Analysts Assess Binance’s Market Share Decline Over the Past Year

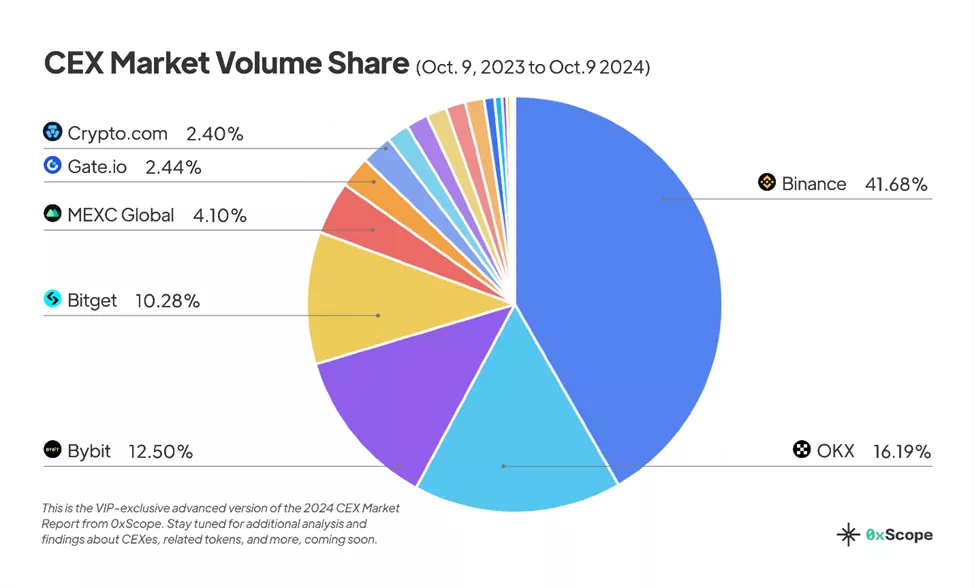

Over the past year up to October 9, Binance accounted for $22.5 trillion out of $54 trillion in trading volume across spot and derivatives markets on 22 platforms, according to data from 0xScope.

Read the full report here: https://t.co/0PsYzBujP3 pic.twitter.com/wJNz17rwqr

— 0xScope (@ScopeProtocol) October 21, 2024

Analysts noted increased competition among CEX, which has weakened the position of the largest cryptocurrency exchange, Binance.

Market Share

Three trading platforms have become the main beneficiaries of Binance’s declining share:

- OKX — from 13.4% to 16.1%.

- Bybit — from 9.6% to 12.5%

- Bitget— from 7.0% to 10.28%.

MEXC Global remained in fifth place, despite a decrease in market share from 6.9% to 4.1% over the year.

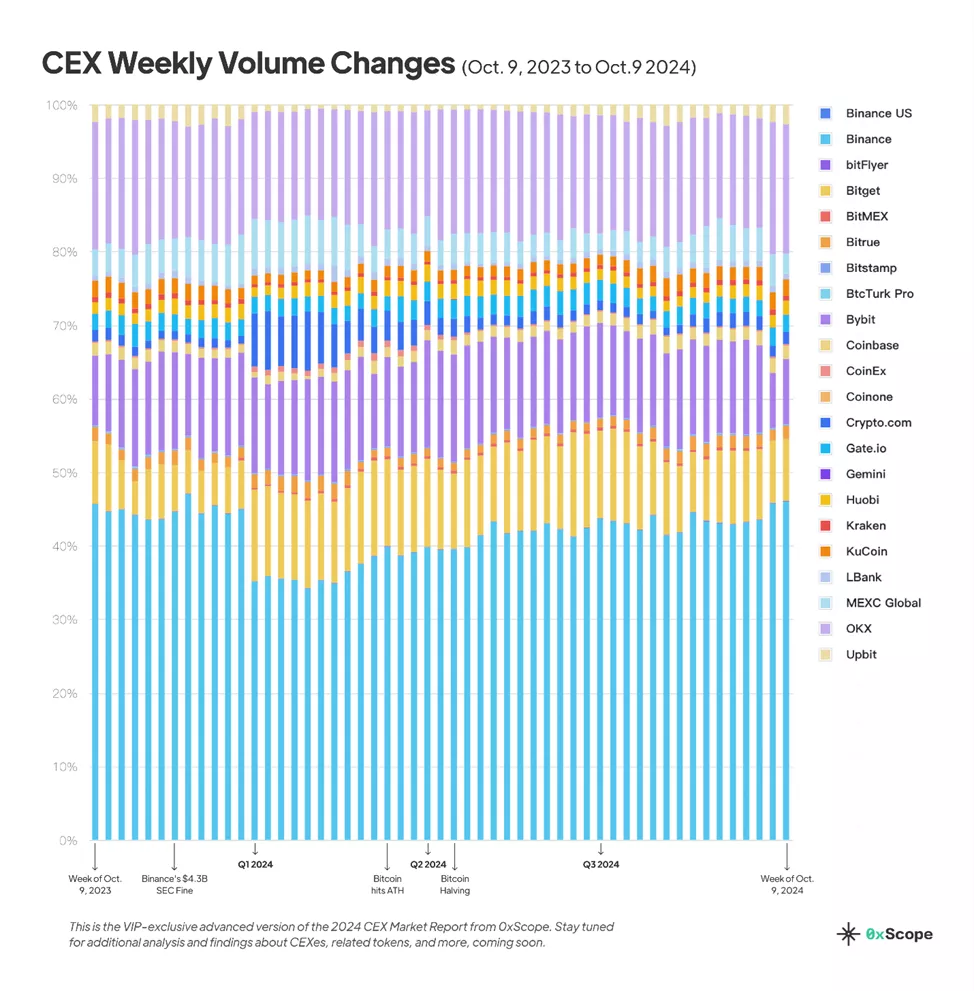

In terms of annual dynamics, experts made the following conclusions:

- 1. At the end of 2023, Binance’s share was 45%, but after the new year, it fell to 34%. The exchange only managed to recover losses after the summer.

- 2. Bitget began the period with a jump from ~6-9% to 10-14% for most of 2024, but later reduced its share to 9% amid Binance’s recovery. A similar trend was observed with the stability of OKX and Bybit metrics.

- 3. In January 2024, Crypto.com concentrated 7-8% of the turnover, but by the end of the period, it retained only 1-2%.

Spot and Derivatives Trading

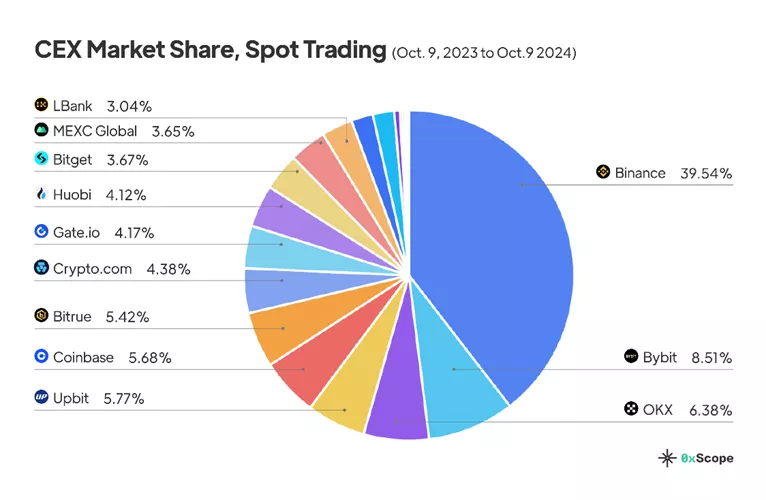

The turnover on the spot market of the platforms in the sample for the period amounted to $14.6 trillion.

The leader’s share decreased to 39.54% from 52.5% a year earlier.

The rest showed the following dynamics:

- Bybit rose from seventh place (3.2%) to second (8.51%);

- OKX strengthened its position in third place (from 5.4% to 6.38%);

- Upbit fell from second to fourth (from 6.8% to 5.77%);

- Coinbase moved from third to fifth place (from 5.8% to 5.68%).

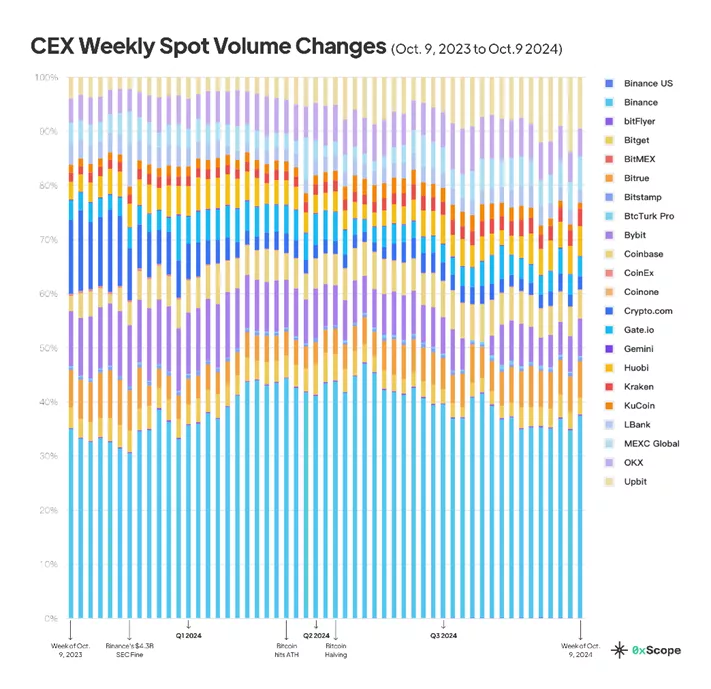

The following chart shows that Binance is recovering its early-year losses, while Bybit is reducing turnover. At the end of 2023, Crypto.com surged to 15%, but its share has since fallen fivefold.

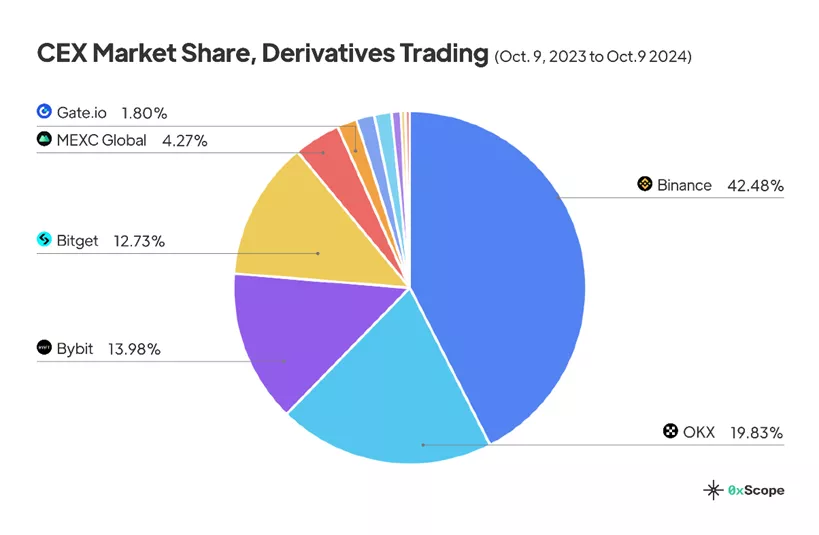

Derivatives

Out of 22 major exchanges, 11 offer derivatives trading. Over the past 12 months, these platforms processed a total of $39.38 trillion, nearly three times the total spot trading volume.

Binance’s share fell from 50.9% to 42.5%. This allowed several competitors to strengthen their positions:

- OKX increased its share from 15.5% to 19.8%;

- Bybit – from 11.3% to ~14%;

- Bitget – from 8.2% to 12.7%;

- MEXC Global’s share decreased from 7.3% to 4.3%.

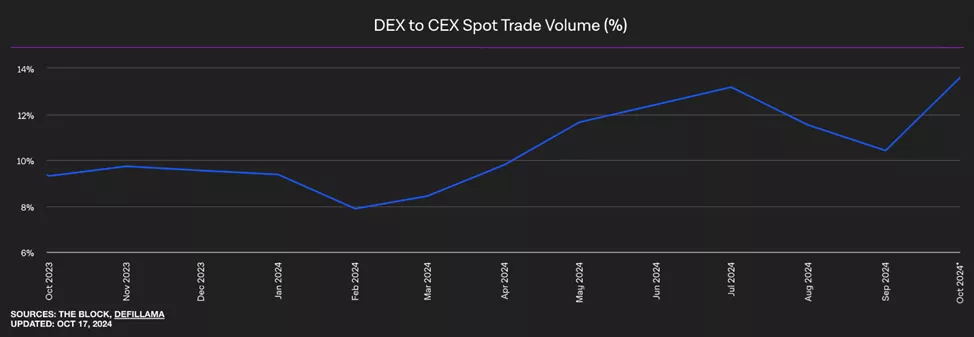

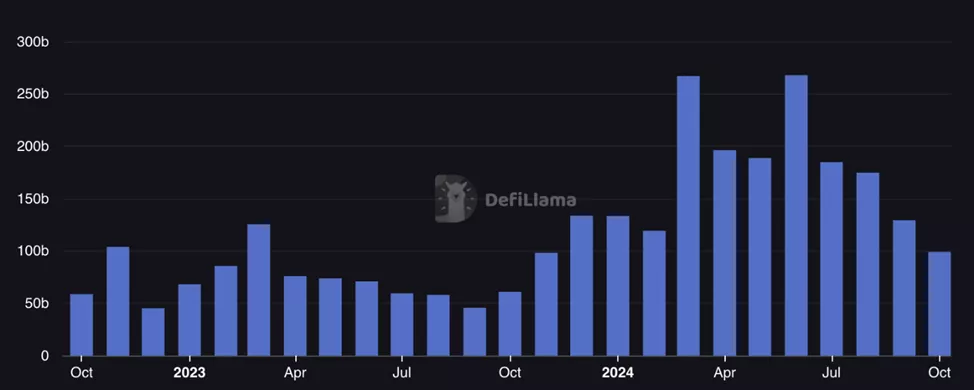

CEX vs DEX

Experts forecasted increased competition from DEX. Their share in relative terms rose from less than 10% to 13.6%. In May 2023, the figure jumped to a record 14.2%.

Over the past 12 months, trading volume on DEX has grown significantly. In March 2024, non-custodial platforms processed over $250 billion in transactions for the first time since December 2022. This milestone was repeated in June 2024.

Earlier, CCData estimated Binance’s share of the total trading volume on spot and derivatives markets at 36.6%. They identified Crypto.com, Bitget, and Bybit as beneficiaries.

Previously, the latter strengthened its position thanks to the launch of BTC-ETF, according to Kaiko.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!