Analysts Assess Impact of US-Venezuela Conflict on Bitcoin

Bitcoin market unlikely to face deep correction from US-Venezuela conflict, says analyst.

The likelihood of a significant correction in the cryptocurrency market due to the US-Venezuela conflict is extremely low, according to MN Trading founder Michaël van de Poppe.

I don’t think we’ll see a widespread correction based on the attack in Venezuela on #Bitcoin.

It’s a planned and coordinated attack on Maduro, and is already past us.

The likelihood of more negativity on the markets from that single event are relatively slim.

I would assume…

— Michaël van de Poppe (@CryptoMichNL) January 3, 2026

“It’s a planned and coordinated attack on [Venezuelan President] Nicolás Maduro, and it is already in the past,” the expert added.

According to van de Poppe’s forecast, Bitcoin could soon surpass the $90,000 level. At the time of writing, the leading cryptocurrency is trading around $91,500, having gained 2% in the past 24 hours.

On January 3, the US conducted strikes on Venezuela. The attack lasted about 30 minutes, resulting in Maduro being captured and taken out of the country.

Initially, Bitcoin reacted to the situation with a slight decline but then resumed its upward trend.

“Markets are usually affected by uncertainty, not events that have already occurred. In this case, it seems largely priced in,” noted crypto analyst Shagun Makin.

He also emphasized that the ability of digital gold to remain stable amid “geopolitical noise” is more likely to strengthen demand above $90,000 than undermine it.

“The situation might even bring some profit to the market, as people perceive it as a sign of strength,” added analyst Tyler Hill.

Insider Bets

Researchers at Lookonchain discovered suspicious activity on Polymarket. According to their data, three wallets placed bets on Venezuelan President Maduro leaving office just hours before his arrest.

Three insider wallets on #Polymarket bet on Venezuelan President Maduro being out of office just hours before his arrest, netting a total profit of $630,484!

The three wallets were created and pre-funded days in advance.

Then, just hours before Maduro’s arrest, they suddenly… pic.twitter.com/VRAkQh8i9a

— Lookonchain (@lookonchain) January 4, 2026

Their total profit from the trades exceeded $630,000. One wallet invested $34,000, resulting in a return of $409,900.

“All three addresses only bet on events related to Venezuela and Maduro, with no history of other trades—a clear sign of insider trading,” stated Lookonchain.

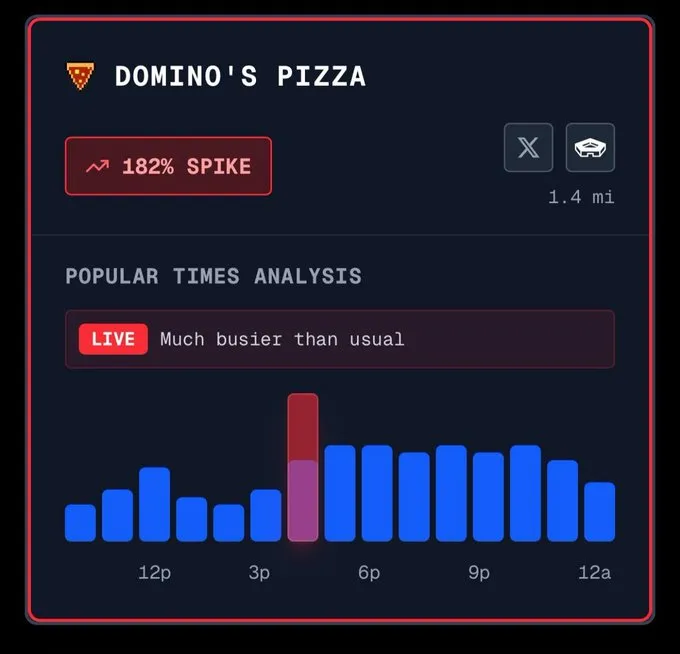

Meanwhile, a trader on Polymarket under the pseudonym Sweetceecks revealed that he earned $80,000 overnight by betting on the overthrow of the Venezuelan president.

He noted that he noticed a rise in the “pizza index” and placed a bet. The indicator reflects the number of orders from nearby Domino’s Pizza outlets located near the Pentagon, considered an indirect sign of increased US military activity.

By the end of 2025, retail investors surpassed whales in the pace of Bitcoin accumulation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!