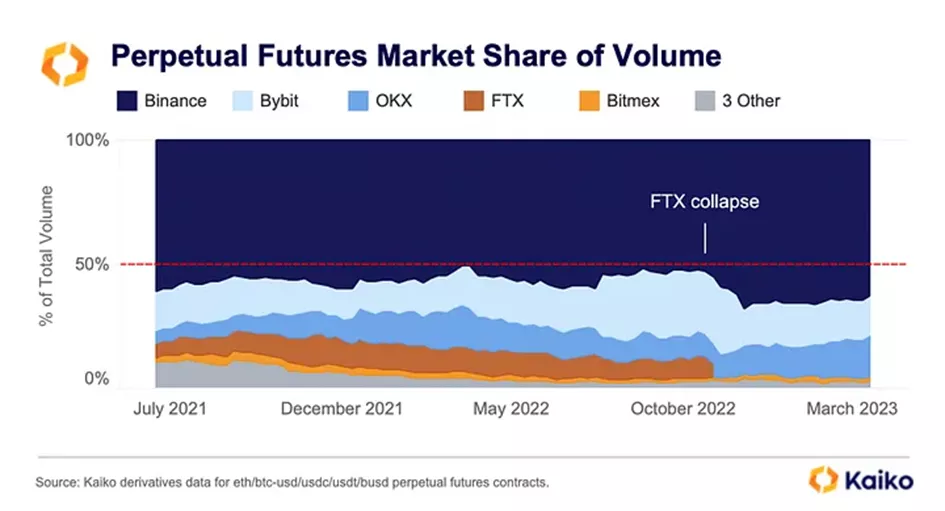

The rally in digital assets in Q1 did not revive the crypto derivatives market.

Open interest (OI) in Bitcoin fell by 20%, to 211,000 BTC. A substantial weakening of the metric— by 54% and 35% respectively— was shown by OKX and Bybit. OI on Binance fluctuated around 130,000 BTC.

For Ethereum, the decline in the metric among the three mentioned platforms exceeded 30%. The total share of Binance in the perpetual contracts market fell by 2%.

“Most of the reduction in positions on the largest CEX is linked solely to the cessation of zero-fee spot trading, and not to FUD around the legal case,” — analysts said.

The main beneficiaries of the collapse of FTX were Binance and OKX. Binance’s market share rose from 50% to 65%, the latter from 10% to 17%. Huobi, BitMex and Deribit’s metrics declined.

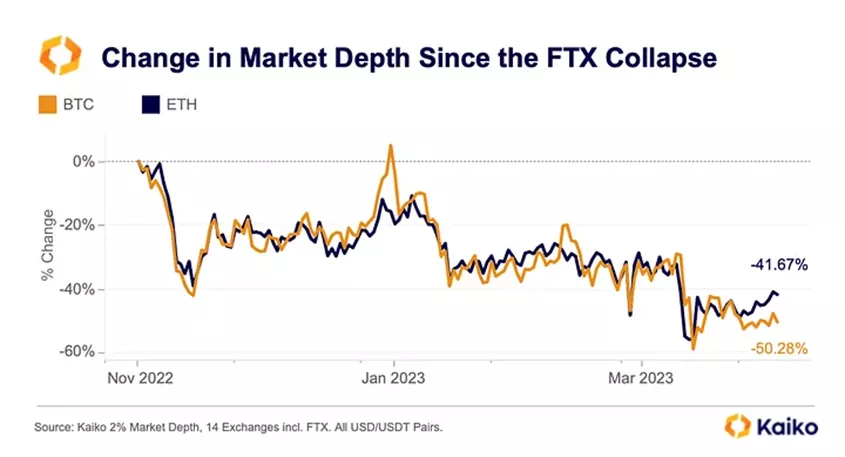

Analysts noted a reduction in liquidity in BTC and Ethereum pairs against USD and USDT. The trend followed the collapse of FTX and Alameda Research.

In mid-March, market depth (the number of orders within 2% of the average price) fell to May 2022 levels. In Bitcoin the metric plunged by 50%, in Ethereum— by 41%. Analysts attributed this to the cessation of zero-fee trading in BTC pairs on Binance.

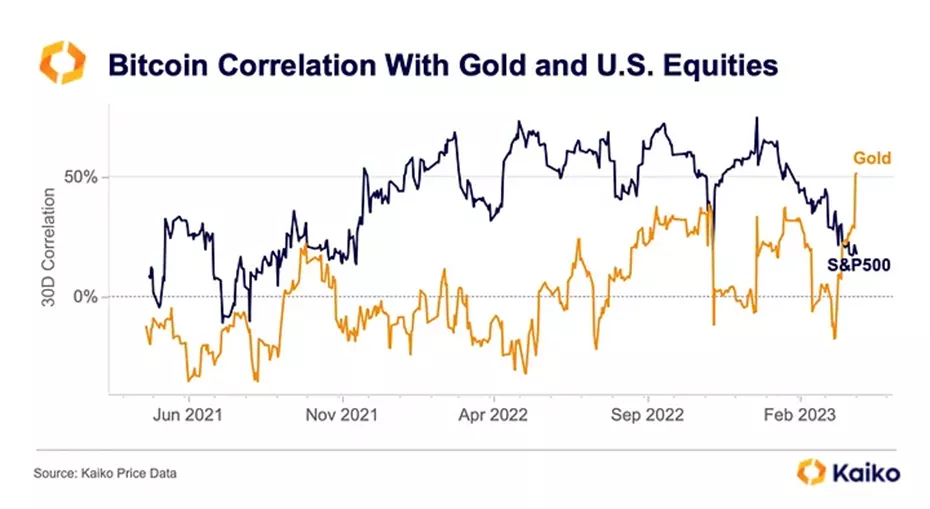

The correlation of Bitcoin with gold reached a multi-year high of around 50%. The price linkage of the leading cryptocurrency with the S&P 500 index fell threefold.

In April, the CFTC lawsuit against Binance did not lead to a material outflow of users from the platform nor shake investors’ confidence in the leading cryptocurrency, according to Glassnode analysts.

In March 2023, Messari founder and CEO Ryan Selkis forecast Bitcoin to rise to $100,000 within 12 months.

A similar view was voiced by many industry experts, according to a CNBC poll.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!